![]()

Even with the benefit of a weekend to digest it, market participants are still struggling to put a bullish spin on Friday’s NFP report. In fact, for many traders, the disappointing jobs report has pushed expectations for interest rate “liftoff” into 2016: according to the CME’s FedWatch tool, fed funds futures traders are only pricing in a 30% chance of a rate hike this year, and the odds don’t break above 50% until March of 2016.

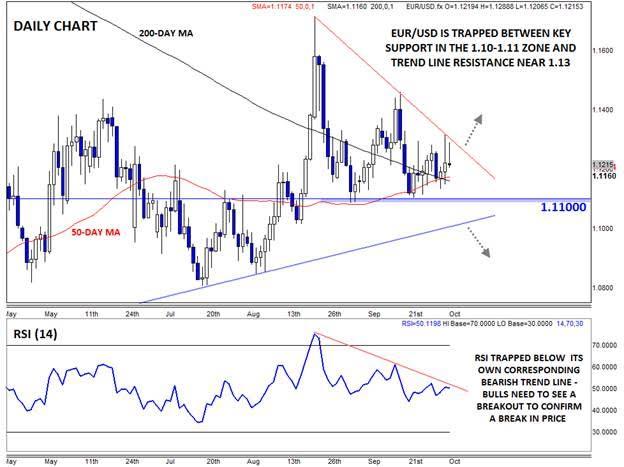

With that backdrop, it’s no surprise that the US dollar is struggling early in this week’s trade. The dollar index, which measures the strength of the world’s reserve currency against six of its biggest rivals, continues to hold below its 50-day moving average while its biggest component, EUR/USD, continues to hold above its own 50-day MA. Taking a step back though, EUR/USD is clearly trapped between a bullish rock and a bearish hard place.

To the downside, there is strong near-term support at the 1.1100 level, which has put a floor under rates twice in the last month. Below there, the rising trend line off the 12-year low from earlier this year comes in around 1.10, and longer-term traders will remain cautious above that level. The recent “golden cross” of the 50-day MA above the 200-day MA has turned some traders optimistic on the longer-term prospects for the world’s most widely-traded currency pair, but there are some clear bearish hurdles to clear first.

Specifically, Friday’s rally stalled out directly at the bearish trend line off the late August high and the unit remains below that resistance area (1.1300) as of writing. Meanwhile, the RSI indicator is trapped within its own corresponding downtrend, so more conservative readers may want to see if both the exchange rate itself and the RSI indicator can break above their bearish trend lines before turning more optimistic on EUR/USD.

The range between the bearish trend line and support in the 1.10-1.11 zone is becoming increasingly tight, foreshadowing a likely breakout in the next week or two. In terms of potential catalysts, traders should monitor today’s US ISM Services PMI report, the Eurogroup/ECOFIN meetings (concluding on Tuesday), ECB President Draghi’s speech in Frankfurt (also on Tuesday), the FOMC meeting minutes (Thursday), and Fedspeak from FOMC members Williams (Thursday), Lockhart, and Evans (both Friday).

Intraday traders may still find some short-term opportunities in EUR/USD, but everyone else may want to wait for a confirmed breakout before committing too strongly in either direction.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.