NZD/USD

The dollar traded unchanged or higher against all its G10 counterparts during the European morning, on Thursday. The greenback was higher against CHF, EUR and JPY and NZD, while it remained near its opening levels against AUD, SEK, NOK, GBP and CAD.

The Swiss franc was the main loser of this morning, after the Swiss National Bank said that the currency remains high and that is prepared to take further steps if necessary. Today, the SNB maintained its benchmark rate at 0% and pledged to defend the 1.20 floor of EUR/CHF.

EUR/USD continued its decline for a second day, after Fed officials indicated that the Bank could begin to raise rates about six months after the bond-buying program winds up.

The kiwi continued declining after New Zealand’s GDP slowed to +0.9% qoq in Q4 from a revised +1.2% qoq in Q3.

The dollar was also unchanged of higher against all the EM currencies we track, with the ruble recording the biggest losses as EU leaders gather in Brussels today to discuss additional sanctions against Russia after its intervention in Crimea.

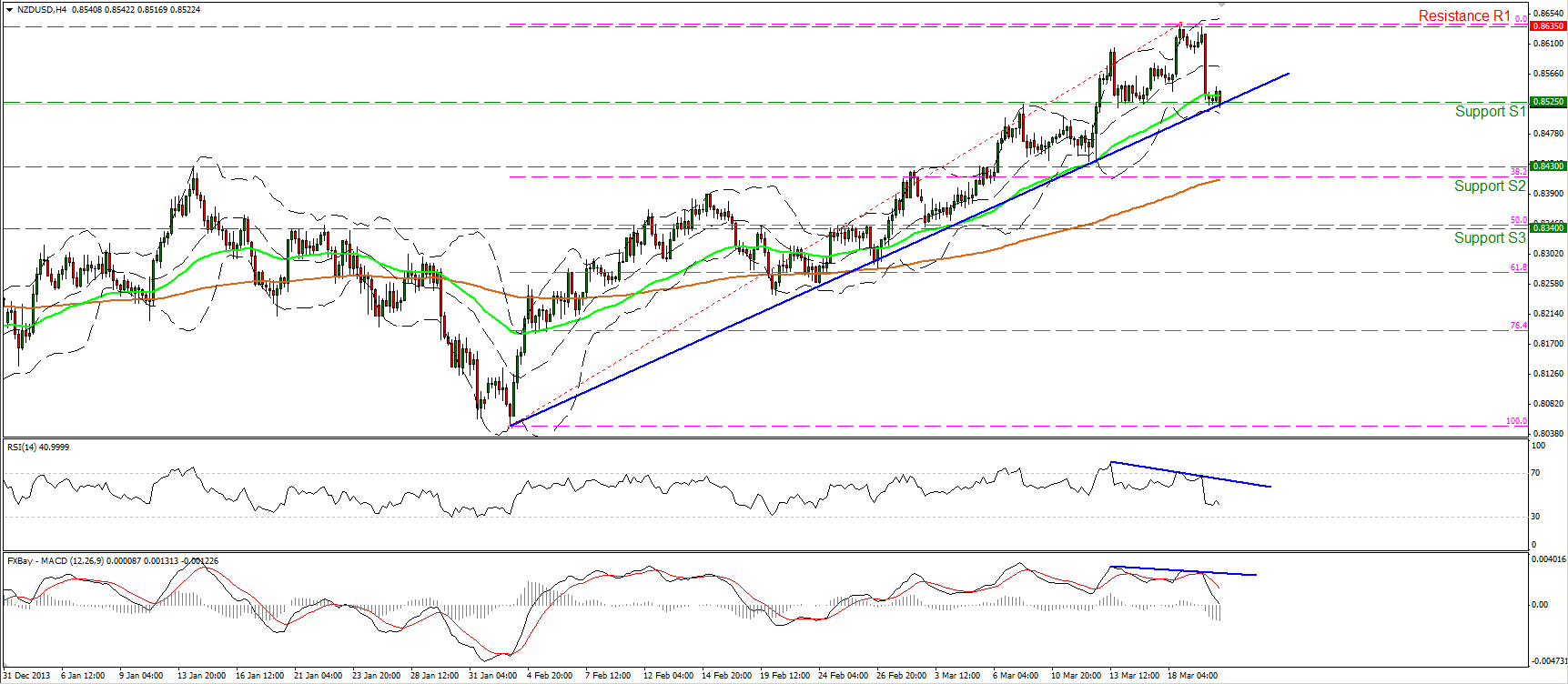

NZD/USD fell sharply overnight reaching the blue trend line and the support barrier of 0.8525 (S1). A clear dip below that support zone, may extend the decline and target the next hurdle at 0.8430 (S2), near the 38.2% Fibonacci retracement level of the prevailing uptrend. The MACD oscillator seems ready to obtain a negative sign, shifting the momentum to the downside. Considering negative divergence between both our momentum studies and the price action, I believe it is a matter of time for the rate to break through the support of 0.8525 (S1).

Support: 0.8525 (S1), 0.8430 (S2), 0.8340 (S3)

Resistance: 0.8635 (R1), 0.8675 (R2), 0.8845 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.