![]()

The S&P reached and breached the key 2000 level on the back of today’s non-farm payrolls report. Traders’ initial reaction to the data was joy as they saw the 242,000 NFP figure flash in their screens but then realised wages were weak (down 0.1% month-over-month), so they sold stocks and the S&P tumbled. But then the markets recovered as traders bought the dip possibly because they figured that the Fed may hold off raising rates again this year. At the same time, the weaker dollar helped to lift oil prices to fresh weekly highs. This also helped to fuel the kick-back rally. Confusion is the key takeaway point from this morning’s trade.

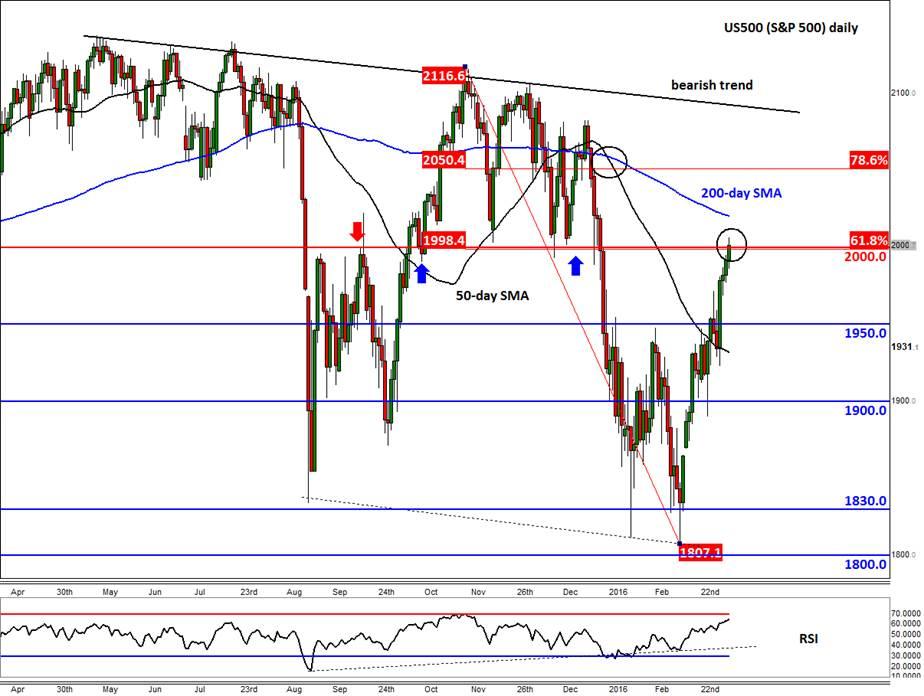

But as we go to press, the indices are struggling to push further higher, no doubt because of profit-taking ahead of the weekend and possibly because some traders are going to the dark side again now that we have had a significant bounce. Indeed, the S&P has reached a key hurdle, namely the area around 2000. This psychological level had been strong support and resistance in the past. It is also where the 61.8% Fibonacci retracement level of the most recent drop converges. So, there is a possibility that the rally may derail here.

However, should the S&P hold above 2000 on a daily closing basis then there is a good chance we will see even higher levels in the new week, possibly the 200-day moving average at 2019, the 78.6% retracement at 2050 or even the bearish trend line at some stage. Indeed, given the recent bullish price action, a rally to fresh all-time highs wouldn’t surprise me.

BUT I can’t stress enough the technical importance of the 2000 level. The moving averages are in the wrong order and the index has been making progressively lower highs and lower lows in recent times. So, it could be that the long-term trend may have turned bearish. This can only be confirmed of course if and when the S&P breaks pivotal 1800 level. But in the short-term, traders should proceed with extra care, especially if the index turns decisively lower again from this 2000 level.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.