AUD/USD

The dollar traded mixed against the other G10 currencies during the European morning Wednesday. It was higher against SEK, CHF, NOK and EUR, while it depreciated against AUD, NZD and CAD. It remained near its opening levels against JPY and GBP.

The Aussie was the main gainer as the RBA Governor Stevens said Australia’s economy may strengthen in 2014 and that there are encouraging early signs of a handover from mining-led demand to domestic consumption.

The Swedish Krona fell after Sweden’s consumer confidence index for March fell to 99.6, missing market expectations of a rise to 101.8 (previous = 100.3). The country’s trade surplus for February came at SEK 5.0bn, below forecasts of SEK 6.1bn, while January’s figure was revised down to SEK 5.1bn from SEK 5.8bn. This pushed the Krona even lower.

The euro held yesterday’s decline after the efforts by Eurozone officials to talk down the currency.

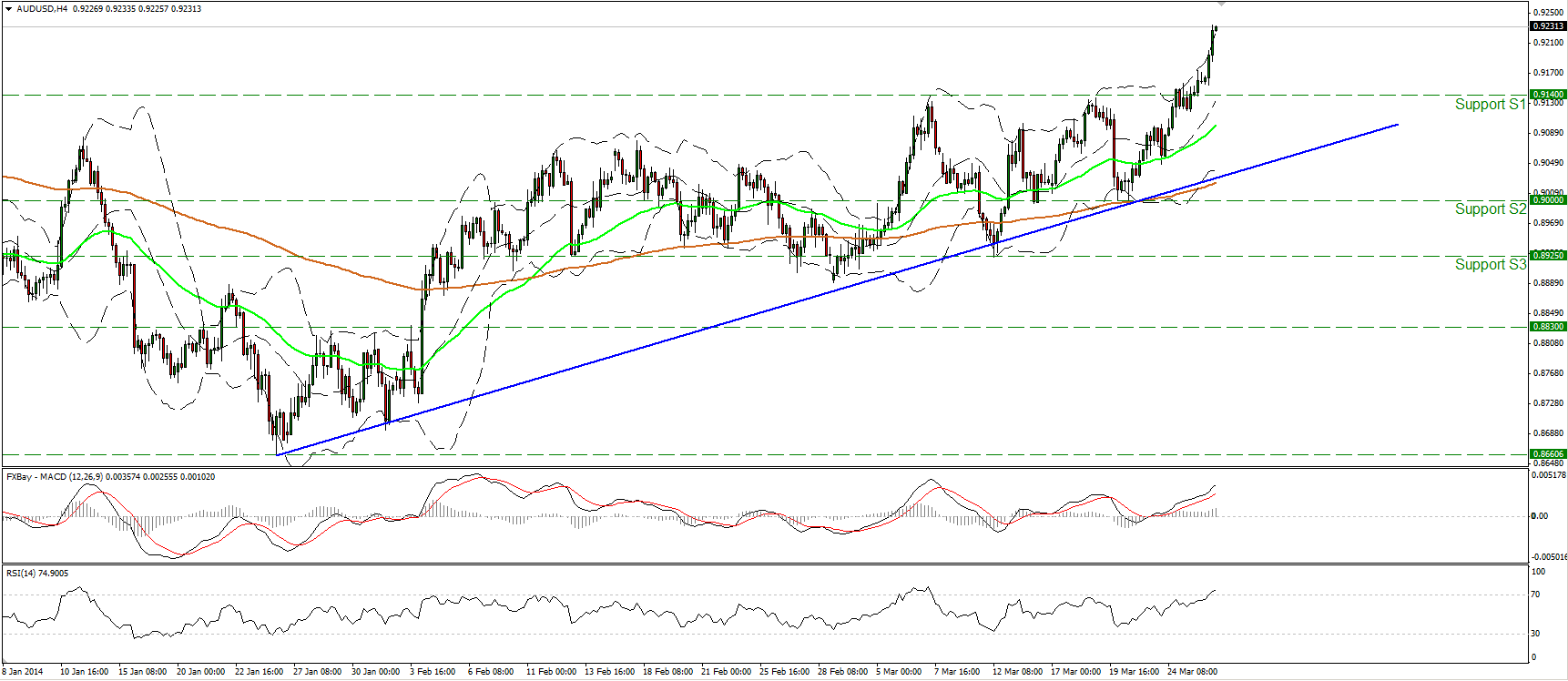

AUD/USD moved significantly higher, breaking above the 0.9140 hurdle. I would expect the rate to continue its advance and challenge the resistance of 0.9270 (R1), where a clear upward violation may pave the way towards the bar of 0.9450 (R2). The pair is trading above both the moving averages and the blue uptrend line, thus the overall short term picture remains positive. Nonetheless, since the rate broke the upper Bollinger Band, while the RSI lies within its overbought territory, a price pullback upon the oscillators exit from the extreme conditions is possible.

Support: 0.9140 (S1), 0.9000 (S2), 0.8925 (S3)

Resistance: 0.9270 (R1), 0.9450 (R2), 0.9545 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.