![]()

The North American trading session has been quite a ride so far this morning as news is beginning to break out of Europe in regard to the Greek situation. A Greek government official let it leak that discussions were going well, which encouraged investors to stock up on their EUR positions driving the EUR/USD up to 1.08. US data releases were likely helping the popular currency pair ascend as well as all four major releases (Initial Jobless Claims, Continuing Jobless Claims, Markit Manufacturing PMI, and New Home Sales) missed their consensus expectations and put the USD on its back foot. Equity markets started the day lower, but are trying to mount a rally as we head in to the lunch hour.

Call me a skeptic, but all of this celebration related to an unnamed Greek official who THINKS that talks are going well seems a little overdone. We have been fooled before as Greece sees progress where others see derision, and for skeptics like me; “once bitten, twice shy” doesn’t even begin to describe the never-ending Greek melodrama. For that reason, I am prone to seek opportunities that assume that another official will tell us that this whole thing is a hot mess, and that nothing will get accomplished.

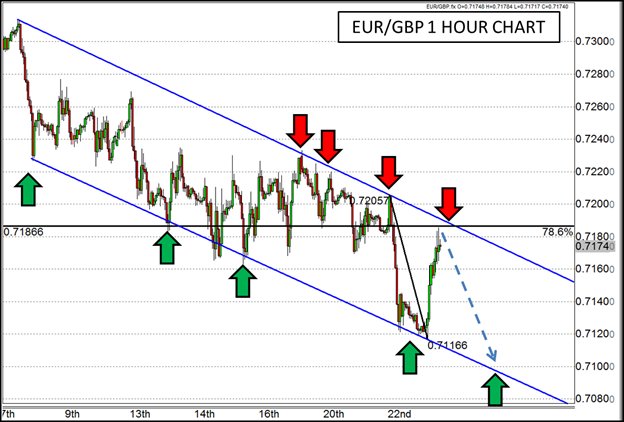

The EUR/GBP appears to be approaching a technical level where the pessimistic among us could logically see a rejection of the EUR rally. Not only is this pair rallying in to the top of a declining channel, but it is also approaching the 78.6% Fibonacci retracement of yesterday’s high to today’s low. If the one-two punch combo of trend line resistance and Fibonacci resistance can align near current prices, the skeptical investors may be able to mount a reversal of the current rally as we head in to the second half of the trading day.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.