![]()

It has been an ugly day for stock market bulls and things get even worse if the major indices fail to hold their technically-important levels that are being tested as I go to press. The falling commodity prices have finally taken their toll on the markets today, with concerns over an imminent rate hike from the Federal Reserve also unnerving some people. Recent macroeconomic pointers from China, including Wednesday’s factory output data, which showed activity slowed to a seven month low of 5.6% in October, continue to suggest growth in the world’s second largest economy is slowing down. In the US, the earnings season is drawing to a close and the results have not been great. There is little further catalyst to support the markets except the on-going expectations that the world’s major central banks will remain extremely accommodative for an extended period of time, and in the case of the ECB expand their bond purchases program and cut rates into the negative.

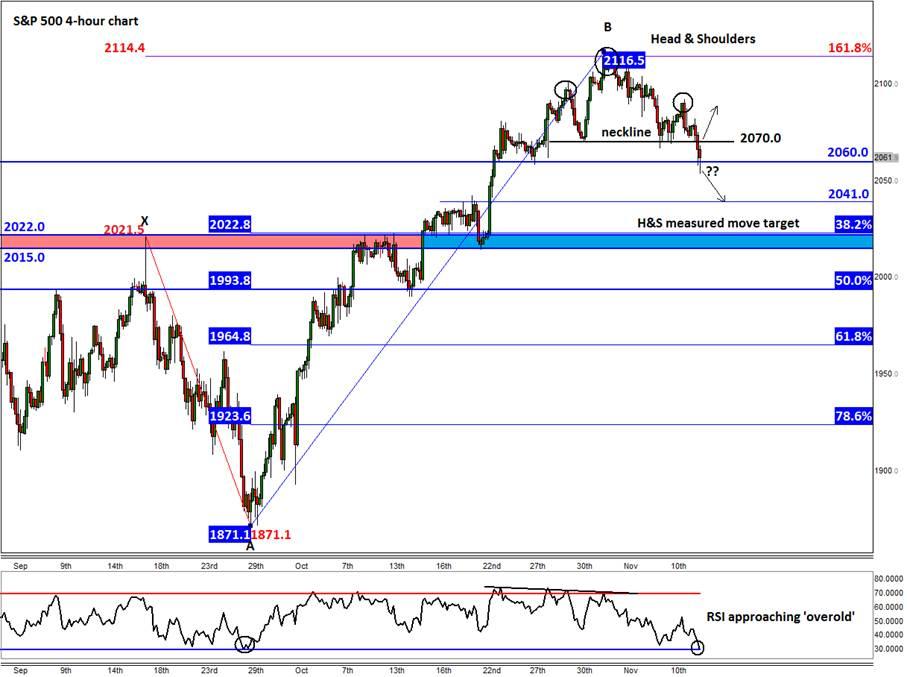

But focusing on the technical outlook of the markets today and the bears are clearly starting to once again win back control – at least in the short-term anyway. The S&P 500’s rally has stalled at the start of this month around the 161.8% Fibonacci exhaustion point of the last notable downswing we observed in September, around 2114/6. Here, bullish traders evidently took profit on their positions, particularly as the momentum indicator RSI had correspondingly been testing overbought levels of 70 and created a bearish divergence. This probably applied some downward pressure, giving the sellers some much-needed confidence.The resulting selling pressure has now created a potential reversal pattern on the S&P: a Head and Shoulders (H&S) formation. As can be seen from the 4-hour chart, the ‘head’ was formed around the 161.8% extension of the XA price swing of 2114/6, while the neckline was formed at 2070. Today, the S&P has broken below the neckline and is now testing another support at 2060. It needs to break decisively below here now in order to confirm the turnaround. The height of the H&S pattern is thus about 46 points (2116-2070). This gives us a projected target of about 2024 (2070-46). Interestingly, the next key support area is between 2015 and 2022, which therefore comes in just below the H&S target. It is therefore likely that the S&P will at the very least stage a modest bounce around these levels, should it get there. A move below this area would thus be very bearish and could lead to a significant drop. Standing on the way of the H&S target is the previous resistance at 2040/1, which could now turn into support.

The bulls, meanwhile, will first and foremost want to see a close back above the 2060 support level, and ideally a decisive break above the neckline at 2070. If seen, the S&P may then resume its rally towards the previous all-time high.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD looks depressed ahead of FOMC

EUR/USD followed the sour mood prevailing in the broader risk complex and plummeted to multi-session lows in the vicinity of 1.0670 in response to the data-driven rebound in the US Dollar prior to the Fed’s interest rate decision.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Ethereum slumps again as long liquidations exceed those of Bitcoin

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.