![]()

The latter half of the North American trading day was much less exhilarating than the first half as the bulk of the gains in US equities were made in the first half. The USD enjoyed a little more strength and WTI did the same as well on the back of a few fundamental factors working in its favor. In fact, the only distressing news of the day came from Washington DC which saw blackouts in the White House and other government buildings that ruffled a few feathers, but turned out to be nothing egregious.

Turning to events that will be happening this evening, the Bank of Japan will be making a monetary policy decision merely one day after the Reserve Bank of Australia surprisingly decided to leave their rates steady. The immediacy of the RBA decision could weigh heavily in currency value terms when considering the AUD against the JPY. While the Bank of Japan isn’t expected to do much when it comes to their interest rates or their Quantitative and Qualitative Easing program, the option to do something is still on the table. In fact, there are some analysts who believe that the BoJ will be increasing their QQE program by the next meeting, which is occurring a little later this month on April 29th. If that is the case, they could hint that something is in the works at this meeting so the actual announcement isn’t such a big surprise.

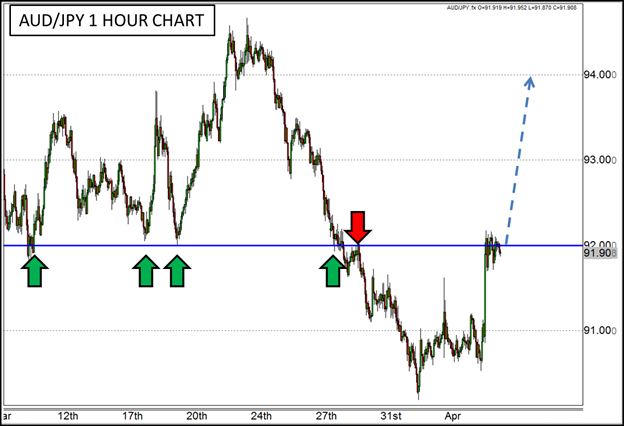

If the BoJ were to drop their insistence that there is no need for further easing at the present time and acknowledge that more could be coming, the AUD/JPY may be the most prime suspect for a strong rally. The prior belief that the RBA was cutting rates severely depressed this pair which was only partially recovered yesterday. The current price where the pair resides is an intriguing level where both support and resistance has been found recently and could act as a staging ground for a move in either direction, however, recent sturdiness from the RBA and the potential for frailty from the BoJ make it look more like a launch pad than a ceiling.

Figure 1:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.