![]()

Background:

Traders often discuss how ‘month end’ flows may impact a currency or a currency pair during the last few day(s) of the month. These flows are caused by global portfolio managers rebalancing their existing currency hedges. If the value of one country’s equity and bond markets increases, these money managers typically look to sell or hedge their elevated risk in that country’s currency and rebalance their exposure back to an underperforming country’s currency. The more severe the change in a country’s asset valuations, the more likely portfolio managers are either under- or over-exposed to certain currencies.

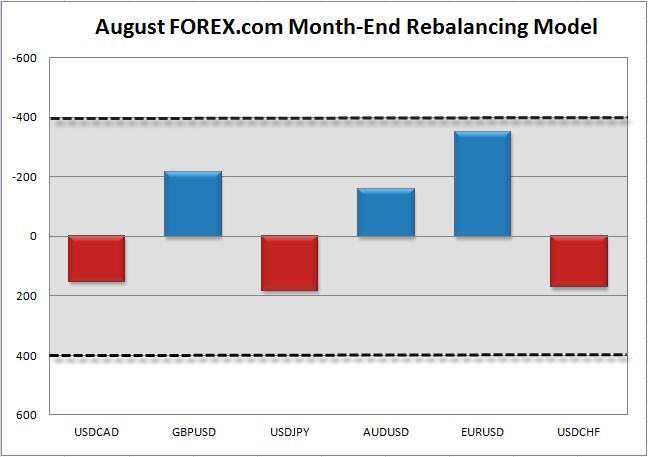

In order to predict these flows and how they impact FX traders, we’ve developed a model that compares monthly changes in total asset market capitalization in various countries. In our model, a relative shift of $400B between countries over the course of a month is seen as the threshold for a meaningful move, whereas monthly changes of less than $400B can be easily overwhelmed by other fundamental or technical factors. As a final note, the largest impact from month-end flows is typically seen heading into the 11am ET fix (often in the hour from 10 & 11am ET) as hedge and/or mutual fund portfolio managers scramble to hedge their overall portfolio ahead of the European market close.

Global market volatility was relatively subdued in August as Northern Hemisphere traders tried to soak the last of the summer’s rays. That said, US stock and bond markets generally strengthened over the course of the month, adding $151B in total market cap, whereas European markets generally trailed behind, shedding $197B in value.

As a result, the model’s strongest signal is bullish on the EURUSD, though that signal still does not quite meet our +/- $400B threshold for a meaningful move. The other major currency pairs generally fail to exceed even +/- $200B change in relative market cap, so traditional fundamental and technical factors are likely to be the most important factors to watch heading into the weekend.

Source: FOREX.com

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.