![]()

FX volatility has fallen to record lows in recent months, which is one reason why trading conditions have been particularly boring, but could this be about to change? Listening to some of the speeches from Jackson Hole at the weekend, the annual conference of central bankers, monetary policy could be about to move down divergent paths in the coming months, and there could be implications for the FX market.

On the one side you have the US and the UK who are moving towards normalising monetary policy, and could embrace rate hikes early next year. On the other hand you have the Eurozone where the ECB is likely to embark on QE in the next few months. Since central bankers have been blamed for supressing FX volatility in recent years, as some countries embark on the normalisation of monetary policy it could be high time for FX volatility to come back with a bang.

Volatility is something that no one in the market can control, which means that when it returns (and it always returns) it is likely that it will turn up unannounced. There are no reliable lead indicators to determine when volatility will bounce back, however, since we believe that divergent central bank stances could be a core driver of volatility going forward, it makes sense to do some yield analysis.

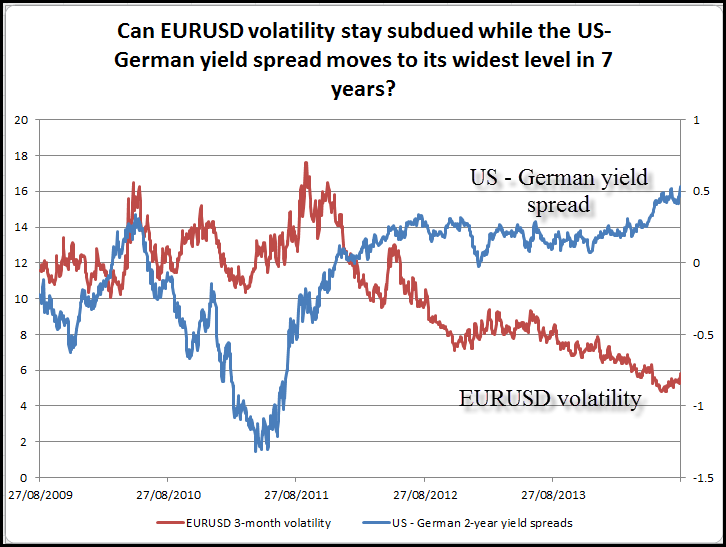

The chart below shows the spread between US and German 2 –year bond yields, which is sensitive to changes in monetary policy, and 3-month at the money option volatility for EURUSD. As you can see, the spread has widened to over 50 basis points, the last time the yield spread was this wide was in 2007. Back then the yield spread was declining as the US started to cut interest rates, then the financial crisis happened and FX volatility surged.

While history doesn’t always repeat itself, there are a couple of things to point out:

1, The yield spread has never been this wide at the same time as volatility has been this low, which suggests that if the spread continues to widen then volatility could rise.

2, EURUSD volatility has started to pick up in recent days, and may continue to pick up as we wait for next week’s ECB meeting to see if the Bank is going to embark on QE. If it does then this could be the trigger that unleashes a wave of volatility in the coming months and could weigh heavily on EURUSD.

Why do yields impact currencies?

This goes back to your FX trading 101, but in a nutshell, a yield is essentially what you earn from holding a currency. Typically (but not always) higher yields are more attractive to currency traders and vice versa. Since the yields of major currencies have been supressed for so long, with everyone from the ECB to the Fed pledging to keep interest rates low for the long term, it has been difficult to tell currencies apart, hence the fall in volatility. But as economies diverge and central banks start muttering about normalising monetary policy at different rates, the relative value of currencies is coming back to the fore.

Currency pairs that could be impacted:

If volatility does rise then we think EURUSD and USDJPY are the ones to watch. EURUSD could sink below 1.30 if the ECB embarks on QE, and the spread between US and German yields continue to widen. With the Bank of Japan also sticking with QE, we expect further strength in USDJPY towards 105.00 and beyond, particularly if the US economic data holds up, pushing the Fed towards monetary policy normalisation.

Conclusion:

- · The short-term yield spread between the US and Germany is at its widest level since 2007.

- · This could boost FX volatility after it sunk to record lows.

- · As global monetary policy paths diverge, FX volatility could pick up.

- · We think EURUSD and USDJPY could be the most effected by a pick-up in volatility.

- · Next week’s September ECB meeting could determine the extent of divergence between the US and Eurozone’s monetary policy paths, and could trigger a bout of volatility in the FX market.

Figure 1:

Source: FOREX.com and Bloomberg

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.