![]()

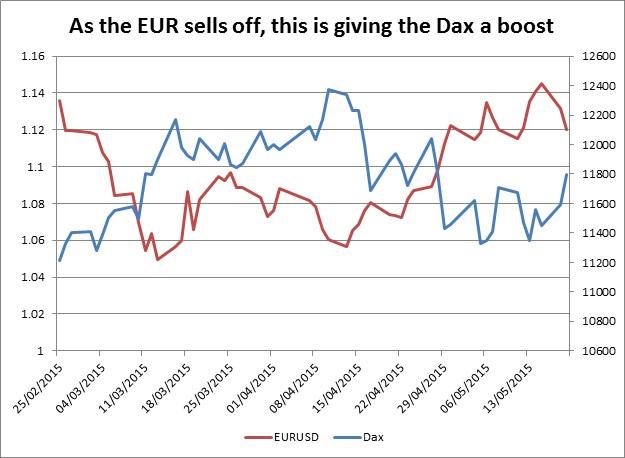

As the EUR continues to pullback from prior highs vs. the dollar of 1.1450, the Dax is off to a flying start this week. In the last 2 days, the Dax is up more than 3%, and is testing its 50-day sma at 11,822, the highest level since the end of April. If the index continues to rally at this current pace then we could see back to 12,000, and maybe the record high of 12,390.

The Dax can thank the EUR for its recent rise, as the negative correlation between the two has surged in recent days. To put this into some perspective:

Since the start of this year the Dax and EURUSD has had a negative correlation of -0.36.

This has risen to -0.51 since the start of May.

Since 10th May this correlation has surged to -0.66.

Thus, when EURUSD falls, the Dax rises 66% of the time. Read our technical update on the Dax on our website, but the fundamental reason for the increase in the Dax is closely tied to the EUR for the following reasons:

EUR weakness helps Germany’s exporters, including its car manufacturers, which are its best performers on Tuesday.

The EUR has weakened on the back of comments from ECB officials that its QE programme will not end prematurely, and that the ECB may front-load asset purchases this summer, which could heavily on the EUR in the coming weeks.

Stock markets love the liquidity provided by QE, hence why Europe’s largest index is rallying on the back of news that the ECB’s programme is here to stay.

To conclude, if you are trading the Dax, make sure you watch what the EUR is doing, a break below 1.10 in EURUSD could help the Dax regain recent record highs.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.