![]()

The dollar is in demand today as the euro and the pound give back their recent gains, this was triggered by ECB President Mari Draghi who was speaking at the European Banking Conference in Frankfurt. He focused on inflation and said that some inflation expectations are excessively low. This is significant since the ECB’s mandate is to promote price stability in the medium-term. If inflation expectations are also falling then the ECB should feel motivated to take more accommodative policy action. Draghi is chomping at the bit to take steps towards QE, and for the second time this week he has said that the ECB would broaden its purchases (of bonds) if its current policy to boost inflation does not work.

QE in December anyone?

While the ECB never pre-commits to policy (or, so they say), the fact that Draghi openly touted the prospect of QE in Frankfurt is worth noting, since the Bundesbank has been resistant to the idea of sovereign bond purchases. If Draghi is able to persuade the Germans that QE is the only answer to the ECB’s problems then QE could be on the cards for early 2015. This is what the market is currently pricing in, and why the euro is under pressure and the USD is clawing back some lost ground.

The technical picture: could 90.00 be on the cards?

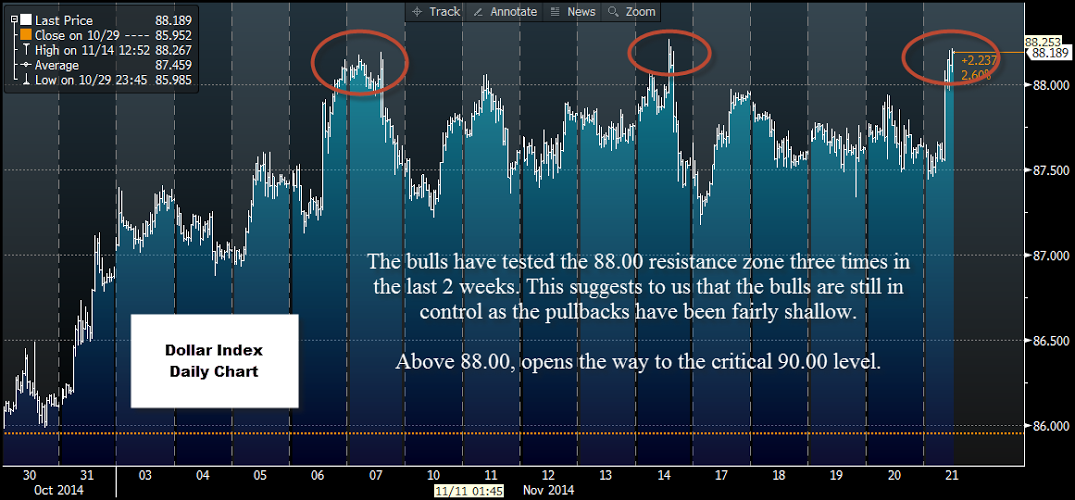

The fundamental picture is supportive for the buck right now, and the technical picture also suggests that the dollar index could make a decisive break of 88.00. The dollar index has tested resistance at 88.00 three times since the 7th November, as you can see in the chart below. The pullbacks have been shallow, suggesting that the bulls still have control; they are just taking a breather. Since this level has been tested repeatedly in the last two weeks, we believe it could eventually be broken, which would open the way to 90.00 – a key psychological level and the highest level since 2006.

If we get a weekly close above 88.00 later today then it could herald another leg higher for the dollar against the EUR and the GBP, with 1.55 a possibility in GBPUSD, and 1.20 a potential for EURUSD.

Conclusion:

ECB President Mario Draghi has been touting the prospect of QE once again, which is weighing on EURUSD.

The dollar index is testing a critical level of resistance.

The market is making its third attempt to take 88.00 in DXY. This suggests to us that the bulls have control and we could clear this level in the coming days, which may open the way to 90.00.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.