GBP/JPY

- The dollar traded unchanged or higher against most of the other G10 currencies during a quiet morning in Europe. The only currency that managed to outperform USD was CAD, while the main losers were GBP, JPY and AUD with the former depreciating the most. The pound fell against the dollar despite moderately GBP-positive news from the Rightmove house price index, which showed an acceleration in UK house prices in February. GBP seems to have hit some squaring of long positions after ending last week as the biggest gainer.

- JPY was the second loser in line, as Nikkei closed the Asian day up 0.6% and all the European stock indices are trading above their opening levels, showing that risk appetite has returned to the markets.

- The only economic data release was Italy’s current account balance. The surplus declined to EUR 1848mn in December from 2828mn in November, but this has no impact on the euro.

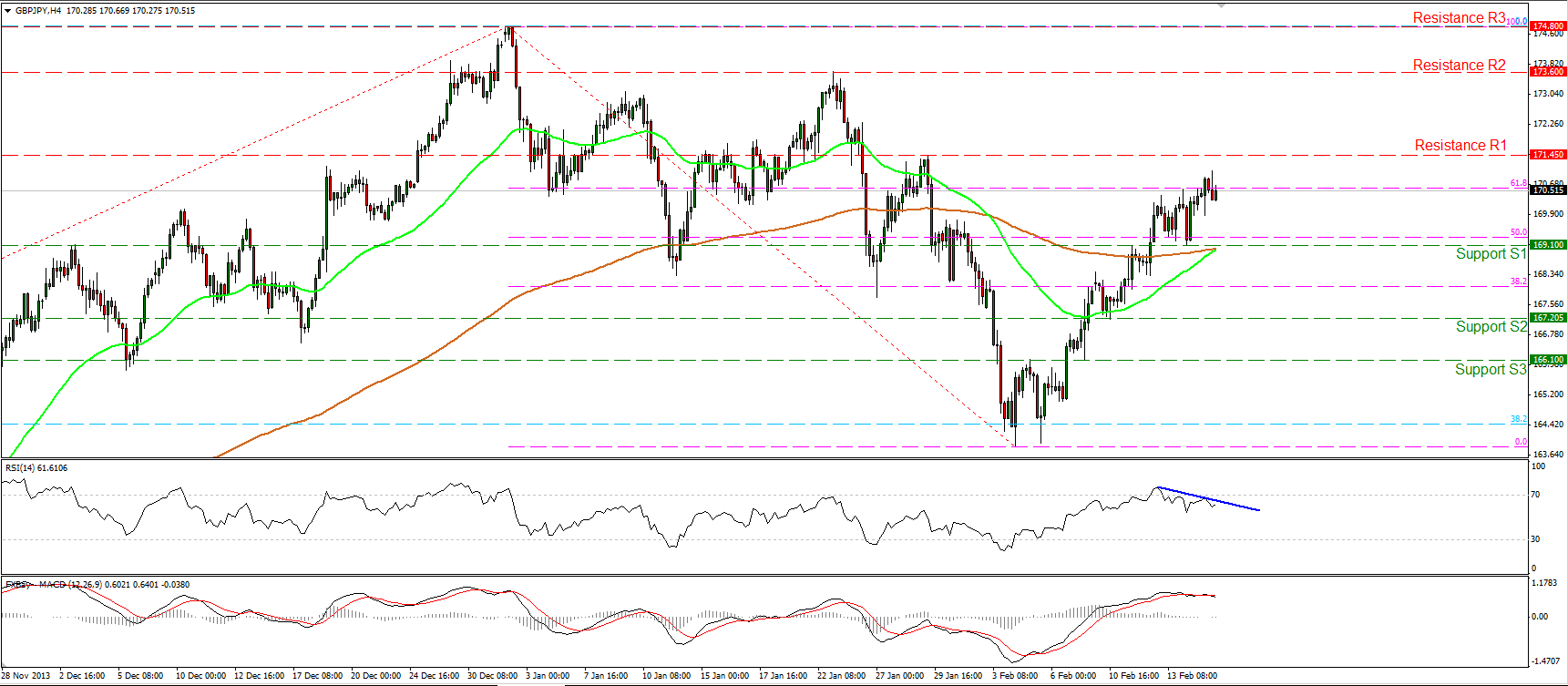

- GBP/JPY consolidated near the 61.8% Fibonacci retracement level of the 2nd Jan. - 4th Feb. decline. A clear break above that level followed by a violation of the resistance at 171.45 (R1) may argue that the aforementioned decline has bottomed and it was nothing more than a 38.2% retracement of the 7th Aug. - 2nd Jan. uptrend. However, negative divergence is identified between the RSI and the price action, while the MACD although in a bullish territory, crossed below its trigger line. This shows decelerating positive momentum and increases the probabilities for a downward corrective wave in the near future.

- Support: 169.10 (S1), 167.20 (S2), 166.10 (S3)

- Resistance: 171.45 (R1), 173.60 (R2), 174.80 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.