![]()

Yesterday we looked at gold and pointed to the fact that it hasn’t found much safe haven demand despite all the on-going geopolitical risks. What’s more, the strengthening of the US dollar and the resilience of the stock market has further discouraged demand for yellow metal. But gold is not the only metal struggling. Silver, platinum and copper have all come under pressure too. Other commodities such as crude oil have also failed to respond positively to the deteriorating geopolitical tensions, with both Brent and WTI contracts falling viciously since the start of the summer. However there has been at least one commodity that has bucked this trend: palladium (until today).

Palladium has been rising strongly of late and yesterday touched a fresh 13-and-a-half year high when it climbed to above $910 per troy ounce. It has been boosted, above all, by concerns over potential supply disruptions from Russia, the world’s biggest producer of platinum, due to the country’s involvement in the crisis in Ukraine. If Russia’s palladium exports were to be restricted then it would exacerbate the already large palladium deficit. However we don’t think this would be the case. As palladium is mainly used for catalytic converters in automobiles, any restrictions of the metal could increase the cost for Europe’s carmakers. Clearly this would not be in anyone’s interest. Therefore, I think palladium may be overpriced and overbought.

In fact palladium could not defend itself from the pressure excreted by the rallying US dollar today: it has dropped by more than $25 or 2.8% to $880 from its opening price of $908. It has underperformed all of the commodities mentioned above, as well as stocks and most FX pairs. So, why has it performed this badly? We think it may be because of the one-way speculation that has been on-going for weeks now, and today’s sell-off is probably caused by speculators closing some of those long positions.

Bets from hedge funds and other financial speculators on rallying palladium prices have been increasing for weeks now. In the week to 26 August, net long positions had climbed by a further 560 to 24,600 contracts – just below the record level achieved in April 2013. If the situation in Ukraine improves now, or otherwise speculators continue to book profit on their longs, then we could see a crude-style sell-off in palladium prices over the coming days and weeks.

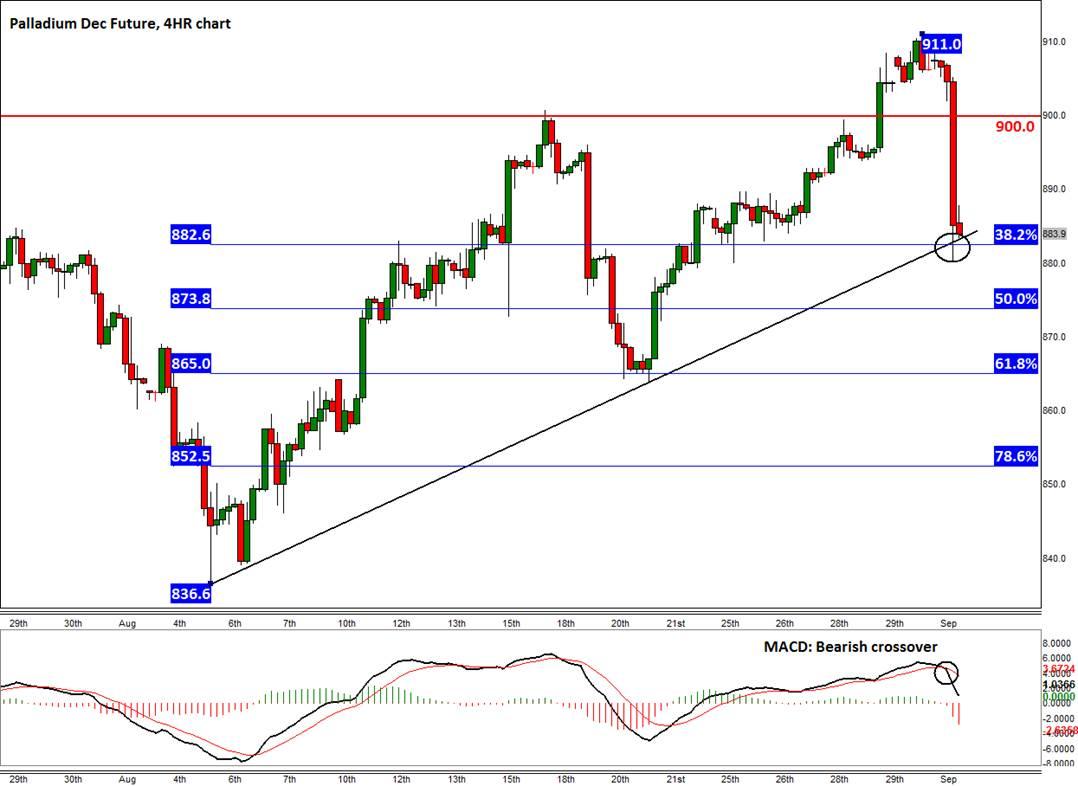

As the 4-hour chart of the December contract shows, the metal is currently trying to break below the $882 support level. This level ties in with a bullish trend line and also the 38.2% Fibonacci retracement level of the up move from the August low. If it breaks below here then the 61.8% Fibonacci retracement level at $865 could be the next stop. Further downside targets are $852 (78.6%), $836 and $800. A potential break below $800 could even reverse the long-term trend. On the upside, the next level of resistance is at $900, followed by $910 and then the December 2000 peak of $959.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.

_20140902162600.png)