![]()

The Greek crisis remains fluid, and the situation continues to change on a daily basis. Yesterday, the outlook was bleak until the ECB stepped in a boosted its emergency lending assistance to Greek banks. Today, the situation improved further on the back of news that the Eurgroup will meet on Friday from 1500 GMT, which is a sign that Greece may have shifted its negotiating position to a more Eurogroup-friendly stance. However, excitement is being contained after Germany said it would reject the deal proposed by Greece in its current form.

The Eurogroup meeting on Friday, the third in a week, comes after Greece requested a 6-month bailout extension. The good news is that, if approved, Greece will be able to pay back the EUR 21 billion of principal debt repayments that come due between now and August. The bad news, is that even if this extension is approved, we will be back in the same position in 6-months’ time and Greece’s long-term debt problems remain unsolved.

What to expect from Friday’s Eurogroup meeting:

Thursday: Eurozone officials are expected to meet to discuss Greece’s bailout extension proposal. Watch for any headlines later this afternoon.

Friday 1500 GMT/ 1000 ET: Start of Eurogroup meeting. Expect headlines and quotes from the Finance ministers as they arrive, approx. 60 minutes ahead of the meeting. If the two sides have reached a conclusion then we would expect these headlines to be more conciliatory than they have been of late.

Friday evening (GMT): If a deal is agreed then they should release as statement that outlines the deal and any conditions that Greece has agreed to. In recent Eurogroup meetings the two sides have not been able to agree on the wording of a statement. So if we do get a statement on Friday it could be a sign of a real breakthrough.

Friday evening (GMT): Look out for a press conference from the Greeks and the head of the Eurogroup, Jeroen Dijsselbloem, we would expect them to talk through the terms of a potential bailout extension. We should be able to tell if both sides are happy with the deal. If they are then this could make future discussions with Greece easier.

Points from the Yanis Varoufakis letter to the head of the Eurogroup:

Greece would like a 6-month extension.

To extend the availability of EFSF bonds to Greece.

To “commence work” on a “possible” new Contract for Recovery and Growth – i.e., to tone done austerity conditions.

To discuss plans around “possible” further debt measures i.e., to reduce Greece’s debt burden.

Varoufakis said that the Greek government is “determined to cooperate closely” with its European partners.

An EU official has said that the Greek letter outlining its request for a bailout extension “may pave the way for a reasonable compromise”. However, a German finance ministry official said earlier that Germany rejects the Greek extension of the proposal, so it looks like there are still some tough negotiations needed before Greece can say that its financial situation has stabilised.

In the longer term, the apparent U-turn by the Greek government seems at odds with Syriza’s election pledge. This could put pressure on the new government to continue to demand a new bailout agreement without austerity conditions when the next round of Greek bailout negotiations come round sometime in the summer. Don’t expect the Greek crisis to go away just because of any “positive” developments in the next few days.

The market view:

Greek assets have been knocked off their highs on the back of the German comments that it rejects Greece’s proposal, however 10-year yields remain below 10%. If the rest of the EU agrees with Greece’s proposal, then surely Germany will have to acquiesce? If they do then expect European risk assets to stage a rally, if not, then we could see a sharp increase in risk aversion.

EURUSD tech view:

This pair fell to the lowest level in 2 days on the back of the German comments, but this pair is essentially range-bound ahead of Friday’s Eurogroup meeting. Key support lies at 1.1334 – the low from Wednesday, then 1.1320 – the low of the week so far. Below here, opens the way to a deeper sell off towards 1.1262 – the lows of the past month.

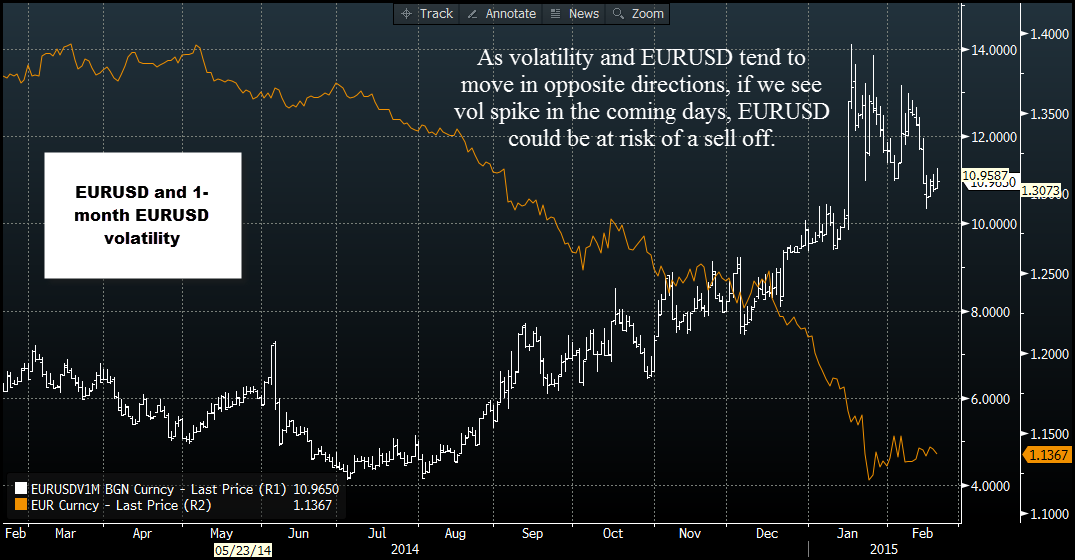

If a deal is reached then we could see a sharp move higher for EURUSD. 1.1534 – the high from the 3rd Feb – is key resistance, ahead of 1.1679 – the high from 21st Jan. As you can see in figure 1 below, EURUSD volatility remains stable ahead of this meeting, however don’t expect the calm to last if we get an adverse outcome for Greece in the next 24 hours. If volatility spikes then we would expect EURUSD to come under downward pressure.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

The Fed leaves rates unchanged, as expected. Focus now shifts to Powell’s press conference – LIVE

As largely anticipated by market participants, and in an unanimous vote, the US Federal Reserve maintained its policy rates unchanged at its event on Wednesday. The Fed announced a reduction in the balance sheet runoff pace and highlighted lack of progress in inflation.

EUR/USD climbs to daily highs on steady FOMC

The selling bias in the Greenback remained unchanged after the Federal Reserve left its interest rates unchanged on Wednesday, sending EUR/USD to daily highs near the 1.0700 barrier.

GBP/USD regains its smile after the Fed leaves rates unchanged

The resumption of the upward pressure lifts GBP/USD back above 1.2500 the figure, partially trimming Tuesday’s strong retracement and bouncing off earlier lows near 1.2470.

Gold accelerates its gains on unchanged rates by the Fed

The precious metal maintains its constructive stance near the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.