We chart forex pairs like USDJPY and AUDJPY and provide the reasons for trades. Other pairs being analysed today are:

EURUSD,EURJPY, GBPUSD, GBPJPY.

Our clients have always been at an advantage as we provide high quality analysis from the world of intermarket. Our trade copier performance over the last 1 year speaks about our analysis and its importantance for traders.

Dollar Index

Dollar Index may finally be exhausting its mega uptrend which began in Aug 2014. The weekly charts indicate a bearish reversal with the prices next targeting 95.2.

DXY weekly

The weekly trends have a large bearish reversal (which often precedes large trend tops). The US inflation is still low with chances of breaking into shallow dis-inflationary zone. US inflation is still below the Fed’s target

The above chart compares the PCE total versus the PCE core—it excludes volatile food and energy costs. The Fed’ target inflation rate is 2%. It tracks inflation through the PCEPI. As of January 2015, the core personal consumption index was 1.3%. The total personal consumption index was 0.2%.

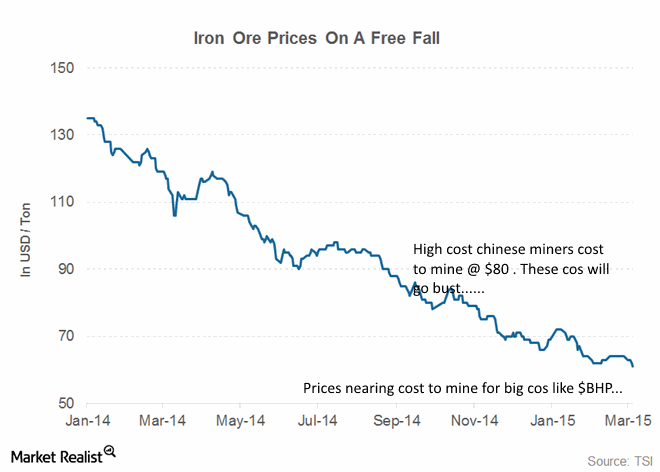

OIL

Oil has broken below $50 and is sitting comfortably with no signs of a bounce. This suggests that price may dip to $40 as well but the speed of fall may now extend over months. The fall in oil prices will start having larger repercussions in the economy as oil cos start squeezing wages and letting people go thus raising unemployment.

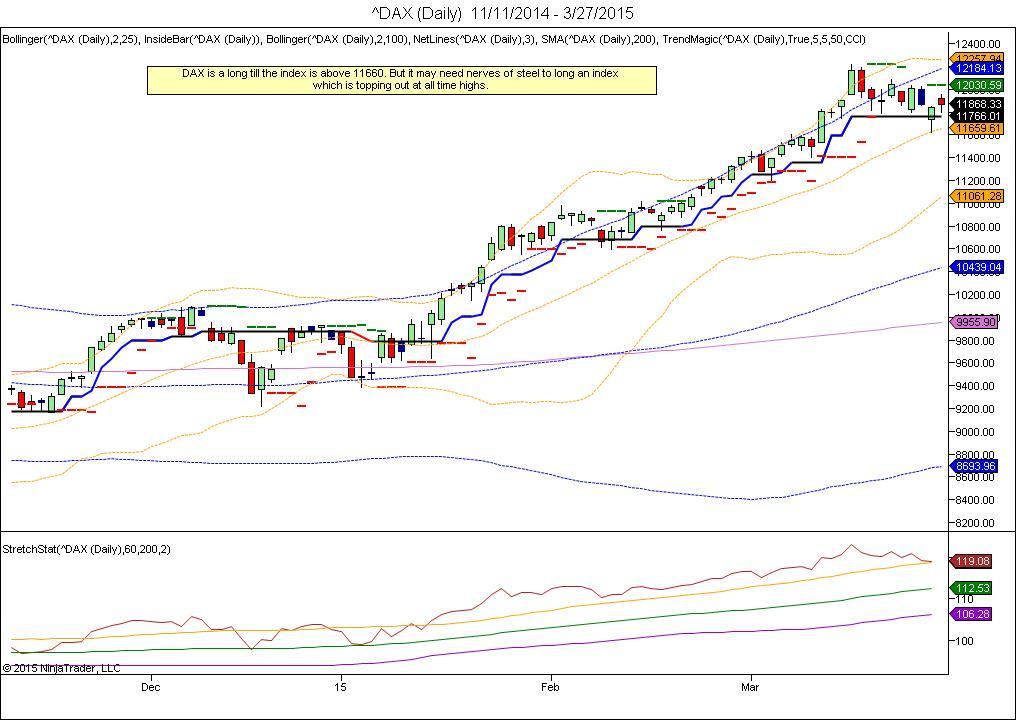

DAX

DAX is a long till the index is above 11660. But it may need nerves of steel to long an index which is topping out at all time highs. The ECB QE may start having a bullish effect on the DAX.

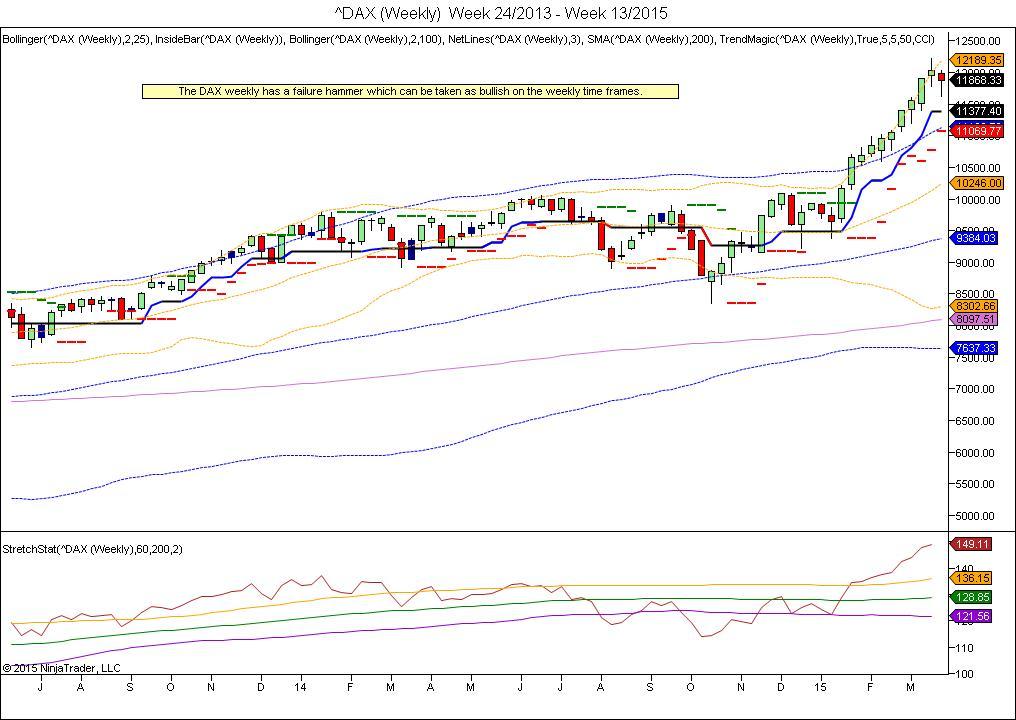

DAX Weekly

The DAX weekly has a failure hammer which can be taken as bullish on the weekly time frames.

Forex Analysis

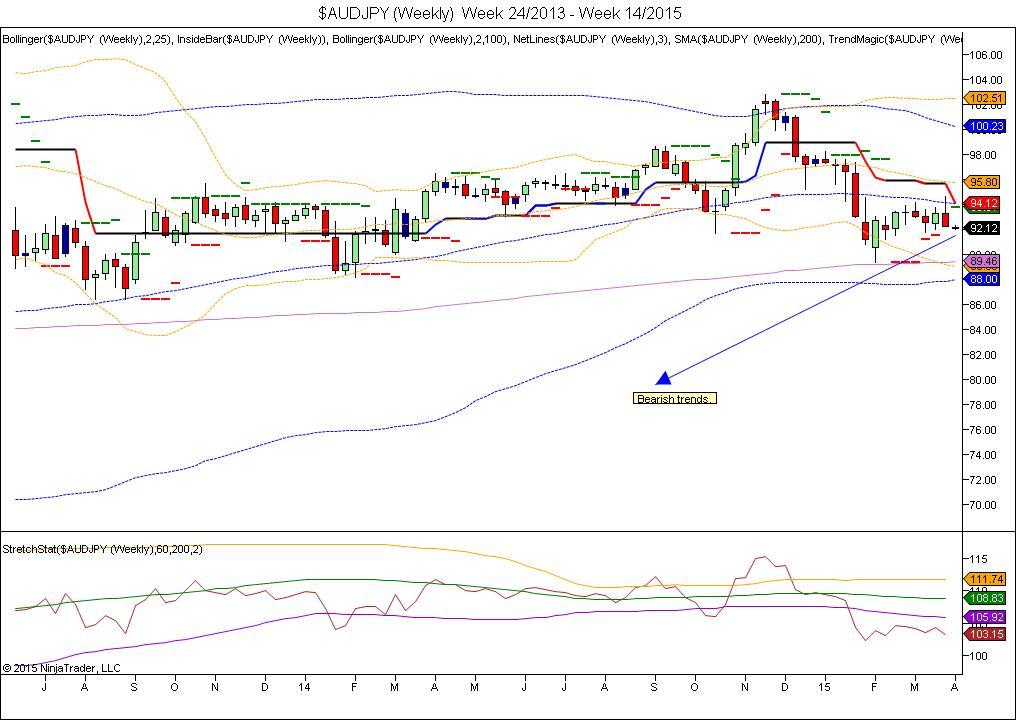

AUDJPY WEEKLY

AUDJPY weekly is in strong downtrend with initial target at 89.5. That is over 250 pips and we suggest to start entering shorts at 92.1 onwards down to 91.5 with stops at 93.1

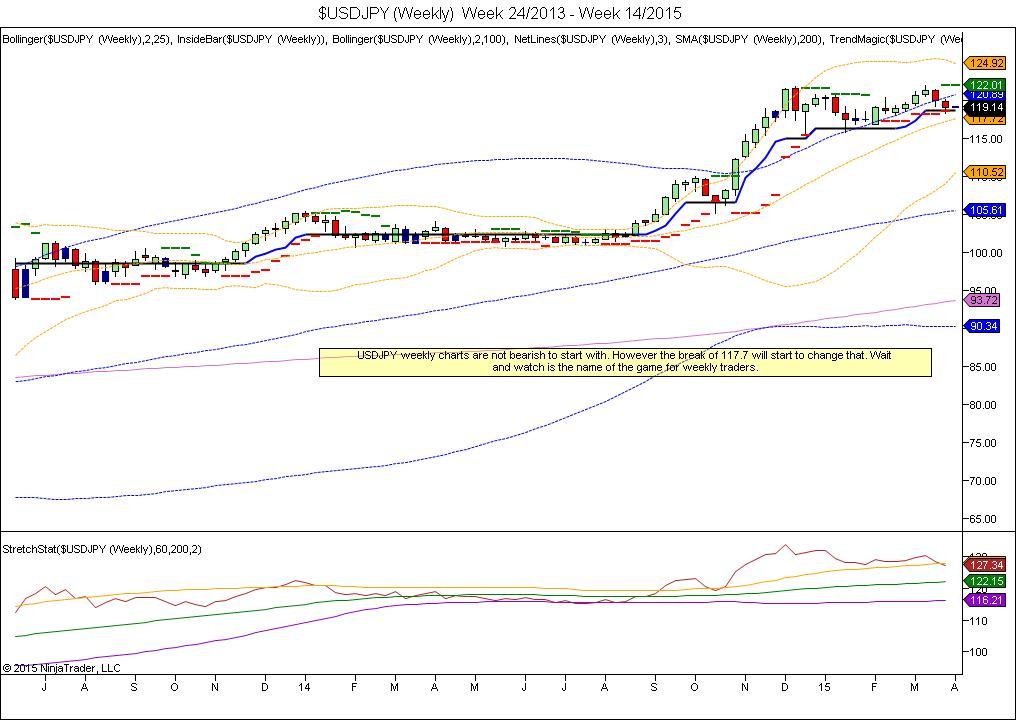

USDJPY weekly

USDJPY weekly charts are not bearish to start with. However the break of 117.7 will start to change that. Wait and watch is the name of the game for weekly traders.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.