Today's focus is on FOMC meeting and that is the reason why the market has been calm all day long. We should expect FED to focus on China slowdown, market volatility and weak US data. At the present FED could probably take a pass on policy and mention "patience". There are 2 possible scenarios: Hawkish scenario would be mentioning another rate hike soon (March) and if the FED skips any mention of raising rate hikes and takes on weak US data in the statement addressing both global and GDP slowdown, the statement will be considered dovish. The statement will come in the written form at 19:00 GMT.

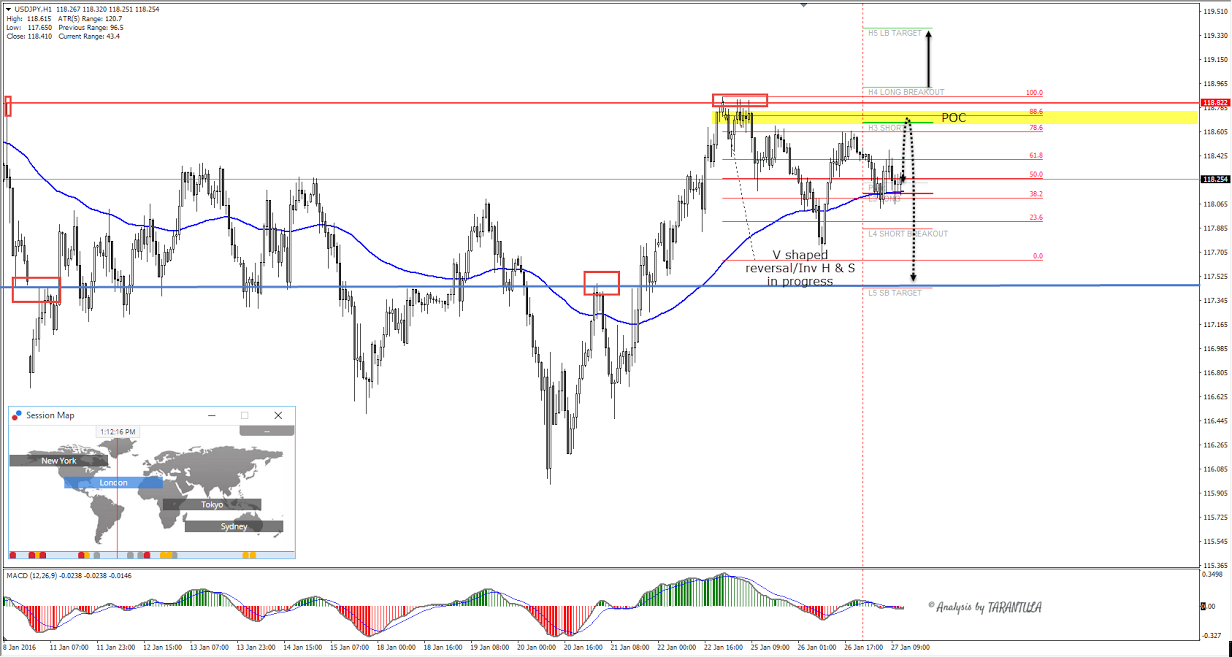

Technically the pair is ranging with slightly bullish bias so we need to pay attention to important levels. 118.65-80 is POC (H3, 88.6, historical sellers) and on dovish statement the pair should drop towards 118.00 and 117.40 L5 intraday support. Currently the price shows a combined V shaped reversal and inverted Head and Shoulders in progress that could spike the price up towards POC sell zone.

However if the price breaks and closes above 119.00 (slightly above historical sellers and H4) it might spike up to 119.40 where it will face resistance. MACD is flat providing us with additional confirmation that market is in waiting mode so pay attention to increased volatility just before,during and after the statement has been publicly released.

-------Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.