![]()

At 1330 GMT/0830 ET the latest US inflation data is scheduled to hit the wires. The market is expecting prices to fall by 0.1% in October, which could push the annual rate down to 1.6% from 1.7%. This would be the lowest level since March. The risk is to the downside after sharp falls in energy and food prices last month, there is also a disinflationary impulse across the world which we doubt that the US can avoid.

Is the Fed ignoring inflation?

US CPI data is released at an interesting time, as the market digests the minutes from the last FOMC meeting that took place at the end of October. These minutes had a fairly hawkish tone, as the FOMC took the view that the US economic recovery is strong enough to withstand external headwinds such as a slowing Eurozone economy. Regarding the recent decline in prices, the majority of members shrugged off concerns about disinflation, however, if CPI falls faster than expected for October the Fed may be forced to reassess its view.

Unemployment vs. inflation

Going forward, the Fed could find itself in a situation where the unemployment rate continues to fall at the same time as prices remain subdued. While a strong labour market supports a rate increase, weak price pressures suggest that the Fed should hold off until inflation returns to the 2% target. Since falling prices is a fairly recent development, the Fed may still be working out how to address this dichotomy and what it means for the timing of the first rate hike. This presents a challenge to the market as we try to figure out the Fed’s next move, so if US prices do fall in the coming months it could create excess market volatility at the start of 2015.

Could weak price pressure be here to stay?

We think that the period of weak inflation could be here to stay. The Eurozone is hovering near deflation territory; CPI in China has fallen since the summer and in the UK, average UK shop prices fell by 1.5% in October, the biggest annual drop for 12 years. We do not believe that the US is immune to this decline in price pressures, and if we see a weaker than expected CPI reading later today then we could see the Fed strike a more cautious note during its December meeting.

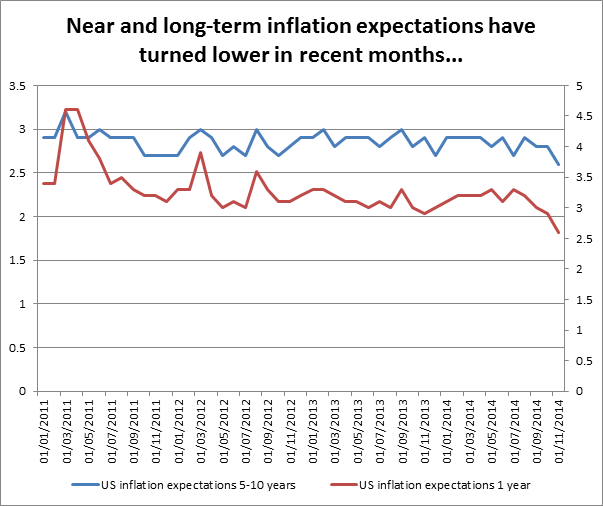

While the Fed is likely to look through month on month price changes, it can’t ignore the fall in inflation expectations. The University of Michigan survey of inflation expectations 1 year ahead has fallen to a 4-year low at 2.6%, longer term inflation expectations are also at 2.6%, the lowest level since 2009. While inflation expectations remain above the Fed’s 2% target the Committee may be fairly sanguine on price pressures, however, if we continue to see expectations fall at this pace the Fed may be forced to delay its plans to hike rates in the middle of 2015.

Potential reactions from the Fed

Fed members continue to state that the timing of the rate rise is dependent on the economic data, so if inflation continues to fall then the market could start to price in a delay to Fed tightening. The powerful core at the FOMC tend to lean to the dovish side of the spectrum (think Yellen, Dudley), however, we would not expect a shift to a more dovish rhetoric from the Fed until we see long-term inflation expectations slip below 2%.

The market reaction

The dollar continues to make fresh 7-year highs against the yen; however, on a broader basis the buck has given back some recent gains versus the EUR and the GBP. The dollar index is struggling at 88.00, a major level of resistance. While we continue to think that in the medium-term there will be further upside for the USD, on the back of a weaker than expected inflation report later today, we would expect to see the USDJPY rally stall, and EURUSD and GBPUSD continue to extend their recent recoveries.

A weak inflation report could boost US stocks, which lost some ground after the more hawkish than expected minutes, as it could force the Fed to delay raising borrowing costs which is good news for corporate US.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.