![]()

The growing disparity between monetary policies in the US and almost all the other major central banks is the name of the game in the FX markets right now. In the US, the Federal Reserve may have turned a little less hawkish since the summer, but it still remains the front runner in the race – for the lack of a better word – to hike interest rates first. Indeed, the FOMC statement turned out to be more hawkish than had been expected as my US colleague Matt Weller highlighted last night. The Fed once again raised the prospects for a rate hike in December and the markets responded by buying the dollar and selling everything else priced in the US currency, including precious metals. The probability of a December rate hike has now risen to just below 50 from around 30 per cent previously, according to the Fed Fund Futures. Out of the major central banks which are or turning more dovish are the European Central Bank, the Swiss National Bank and the Bank of Japan, with the latter scheduled to announce its decision on monetary policy tomorrow. The dollar bulls are thus spoilt for choice.

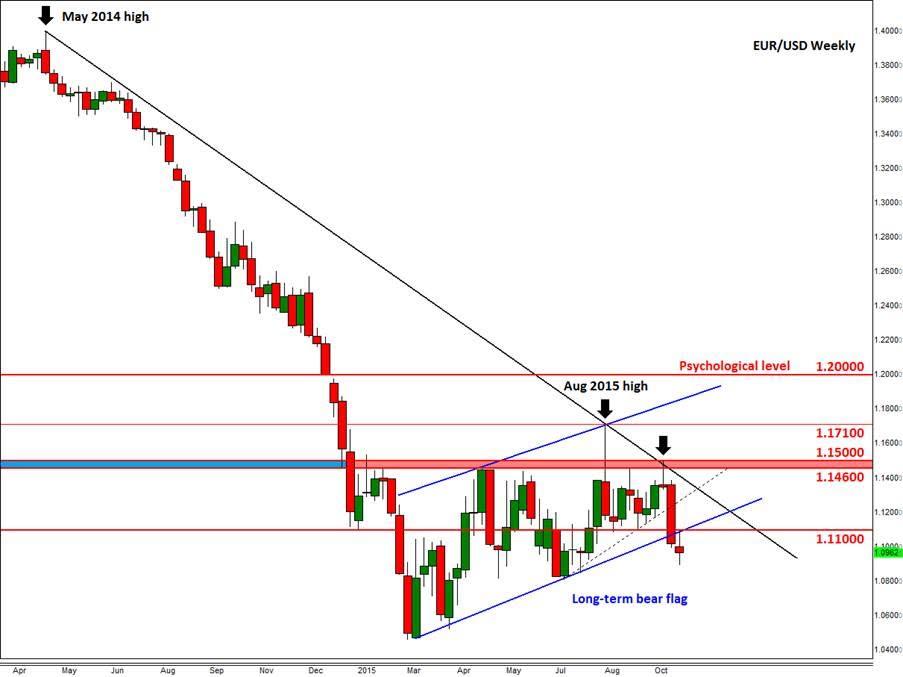

However the EUR/USD has managed to bounce back a touch after receiving a double whammy of bearish news as the ECB turned more dovish and the Fed remained surprisingly hawkish in recent days. It has been supported in part because of profit-taking as we will have the Advance US third quarter GDP estimate out at 12:30 GMT. Will it be a hat-trick of good news for the bears? The world’s largest economy is expected to have expanded at a moderate pace of just 1.6% in Q3 in an annualised format. If correct, it would mark a sharp slowdown from the previous quarter’s growth rate of 3.9%. The euro meanwhile has also been supported by stronger-than-expected European data this morning, with German unemployment falling by a bigger than expected 5,000 in October and the EU's Economic Sentiment index hitting its highest level since 2011.

Ahead of the US GDP data, the EUR/USD is holding its own slightly above the 61.8% Fibonacci retracement level of the upswing from the March low, at 1.0940. Yesterday, the advance at previous support and the backside of the broken trend line was rejected sharply at just shy of 1.1100; this is now a major resistance level going forward. The low from last week of around 1.1000 is another key resistance to watch. On the downside, there are not many further short-term supports seen until the summer lows of around 1.0800/20. Below there, the 78.6% Fibonacci retracement comes in at 1.0730 and then there is nothing significant until the psychologically-important 1.05 handle followed closely by the March low at 1.0460. To parity and beyond I would imagine if US data starts to surprise to the upside from now until the Fed’s December meeting, starting with Q3 GDP today.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.