![]()

The second half of North American trade was very similar to the first half in that the USD continued to take a beating at the hands of the rest of the developed world’s currencies. Major currency pairs were all making notable highs against the USD at least once during the day as EUR/USD rose up to 1.07, NZD/USD took out 0.76, GBP/USD burst through 1.48, and USD/CAD went on a rampage by falling over 250 pips and breaking out of its long drawn out range. Even the much beat up upon AUD/USD made a nearly 100 pip run up to 0.77 before retreating slightly as we careen toward the end of the trading day.

The AUD/USD is where there could be plenty more intrigue though heading in to the Asian trading session. Australia will be releasing their ever-important employment figures this evening which are expected to increase at about a 15k clip. Simply looking at recent examples of Aussie employment doesn’t give us a real good read on how this may end up, but judging by general sentiment out of Australia, it doesn’t look like they could be classified as optimistic. The Westpac Consumer Sentiment released yesterday fell for the second month in a row, meaning that consumers aren’t feeling too good about the current situation. On the other hand, Australian businesses have been faring better as NAB Business Confidence survey increased last month with a small uptick in employment according to the results.

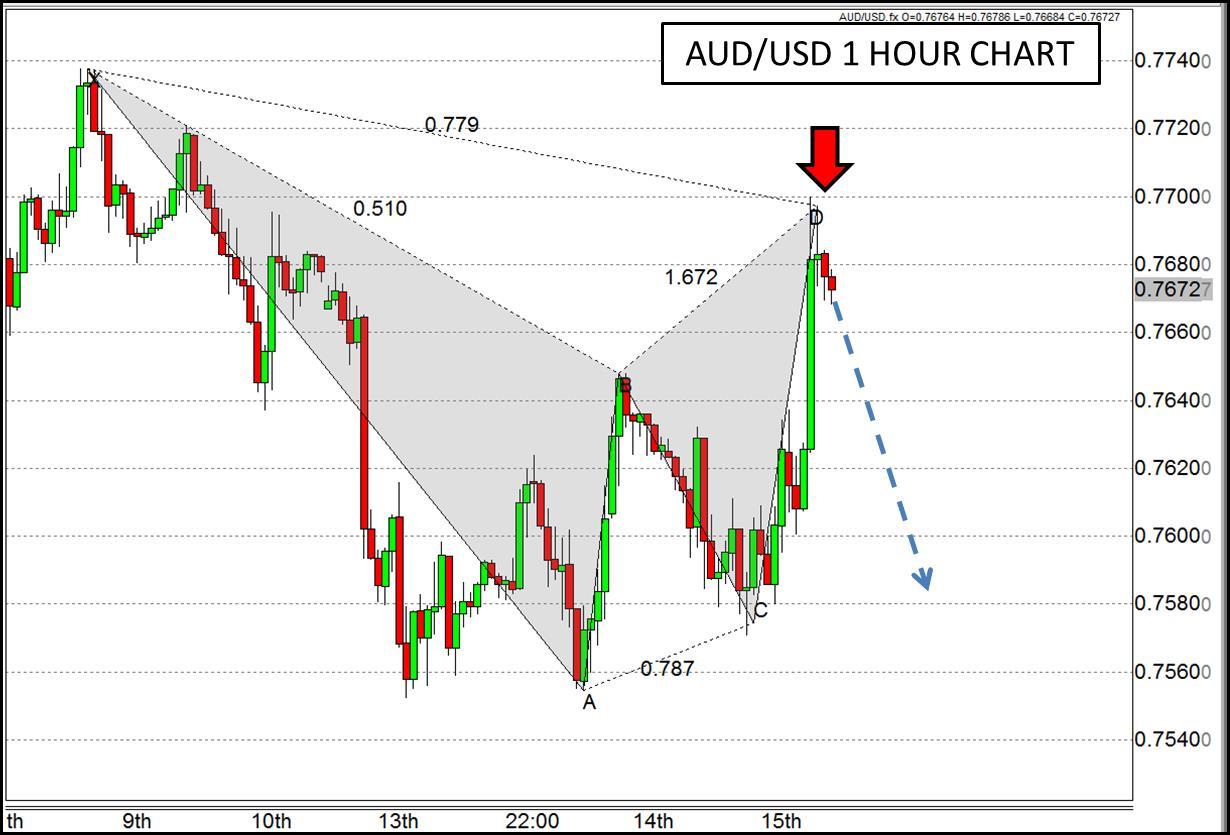

The divergence between consumers and businesses makes this employment figure particularly difficult to predict as the situation appears mixed on the fundamental side. When looking at the technical side of the equation though, there could be a compelling reason to consider a move back down in the AUD/USD. The rally today brought the currency pair right up to 0.77 where it completed a Fibonacci based Bearish Gartley pattern that could prove to be the ceiling on this rise. So at this point, it depends on which dollar you believe in more. Is it the AUD which could prove businesses correct by having a strong showing in employment? Or is it the USD which has shown strength for many months heading in to this report? Based on the arguments laid out here, it would seem the case for a drop back down may be the more likely of the two scenarios as it has both fundamental and technical biases.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.