![]()

US index futures are slightly higher following the retreat on Wall Street yesterday, but they could move more sharply depending on the outcome of US data ahead of the opening bell. In Europe, it has been a quiet day so far due to the lack of top-tier economic data here and with some market participants occupied in trying to figure out the potential impact on European markets of the latest Western sanctions on Russia for the latter’s involvement in the Ukrainian crisis. So far, most of the jitters have been confined to the domestic Russian market where stocks and the Ruble have both fallen sharply. However companies with direct exposure to Russia may also start feeling the heat soon, particularly if more, tougher, sanctions are introduced in the future. For now, the mostly better corporate earnings results and the overwhelming expectations that the US economy rebounded strongly in the second quarter, and is continuing to expand in the third, are among the factors helping to support sentiment on Wall Street. Most people agree that the first quarter GDP disappointment was transitory and largely due to weather related effects. But they won’t be able to use the same playbook if Q2 GDP fails to rebound at least as strongly as it had dropped in the first three months of 2014 i.e. 2.9%. But if somehow it were to recover even more strongly than that or the 3 percent growth expected then stocks and dollar should in theory both jump in reaction to the data. However, it is not as straight forward as that because 15 minutes earlier, at 13:15 BST (08:00 EDT), we will have the latest ADP payrolls report which also has the potential to move the markets in a meaningful way. In line with the official employment report, which comes out on Friday, economists expect the APD data to reveal that around 230 thousand jobs were created in the month of July – excluding of course the government and farming industry. Today’s other key event – the FOMC policy decision – is expected to show few surprises for the Fed has already said it intends to end QE with a single $15bn transaction in October. On top of this, there won’t be a FOMC press conference.

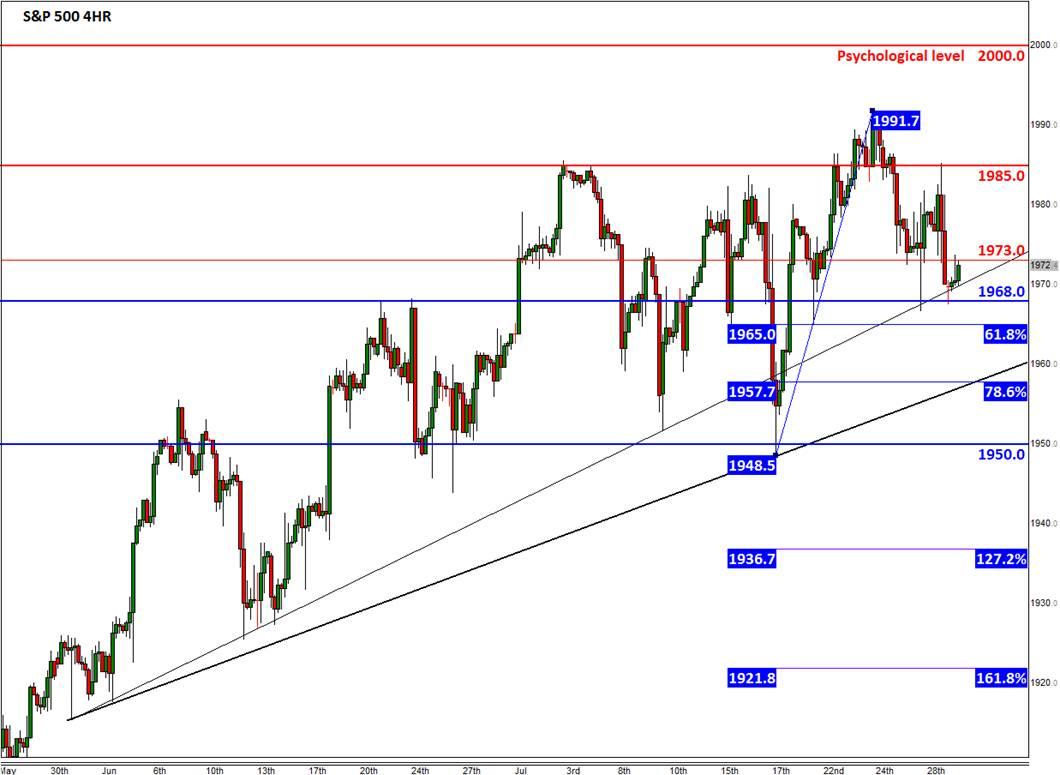

The S&P’s short-term charts clearly reflect the bulls’ hesitations as it has been consolidating just below the record level achieved last week which is not surprisingly given the high-impact economic data coming up this week. The price action is beginning to look a little bit ugly from a bullish point of view, but there are still distinct higher highs and higher lows visible which suggest the upward trend is still intact. Some of the immediate levels of support and resistance are highlighted on the 4-hour chart, below, in blue and red colours respectively.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.