![]()

Financial markets are calmer on this last day of the week, with US index futures pointing to a slightly firmer open on Wall Street. Concerns over Portugal’s banking sector have diminished, with the benchmark PSI-20 index up some 2 percent. Other European markets have likewise recouped some of the losses from yesterday and volatility is moderating. Banco Espirito Santo's shares were again suspended earlier, but have now re-opened and are currently up 3%. With today being a quiet day in terms of data releases, the markets may drift aimlessly or push slightly higher as the sellers continue squaring their positions ahead of the weekend. Meanwhile Wells Fargo has been the first major US bank to report its earnings results. As expected, the San Francisco lender posted a second quarter EPS of $1.01, although its revenue of $21.1bn was higher than analysts had anticipated. Earnings will kick into a higher gear next week. Citigroup, JPMorgan Chase, Bank of America, and US Bancorp will be among the banks to report their numbers. If on balance their results are better than expected then we may see the indices find some support and head towards fresh all-time highs once again. Otherwise the recent weakness could turn into a correction of some sort.

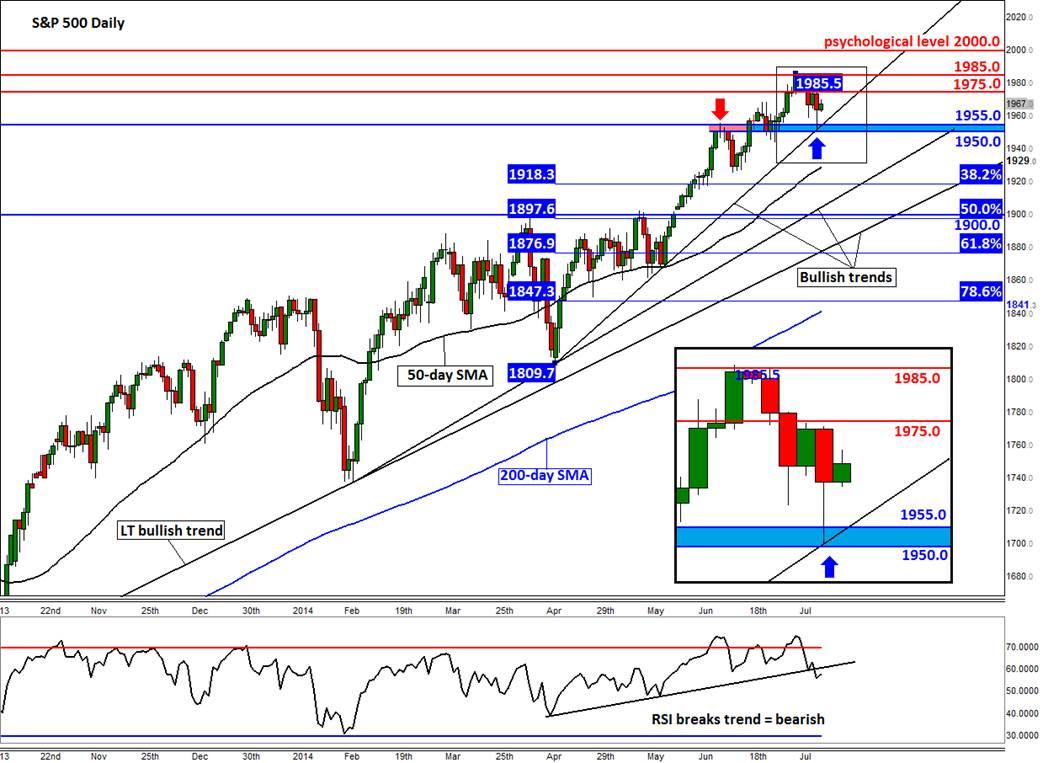

The S&P bounced back on Thursday afternoon as it found support from 1950/55. This area was formerly resistance and corresponds with a bullish trend line. The index needs to hold above here otherwise we may see a more significant pullback. But with the RSI breaking its own corresponding trend, there is a chance the S&P may now follow suit. If it does, then the next obvious level of support would be all the way down around 1930, which ties in with the 50-day moving average. Below that is the 38.2% Fibonacci retracement level of the upswing from the April low, at 1918. Depending on how fast or otherwise the index would get there (if it does), there is another bullish trend line also converging around 1918. But a more profound support level is around 1900, which admittedly is some way off from where we are at the moment. Meanwhile 1975 is the key resistance level to watch on the upside. A potential break above this level could pave the way for the July’s high of 1985.5 and potentially a run towards the next key psychological barrier of 2000.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.