![]()

More than ever the OPEC needed a clear strategy to help shore up oil prices on Friday. But failing to even agree on an oil production ceiling, not only does this mean that the global supply glut will remain in place for a lot longer than expected, but it also brings into question the organization’s role as a cartel. Oil producing nations and companies will therefore continue to do what is in their own best interest and produce as much oil as possible in order to stay in the game and avoid losing market share. Eventually, some of the weaker producers will go out of business. This, combined with industry consolidation and stronger demand, means we are getting closer to a bottom for oil prices. But this could take at least several months as shale producers are still surprisingly resilient. In the short-term, the excessive surplus will continue to exert heavy pressure on prices, which should help to keep the potential gains in check.

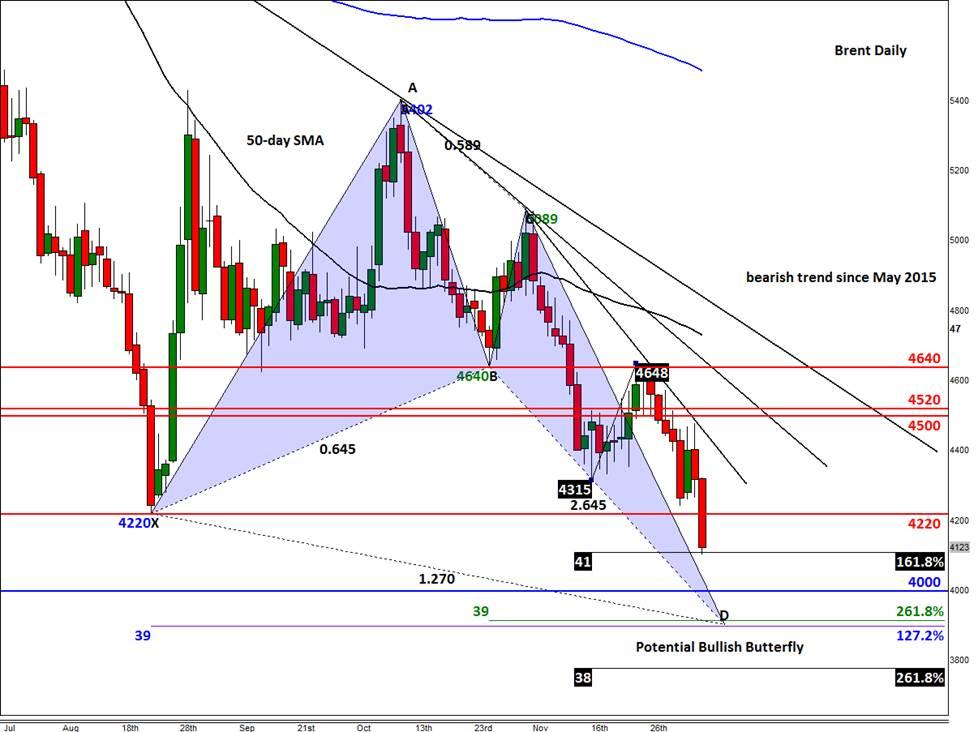

At the time of this writing, Brent oil was finding itself at just shy of $41 a barrel, a fresh multi-year low. Here, it was testing the 161.8% Fibonacci extension level of its most recent upswing. Thus, we may see some profit-taking around this exhaustion point, which could lead to a bounce of some sort. If Brent does find support here, or at another level lower, it could eventually rise to test the broken support – now resistance – at $42.20. Failure to bounce $41 however would expose the psychologically-important $40 handle for a test. If this level also breaks down, Brent may then drop to the Fibonacci converges area around $39.00 before potentially bouncing from there as the shorts take profit. The $39.00 level is also the extended point D of an AB=CD move, so it represents a Bullish Butterfly pattern, which can sometimes pin-point the exact top, and in this case, bottom. A potentially bullish outcome for Brent would be if it rallies from these levels and end today’s session back above $42.20 and thereby create a false breakdown signal. If this admittedly unlikely scenario happens, we may then see a significant bounce in the following days, particularly because of the extreme negative sentiment at the moment.

WTI meanwhile could follow Brent and break its earlier 2015 low of around $37.75 today or in the coming days. At the time of this writing, the US oil contract was just 25 cents away from this level, so it wasn’t looking great for the bulls. The Fibonacci extension levels from the previous price swings are shown on the chart, in figure 2. These would be among the possible support levels to watch. In addition, there is a potential falling wedge pattern in the making; the support trend of this formation needs to be watched closely around $34 a barrel. The key resistance for WTI is the old support at $40. The near-term bias remains bearish while it holds below here on a closing basis.

Figure 1:

Figure 2:

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD tumbles out of recent range, tests below 1.0770 as markets flee into safe havens

EUR/USD slid below the 1.0670 level on Tuesday after an unexpected uptick in US wages growth reignited fears of sticky inflation, chopping down rate cut expectations and sending investors into safe haven bids.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Ethereum slumps again as long liquidations exceed those of Bitcoin

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

No tap dancing around inflation concerns

Tuesday saw U.S. stocks closing considerably lower as investors grappled with economic indicators indicating increasing labour costs and a decline in consumer confidence, all coming ahead of a crucial Fed policy meeting aimed at determining the trajectory of interest rates.