![]()

Some people have been looking for the Fed to hike interest rates to help reignite the dollar rally. Bad news, some fairly basic analysis suggests that the dollar is not that closely related to the Fed’s rate hiking cycles.

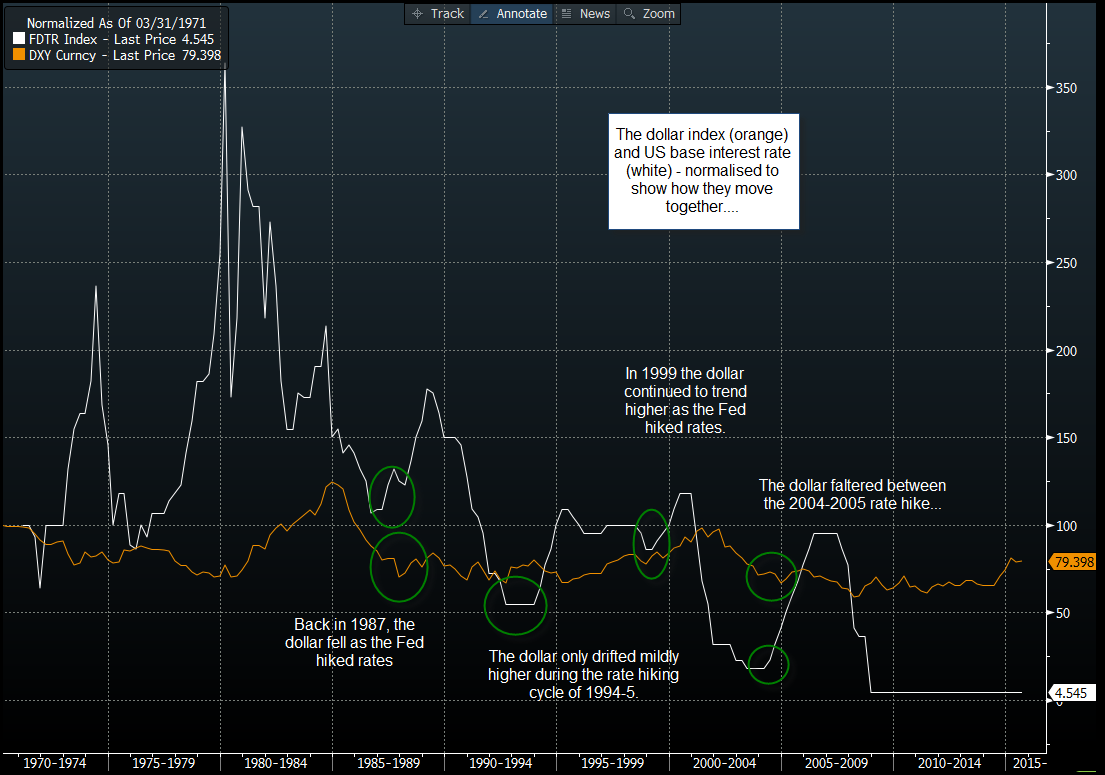

We looked at previous hiking cycles in 1987, 1994, 1999, and 2004, here are the results:

1987: dollar fell in the first few months of hikes.

1994: Dollar drifted sideways, before embarking on a mild upward trend.

1999: the dollar continued with its mild uptrend, which had started before the Fed began raising interest rates.

2004: The dollar fell as the Fed embarked on a rate hiking cycle.

You can see a visual representation of this in the chart below, which shows the dollar index and the US Base rate, this chart has been normalised to show how the two move together.

So what does this mean for traders?

· Do not rely on the Fed to determine the direction of the dollar in the coming months.

· The dollar tends to follow its predominant trend when the Fed starts to hike rates.

· There is no direct link between the Fed hiking rates and the dollar falling, when a weak dollar has coincided with a Fed hiking cycle it has been falling for some time already.

· Due to this, we may see a muted reaction to a potential Fed rate hike next month.

Where could the dollar go this time?

If the Fed does hike rates next month (the jury is still out with only a 50% chance of a hike priced in by the Fed Funds futures market), history tells us not to expect too much of a reaction in the buck. However, because the dollar has rallied into this rate hike, it has been in an uptrend since mid-2014, there is a chance that the buck could rally alongside a Fed rate hiking cycle, although our analysis tells us that this may have little to do with the Fed actually hiking rates.

Figure 1:

Source: Gain Capital, Data: Bloomberg

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.