![]()

The second half of the North American trading day wasn’t too compelling if you were watching charts as a healthy portion of traders were likely taking extended lunches to enjoy the start of the NCAA Tournament. Therefore the moves of the morning pretty much remained for the duration, but Asia is lying in wait to pick up the liquidity. On tap for the region is Meeting Minutes from the Bank of Japan, Reserve Bank of Australia’s Governor Glenn Stevens giving a speech, and a couple of minor New Zealand economic releases. The first two have a decent chance of moving markets particularly now that the world is up to date with the thoughts of the Federal Reserve.

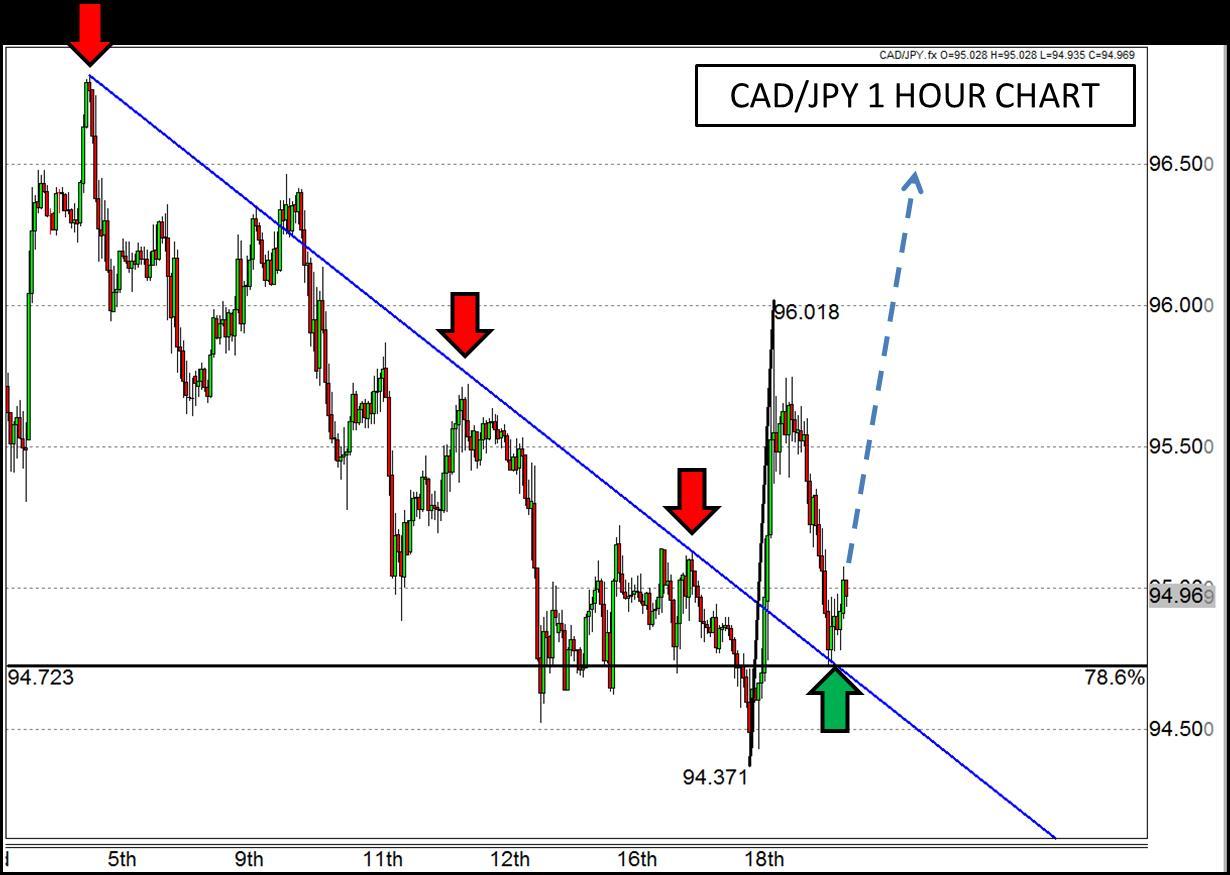

Moving away from the US though may be a wise path to follow for the time being. After witnessing yesterday’s extreme market moves along with today’s reversal of those moves could mean that the market is still trying to figure out what the Fed really meant. In a nod to the aforementioned tournament, sometimes it is better to pick a market underdog to find opportunities, and Canada may qualify (particularly in comparison to the US). The CAD/JPY had an extreme move yesterday after the Fed meeting as well, and has retraced back to an interesting level that correlates with a trend line and a Fibonacci level.

Canada will be releasing a couple of market moving metrics tomorrow including CPI and Retail Sales that have a chance of being good for the CAD. So far this month, the Bank of Canada sounded more optimistic than anticipated, GDP was pretty decent, and Employment wasn’t as bad as expected; perhaps those good vibes could leak over to inflation and sales. If those fundamental factors combine with the former trend line resistance turned support, and 78.6% Fibonacci retracement of yesterday’s low to high, a rally back above 96.00 and beyond may be a possibility.

Figure 1:

Source: FOREX.com

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.