![]()

The pound had an about-turn this morning, after coming off overnight it reversed on the back of the better than expected UK production data for March and has broken above the 200-day sma at 1.5624. So far today’s rally shows no sign of running out of steam even though it has already advanced by more than 100 pips.

The key drivers of the pound this week include:

Short covering after the shock UK election result.

Options coming off post the election – we pointed out before the election that there were a large number of options expiring directly before and after the election that could cause disruption to GBP.

The rise in Gilt yields.

These are fairly potent drivers of the pound right now; however we doubt that the post-election bounce will last for longer than a week or two. Instead, the rise in Gilt yields could be a more important for the pound going forward.

The pound and the yield differential:

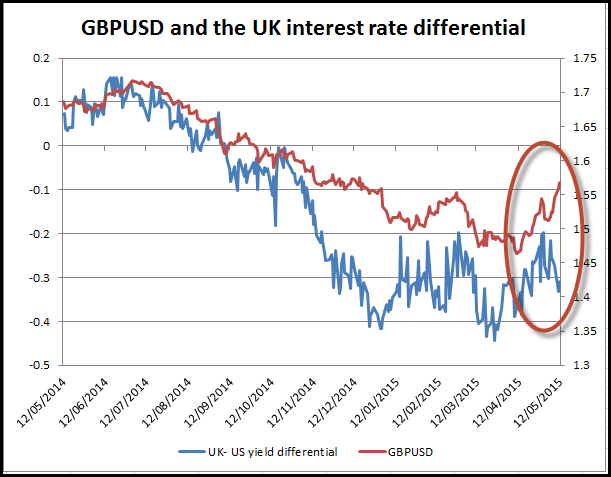

Interestingly, while the pound surges through its 200-day sma, the yield differential between 10-year UK Gilt yields and 10-year US Treasury yields has actually been heading south, as US yields outpace UK yields. This doesn’t seem to be impacting GBPUSD, which is at a 6 month high, as you can see in figure 1. In fairness, the divergence between the UK yield differential and GBPUSD has only occurred in the last few days and could come back together in the near future.

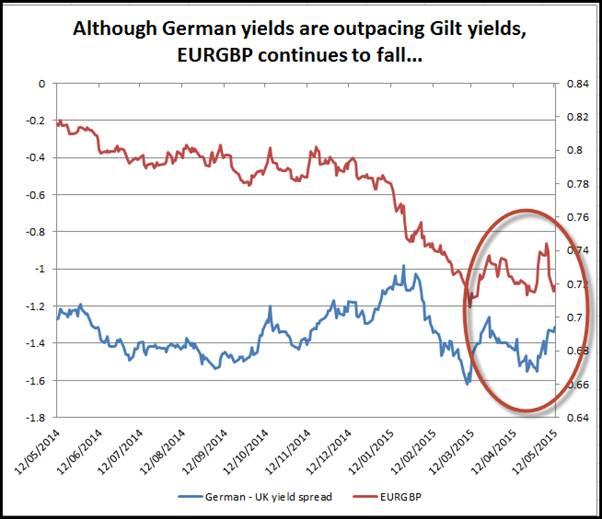

In contrast, even though German yields are outpacing UK yields, EURGBP has been falling. The question is can the EUR remain weak in the face of record increases in German bond yields? Of course, the prospect of a Grexit may also be weighing on the euro, but we still think that EUR weakness vs. the pound could lose strength once UK election fever starts to die out.

The technical view:

If we can hold above the 200-day sma at 1.5624 on a daily close then this is a positive development that could signal further upside in the medium term towards 1.60. Support lies at 1.5552 – former resistance.

But there are a few fundamental hurdles for sterling in the next few days including Wednesday’s BOE inflation report, where the BOE could revise down its growth forecast. We also get UK wage and labour market data on Wednesday, if this data is strong then it could prove to be a peak for GBPUSD especially if Carney and co. at the BOE err on the dovish side.

Takeaway:

The pound is the top performer in the G10 this morning.

Yields are a key driver of FX right now, but interestingly the UK/US yield differential is moving in the opposite direction to the pound.

The pound looks like it may be over-shooting to the upside after the surprise result from the UK election.

However, a dovish inflation report from the BOE on Wednesday could put the brakes on sterling.

From a technical perspective, if GBPUSD can remain above the 200-day sma this would be a positive development; however, fundamental factors could disrupt the uptrend.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.