![]()

The first half of North American trade has been a mixed bag of tricks for traders so far as usual correlations aren’t behaving so well. While the EUR/USD has fallen lower on renewed concerns about Greece, but the typically correlated GBP/USD made a valiant run above the 1.48 level that it has been straddling so far this week. The USD/JPY also continues to hover near 120 even though US stock markets are generally down on the day. Much of the mixing of signals could be attributed to US data releases that only served to muddy the waters as Chicago PMI remained below the 50 boom/bust level for a second straight month whereas it was expected to rise to 52.5. Almost as quickly as the market began thinking bad thoughts though, the Conference Board’s Consumer Confidence figure improved to 101.3, the second highest level since late 2007.

Meanwhile, on the Iranian nuclear front, negotiators are hopeful of an agreement being reached, but the deadline is being pushed back once again. The all-important oil market isn’t reacting in either direction to the news, which could be a potentially worrying sign to oil bulls; no immediate deal would seem to have a buoying effect on the commodity, but that hasn’t come to fruition quite yet.

The unconnected moves of the market thus far make it challenging to pick a direction on many fronts as some primers are lost, however, there was some interesting news out of Australia last night that could be another chink in the armor of the weary AUD. Expectations are growing for another rate cut from the Reserve Bank of Australia next week, and commodities that are failing to increase isn’t helping the matter. As a prime example of AUD weakness of late, the AUD/NZD has been consecutively setting all-time lows over the last few weeks, and threatens to reach the psychologically significant parity level if the tide isn’t turned.

Unfortunately for the AUD though, there may not be much to help turn the tide over the next week. Aussie Building Approvals are scheduled for release this evening, but expectations are firmly anchored on the negative side. Plus, there will be a milk auction tomorrow that could greatly influence the NZD. If the last auction’s 8.8% decline was merely an outlier in the broader recovery of milk prices, the Kiwi could be working from a position of strength.

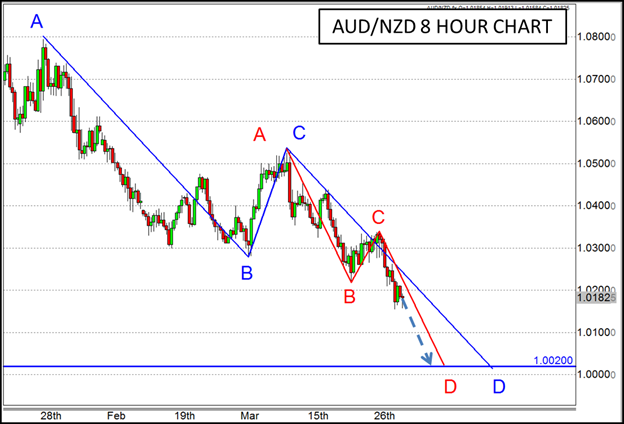

On the technical front, there is precedent for another run lower toward parity as there are a couple of ABCD patterns that would complete slightly above the parity level if they are valid. One is more long term (blue) having started in late January, and the other is more recent (red), beginning its run in mid-March. If these ABCD patterns end up ringing true, parity might act as a virtual magnet as investors turn their attention toward this less traded currency pair.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.