![]()

As US traders groggily filter into their desks after a long holiday weekend of sun and barbeque, the market is still digesting last week’s action-packed economic calendar. Though the ECB’s monetary policy statement and press conference brought few surprises, the US jobs report blew the doors off expectations with a stellar 288k reading and 0.2% drop in the unemployment rate (to 6.1%). Looking ahead to this week, markets may be a bit more subdued, though the economic calendar and recent price action may present some trading opportunities in the Canadian dollar.

With no meaningful US data scheduled, the Canadian Building Permits (12:30 GMT) and Ivey PMI (14:00 GMT) reports will take center stage in today’s US session. Both reports came in below expectations last month, so it may take a clear improvement for Canadian bulls to drive the loonie to new heights. Later this week, USDCAD traders will get new insight into US JOLTS Job Openings (Tuesday), Canadian Housing Starts and the FOMC Minutes (Wednesday), Canadian New Home Prices and Unemployment Claims (Thursday), and finally the Canadian Employment report, which will try to match the strength seen in its southern neighbor last week.

Technical View: USDCAD

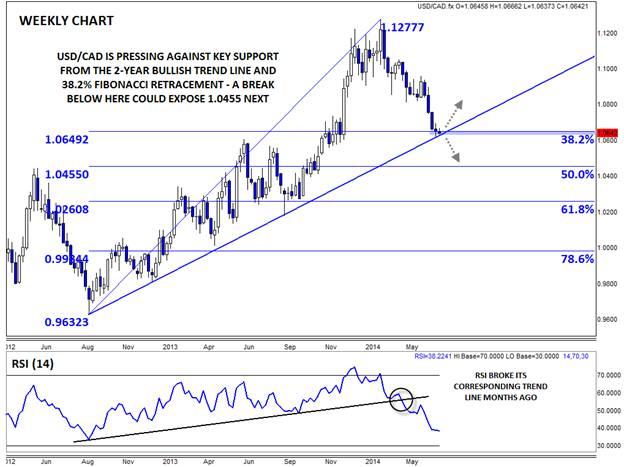

Beyond being aware of the upcoming fundamental data this week, traders should be careful not to lose sight of the longer-term technical picture for the USDCAD. Looking first to the weekly chart, the pair is testing a 2-year bullish trend line off its September 2012 low at .9632, as well as the 38.2% retracement of this trend. This converging support area could lead to a bounce this week, especially if Canadian data generally misses expectations. That said, the weekly RSI broke below its corresponding trend line long ago, and if price follows the indicator lower, a quick move down to the 50% Fibonacci retracement at 1.0455 may be seen next.

Zooming in to the daily chart reveals a more nuanced picture. Rates are clearly testing key support in the mid-1.0600s, but some of the other technical indicators suggest any bounces may be short-lived. For one, the 50-day MA is about to cross below the 200-day MA, pointing to an imminent “death cross” in the pair. This classic technical indication suggests that the longer-term trend has turned lower and points to more weakness in the coming months. Meanwhile, the MACD continues to trend lower below its signal line and the “0” level, showing growing bearish momentum. On a short-term basis, the oversold RSI could lead to a bounce, but traders may lean toward fading any bounce toward 1.07 or 1.08 given the bearish longer-term indications.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.