![]()

Plenty of ink has been spilled about ECB President Mario Draghi’s dovishness last week, especially in contrast to the more-hawkish-than-expected Federal Reserve meeting. Given the big fundamental shift over the last two weeks, we thought it would be worthwhile to check in on the pair’s longer-term technical outlook.

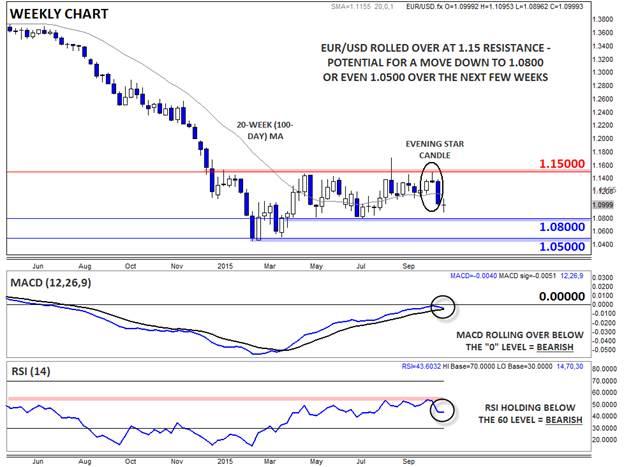

Looking at the weekly chart reveals a mixed picture for EUR/USD. The unit is undoubtedly in a long-term downtrend since peaking near 1.40 midway through last year, though rates have been generally rangebound between 1.05 and 1.15 for most of this year. Looking at the last six months specifically, the range has been even tighter from 1.0800-1.1500.

After testing resistance at 1.1500 in mid-October, the pair formed a clear Evening Star* candlestick pattern. This relatively rare 3-candle reversal pattern shows a gradual shift from buying to neutral to selling pressure and is often seen at important tops in the market. While we haven’t seen much continuation to the downside this week, with price merely forming a weekly Doji candle**, the technical outlook is still bearish below the 20-week (100-day) MA near 1.1200.

Meanwhile, the secondary indicators are also pointing lower. The MACD is rolling over beneath the “0” level and about to cross back below its signal line, signaling the return of bearish momentum. For its part, the RSI indicator remains pinned below the 60 level that typically serves as resistance within an established downtrend.

At this point, medium-term bears should be eyeing the 1.0800 level as the next major level to watch. Buyers could certainly step in to defend that level, as they did in May and July, but if it gives way, a continuation down to the 13-year low around 1.0500 could be next. Based on the weekly chart, it’s hard to have a bullish long-term outlook on EUR/USD as long as rates are pinned below 1.1500 resistance.

* An Evening Star candle formation is relatively rare candlestick formation created by a long bullish candle, followed a small-bodied candle near the top of the first candle, and completed by a long-bodied bearish candle. It represents a transition from bullish to bearish momentum and foreshadows more weakness to come.

**A Doji candle is formed when rates trade higher and lower within a given timeframe, but close in the middle of the range, near the open. Dojis suggest indecision in the market.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.