![]()

The early portion of the North American trading day has been wrought with markets essentially doing their own thing as developments from around the globe have had regional effects. The Aussie dollar has been getting hammered ahead of the Reserve Bank of Australia interest rate decision this evening; equities are all over the place as Asia was up, Europe is down, and the Americas were weak at first, then rallying; the US dollar is simply reacting secondarily to other regions; and the euro is finding some early love as it has rallied on the back of better than expected data out of Europe. One currency that isn’t getting too much favor though is the Pound Sterling that has been losing ground against everything except the euro.

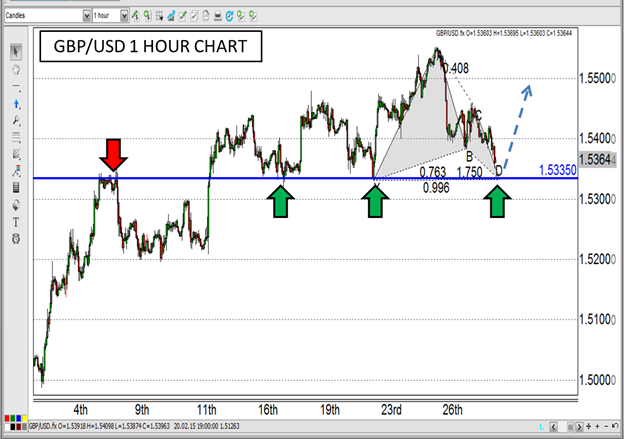

The weakness in the GBP isn’t really based on anything fundamental as UK data wasn’t depressing by any stretch of the imagination this morning. While the House Price Index was dismal (0.4% expected, -0.1% actual), Manufacturing PMI beat estimates and Mortgage Approvals fell in line giving a mixed bag of results. US data was also heterogeneous with Markit Manufacturing PMI beating consensus and ISM Manufacturing PMI missing. Personal Spending and Personal Income were also disappointing, but the USD has gained favor anyway. The GBP weakness in this environment sets up some intriguing opportunities as it approaches support levels in the GBP/USD as a result of the mixed readings, and could find favor like the euro did in early trade.

When searching for support or resistance levels in currencies, it helps to find levels that have been bounced off in the past, and the GBP/USD has a prime example in its sights. The 1.5335 level has been both a support and resistance level over the last month, and to help the cause, there is a bullish Gartley pattern that completes around the same level. If that support can hold once again and the fundamental moves begin to make a little more sense, the GBP/USD may be in for a rebound as the day progresses.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.