AUD/NZD

The dollar traded mixed against its G10 counterparts during the European morning Thursday. It was higher against NZD, AUD and GBP, in that order, while it was lower against EUR, CHF and CAD. The greenback was virtually unchanged against NOK, JPY and SEK.

Eurozone’s economic growth accelerated in July according to the strong readings of the bloc’s PMIs. Eurozone preliminary composite PMI, covering both the manufacturing and service sectors, reached a three-year high of 54.0. The strong figures were boosted from the better-than-expected prints from the bloc’s two largest economies, France and Germany. Both manufacturing and service-sector PMIs were higher, with the latter having the larger gains. However, going forward the effects of Russia’s recent sanctions may be apparent in the German PMIs due to the strong ties between the two countries. EUR rebounded at the release of the news, staying above its 21st of November lows of 1.3400 but finding resistance at 1.3485.

The British pound weakened during the European morning after the UK retail sales data for June fell short of expectations. Retail sales excluding gasoline fell 0.1% mom in June, way below the forecast of a turnaround (+0.3% mom). The slowdown in growth pushed Cable lower by approximately 0.20% at the release.

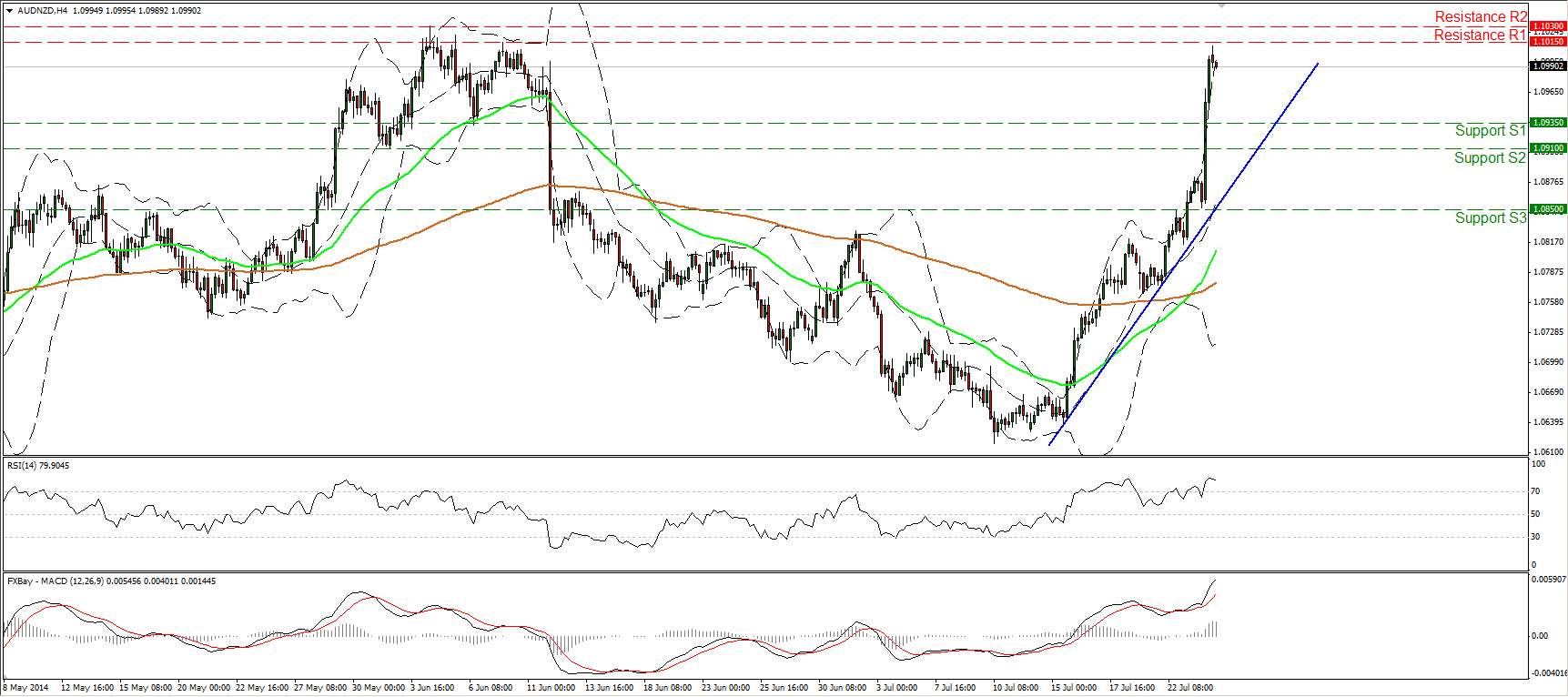

AUD/NZD surged during the Asian morning Thursday, breaking two resistance barriers in a row, but the rally was halted marginally below the obstacle of 1.1015 (R1). I would see the 1.1015/30 zone as a strong resistance zone. Taking into account that our hourly momentum studies shows signs of topping, I would expect the forthcoming wave to be to the downside, perhaps near the blue trend line and the 1.0910/35 support zone. Nevertheless, the price structure remains higher highs and higher lows above the blue uptrend line and above both the moving averages. Hence, I see a positive near-term picture and I would consider any possible future declines towards the 1.0910/35 support as renewed buying opportunities.

Support: 1.0935 (S1), 1.0910 (S2), 1.0850 (S3).

Resistance: 1.1015 (R1), 1.1030 (R2), 1.1110 (R3).

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.