![]()

There were a lot of interesting moments occurring in global markets during the North American morning trading session that has created a bit of a hodgepodge of market moves. First of all, the Chinese GDP figure released last night of merely 7.0% growth over the last year was disheartening as it is the lowest level seen since 2009, but it did meet expectations; however, other Chinese data releases didn’t reach consensus and was a general drag on the commodity currencies as a result. The European Central Bank and President Mario Draghi didn’t release any fireworks in their decision this morning, but they did elicit a confetti drop. Meanwhile, US data did the USD no favors as Capacity Utilization, Industrial Production, and the Empire State Manufacturing Index all missed expectations by wide margins. Amongst all this activity, US equities are surging higher with both Dow Jones and S&P 500 up around 0.5% as we head in to the lunch hour.

Perhaps one of the biggest drivers of price action this morning though has to be the Bank of Canada who appears to be more optimistic than many anticipated heading in to today. The decision by the BoC to leave interest rates at 0.75% was widely expected, but it was the statement that got most of the attention. Within the statement they insinuated that they expect the Canadian economy to recover more quickly than they anticipated merely a couple months ago when they unexpectedly cut interest rates. For instance, “the oil price shock on growth will be more front-loaded than predicted in January, but not largerâ€, and “risks to the outlook for inflation are now roughly balanced†were statements that were deemed much more positive than in the recent past.

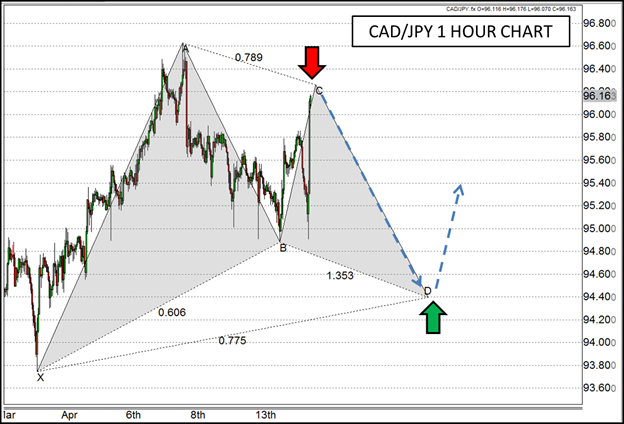

Due to the BoC’s sunny disposition, the CAD has been the star of the show against virtually every other currency, and threatens to break out of the month’s long sideways channel in which it has been trapped in the USD/CAD. Since the USD has been experiencing a bit of a comeuppance against many currencies this morning, that channel break may not be that surprising. It is the CAD/JPY which could offer a more intriguing setup as the CAD is the only currency gaining substantially against the JPY. Remarks from Japanese Prime Minister Shinzo Abe’s economic advisor Koichi Hamada a couple of days ago that the USD/JPY would be priced appropriately at 105 haven’t been retracted, nor have they been denounced by Japanese authorities. Since that statement has been allowed to marinate, the thought is that the JPY may start to get back some mojo here moving forward.

On the technical front, there is a 78.6% Fibonacci retracement near 96.25 that could create some resistance on the CAD/JPY if JPY strength were to take hold. In addition, if it were to decline all the way down to 94.40/50 thereafter, it would complete a visually satisfying Bullish Gartley pattern, where potential support could come in to play. Before we can start talking about bullish patterns though, the resistance near current levels needs to hold, but a break above A near 96.60 could deem this pattern null and void.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.