We take a closer look at the US oil supply story today after a $2 whipsaw on crude prices as Hurricane Joakim approaches New York. The Canadian dollar got a boost from crude and was the top performer while CHF lagged. Australian retail sales are next.

Forecasts showing Joakim headed towards New York harbor early next week boosted crude early in the day and then new forecasts showing it moving further North reversed the trade. The oil market has a history of kneejerk reactions to temporary supply disruptions from storms but they should be used as opportunities to sell because the dynamics of the US market have changed.

A decade ago, much more of US oil was imported via the Gulf of Mexico, which is always vulnerable to hurricanes. There is a heavy offshore drilling presence there as well. But two factors have made the US oil market far less vulnerable to what happens in the ocean. 1) The rise of Canadian oil exports 2) The explosion of US shale. Storms have virtually zero impact on that production so for the foreseeable future, Hurricane-driven spikes will be opportunities to sell. Premium subscribers will obtain a special pre-NFP edition of the Premium Video at about 21:00 EDT (02:200 BST) to go through selected strategies, existing and new trades.

Click To Enlarge

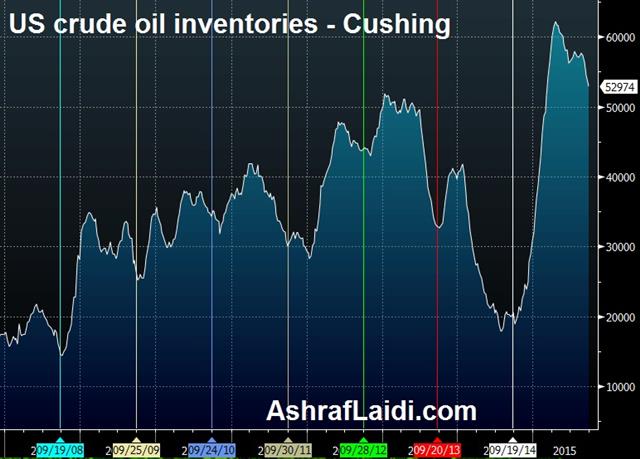

In the bigger picture, US oil storage supplies are virtually overflowing. This is the time of year that US oil supplies at the main hub in Cushing usually trough. As we head into October, refineries shut down for maintenance and to transition to more heating oil and less gasoline. But current supplies at Cushing exceed any pre-2015 point for the past 15 years.

Storage capacity will be maxed out in the coming months and crude will be dumped onto the market at any price. That has severe negative implications for the Canadian dollar and the latest bounce may prove an opportunity to sell.

In the short term, it's the Australian dollar in focus with retail sales at 0130 GMT and expected to rise 0.4%. Interestingly, October is seasonally the best month of the year for the Australian dollar and one of the worst for CAD.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.