![]()

In its downed trajectory, the EUR/GBP has retraced somewhat deeper than I had envisaged in my previous report. Although expectations about the first Bank of England rate hike have been pushed out a little bit, the UK central bank is still expected to tighten its policy well before the ECB does. Recent economic data out of the UK are pointing towards a mixed outlook for inflation and growth. Consumer prices have eased sharply and wage growth has remained weak. But the overall economic output is still relatively strong – as we found out on Friday, GDP grew by a solid 0.7% in the third quarter, matching the consensus forecasts. Today, the CBI's realized sales index for October came in a touch better than expected, printing 31 vs. 29. Meanwhile in the Eurozone, inflationary pressures are non-existent and growth is feeble. That is why we have an uber-dove ECB. Against this fundamental backdrop, I remain bearish on the EUR/GBP.

Though the results of the latest bank stress tests were not as bad as had been feared, which led to an initial rally in European markets this morning, financial stocks have already pared their gains and the major stock indices have now turned red. The EUR/USD has also turned negative on the session, and a revisit of 1.20 for the pair is still not out of the question. The cross meanwhile has broken last week’s low and further losses could be on the way soon, particularly if the Eurozone inflation data later this week disappoints expectations. The euro has certainly not been helped by today’s main data from Europe: the German Ifo Business Climate. This came in at 103.2, compared to expectations of 104.6 and the previous reading of 104.7.

Technical view

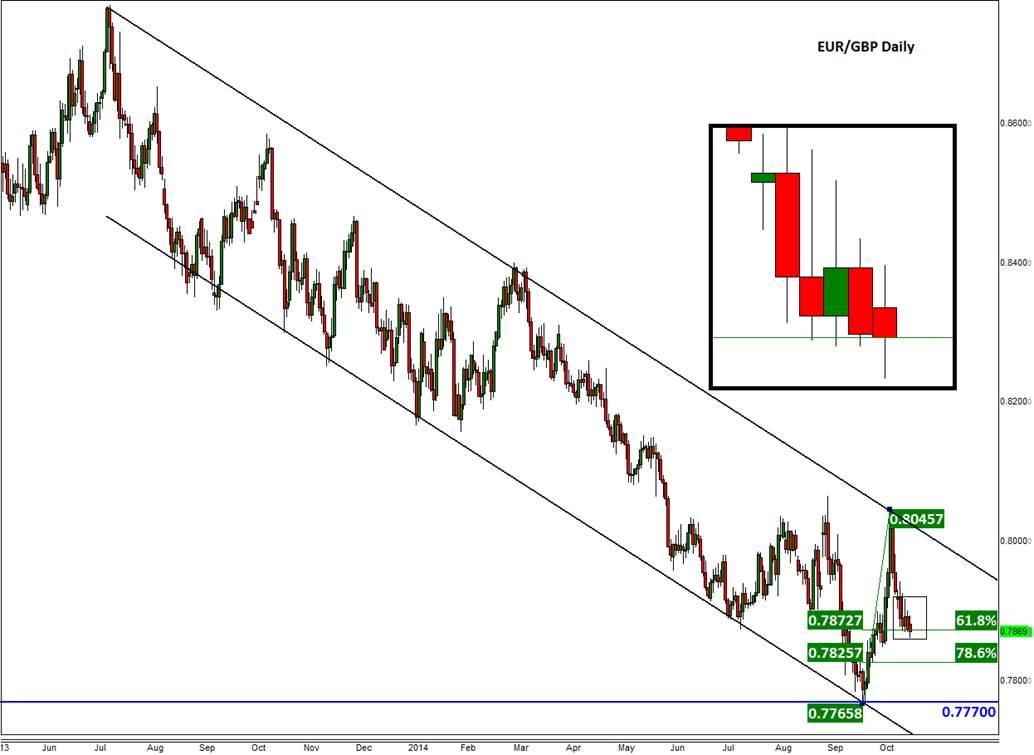

As the daily chart of the EUR/GBP shows in figure 1, the cross has been moving lower inside a downward-sloping channel since the summer of last year. At the time of this writing, it is testing the 61.8% Fibonacci retracement level of the last upswing, around 0.7870. So, there is a possibility for a bounce here. But if the EUR/GBP makes a decisive move below this level, the next stop could well be the key support at 0.7770. This level corresponds to the neckline of a long-term descending triangle continuation pattern which can be seen in figure 2 on the weekly chart. The pattern clearly shows that the demand for the EUR/GBP has been weakening. Thus a potential break below there could possibly send price towards the psychological 0.7500 mark at some point in the near future. Meanwhile a break above resistance at 0.8065 would signal the end of the short-term bearish outlook.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.