![]()

Background:

Traders often discuss how ‘month end’ flows may impact a currency or a currency pair during the last few day(s) of the month. These flows are caused by global portfolio managers rebalancing their existing currency hedges. If the value of one country’s equity and bond markets increases, these money managers typically look to sell or hedge their elevated risk in that country’s currency and rebalance their exposure back to an underperforming country’s currency. The more severe the change in a country’s asset valuations, the more likely portfolio managers are either under- or over-exposed to certain currencies.

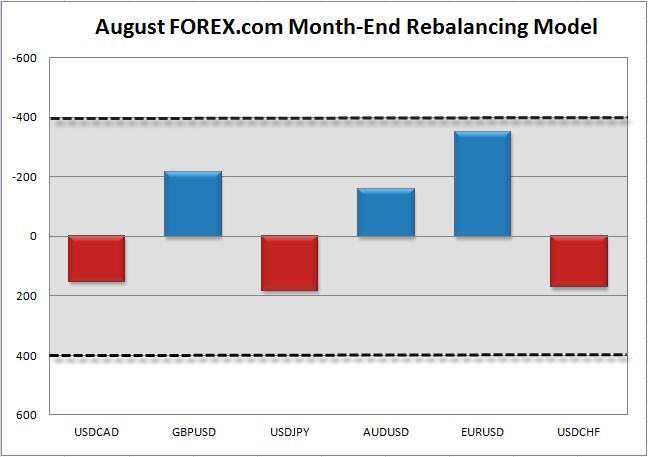

In order to predict these flows and how they impact FX traders, we’ve developed a model that compares monthly changes in total asset market capitalization in various countries. In our model, a relative shift of $400B between countries over the course of a month is seen as the threshold for a meaningful move, whereas monthly changes of less than $400B can be easily overwhelmed by other fundamental or technical factors. As a final note, the largest impact from month-end flows is typically seen heading into the 11am ET fix (often in the hour from 10 & 11am ET) as hedge and/or mutual fund portfolio managers scramble to hedge their overall portfolio ahead of the European market close.

Global market volatility was relatively subdued in August as Northern Hemisphere traders tried to soak the last of the summer’s rays. That said, US stock and bond markets generally strengthened over the course of the month, adding $151B in total market cap, whereas European markets generally trailed behind, shedding $197B in value.

As a result, the model’s strongest signal is bullish on the EURUSD, though that signal still does not quite meet our +/- $400B threshold for a meaningful move. The other major currency pairs generally fail to exceed even +/- $200B change in relative market cap, so traditional fundamental and technical factors are likely to be the most important factors to watch heading into the weekend.

Source: FOREX.com

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.