![]()

The whole world finally returned to the trading realm today as Easter celebrations are finally over in Asia and Europe and have joined in on the over-analyzation of the Non-Farm Payroll disappointment experienced on Friday. For their part, both Asian and European stock markets were markedly higher today with virtually all of the major indexes logging healthy gains, just as US stocks did yesterday. US equities are joining in on the fun too with both Dow and S&P racing out to higher levels in early trade. The reason I say that there is a bit of over-analyzing going on for NFP is that one bad report doesn’t typically make monetary policy change course drastically, and that realization is beginning to play out particularly for the USD.

When NFP was released, doom and gloomers were carving the gravestone for USD dominance and declaring that the Federal Reserve wouldn’t be increasing interest rates in 2015. According to those that were most pessimistic, you had better get on the USD down elevator quickly because all is lost. Granted, that may have been a fringe element of the economic literati, but they were out there, and they were particularly loud after such a large NFP miss. However, cooler heads have prevailed early this week already with some Fed members trying to calm the panic, and the USD has returned to pre-NFP levels once again.

Another argument for the bad NFP simply being an outlier instead of a new trend is the JOLTS Job Openings report releasing this morning. This alternative employment indicator surged to its highest level since 2001 and the quits rate remained elevated, indicating that people have the confidence to leave their current job in search of others or taking another job. The IBD/TIPP Economic Optimism Index released this morning also recovered to post a strong reading of 51.3 with 20 of the 21 groups the measure tracks scoring optimistic in the Personal Financial component. If this economic release is any indication, there could be a surge in spending coming for the world’s largest national economy.

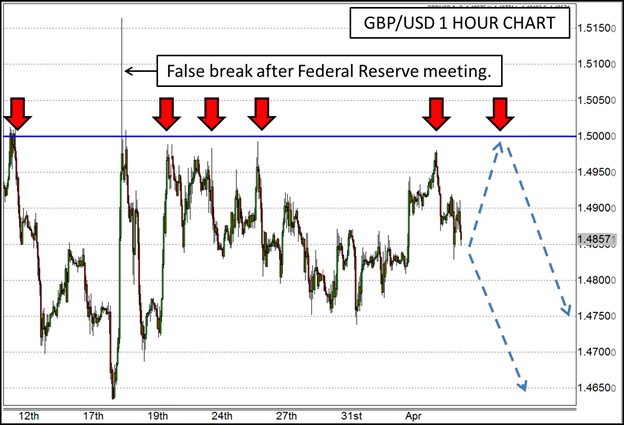

Considering the fundamental factors involved, the USD might go right back to retake the throne it temporarily relinquished. If that is the case, there is a good technical reason to think about the downside in the GBP/USD. The 1.50 level has been a virtual cap on this pair since the Fed had their last monetary policy meeting, and the recent failure for any GBP rallies could continue to keep it capped. While this pair may attempt another run at the psychological 1.50 barrier, the path of less resistance may be down as more investors come to realize that the USD may not be dead quite yet.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.