![]()

The dollar is on everyone’s mind today, after a stunning 3.5% rally since July, the dollar index is taking a breather ahead of key resistance at 82.67 – the high from September 6th. In the short term, =we wouldn’t be surprised if we get below this level as the dollar index looks a little over-extended to the upside, we still think that any pullback will be short lived. Key support levels include:

81.73 – the 61.8% retracement of this month’s advance

81.18 – August 1st low.

However, last week’s break above 81.51 – the 61.8% retracement of the July 2013 – May 2014 bear trade, was a bullish development and we think any pullback will be short lived as the dollar’s pillars of support remain firm including:

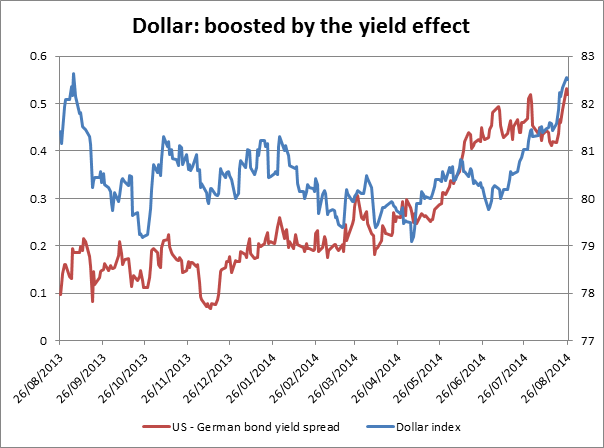

1, Rising 2-year bond yields, which have room for further upside. As you can see in figure 1, the short –term yield spread between the US and Germany is dollar positive.

2, Improving USD fundamentals – watch out for a stellar durable goods report later on Tuesday, the July data could be in the double figures although most of this could be due to airline orders.

3, The Eurozone: EUR is the second most traded currency in the world, and when it is struggling it can be good news for the buck. The fundamental picture is looking bleak for the single currency right now, the French government has been dissolved as divisions rise as France tries to re-boot its economy and embark on an austerity programme, and the ECB may have no choice but to embark on QE at its meeting next week if inflation for August falls to 0.3%, as the market expects.

If we can break above 82.67 resistance then we could see back to July 2013 highs, just below 85.00.

The EUR view:

As we mention above, the performance of the EUR can be critical for the dollar. EURUSD is extending its recent decline, and there is potential for further downside in the near term with supports at 1.3105, the September 6th 2013 low, and then 1.3038 – the 50% retracement of the July 2012 – May 2014 bull trade. Below here would open up the prospect of life below 1.30 – the lowest level since July 2013.

Conclusion:

The dollar may be pausing for breath today, but we continue to think that momentum is to the upside, especially if the EUR continues to come under pressure.

82.67 – the high from Sept 2013 – is key resistance in the dollar index. Above here opens the way to July 2013 highs just below 85.00.

If the EUR continues to come under pressure that could boost the buck.

In EURUSD, watch 1.3105 then 1.3038 – key support levels in the near term.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.