![]()

The last half of the North American trading session was pretty much a reflection of the first as equities pretty much ground lower throughout and the USD kept clawing back some gains as well. The EUR was trying to gain back some respectability on positive sentiment figures out of Germany to start the day, but appears to be losing some momentum as we transition over to the Asian desks. If commodities or equities have an eye toward rallying moving forward, the Australian CPI release this evening will have to step up to the plate, otherwise a bigger drop may be in order.

Circling back to the situation in Europe, today’s EUR rally didn’t really ruffle the feathers of the “short the euro under any circumstances” crowd. If that was an attempt at a short squeeze, the troops may want to regroup and try again, but it may be a futile attempt. The potential for extreme fallout from Greece in merely three days is weighing heavily on the minds of investors as the days and hours pass by. So no matter how often German economic figures repeatedly sing “Everything is Awesome”, investors, and therefore the EUR, just don’t seem to be buying it.

Along with the upcoming inflation news out of Australia, Japan will be releasing their Trade Balance data. Though Japan hasn’t had a surplus reading since 2011, the trade balance in the nation has been trending slowly toward that surplus designation once again. Out of the last five trade balance results, each one was either slightly or much better than the consensus expectation, and has investors believing in the JPY once again. Potentially contributing to some JPY love was Koichi Hamada, an advisor to Japanese Prime Minister Shinzo Abe, who said that the USD/JPY was fairly valued at 105 merely last week. It is unusual for Japanese officials to step out on their own in policy matters, so this may have been a signal from Abe’s camp and the Bank of Japan that the JPY devaluation has run its course, joining in on the Everything is Awesome chorus.

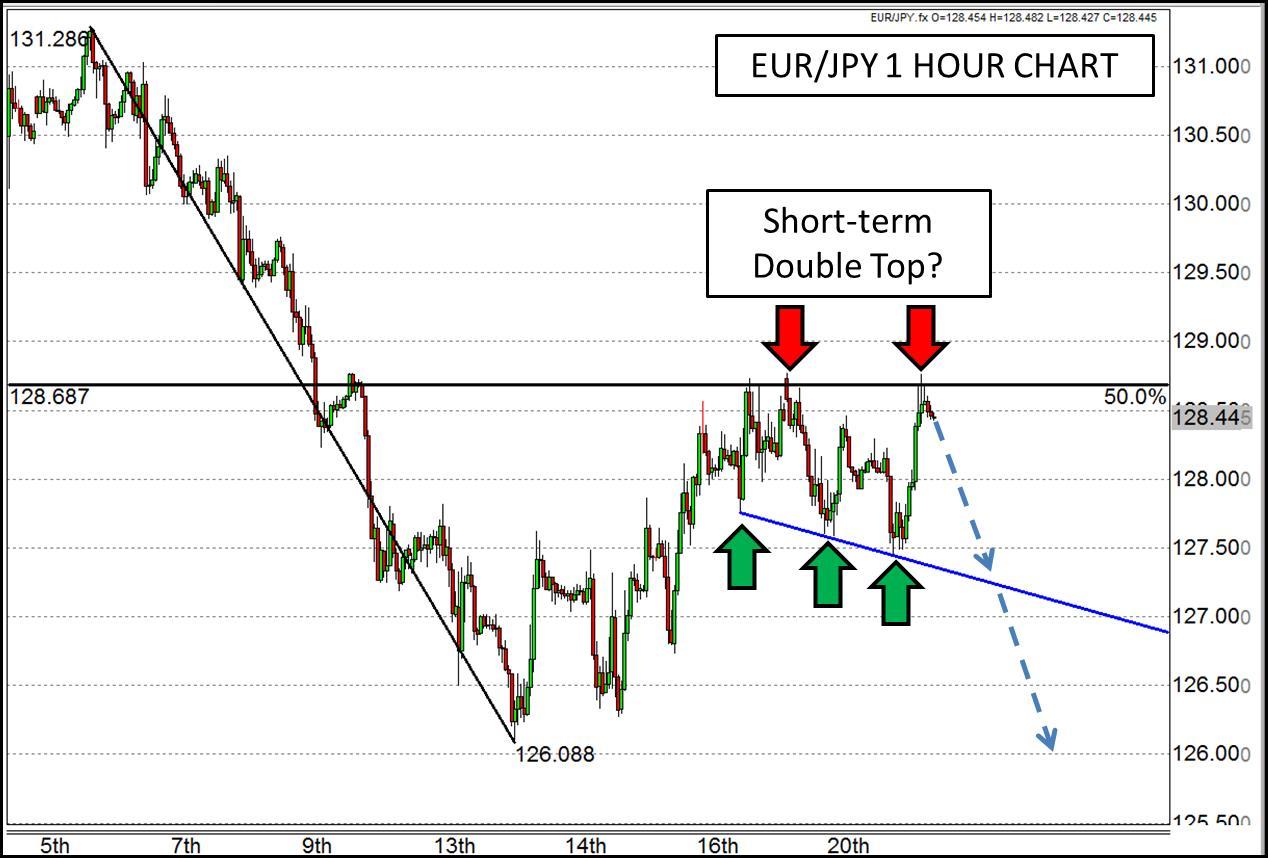

If Japan’s Trade Balance can perform admirably for a sixth straight month this evening, and investors start re-stocking up on their EUR sell orders, the EUR/JPY may be prime candidate for a solid move lower. Not only has the pair rallied up to a 50% Fibonacci resistance level from the April high to low, but it also failed to traverse that level twice, creating a potential short term double top. If these fundamental and technical factors continue to exert their influence, the move in this pair may end up being relatively significant, and only the JPY will be thinking anything is remotely awesome.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.