![]()

The biggest theme in the FX market right now is the weakness in the dollar. It is defying better than expected US economic data (the upside payrolls surprise last Friday) as well as the Fed’s tapering programme. So what is driving this weakness and can it last?

1, The yield effect

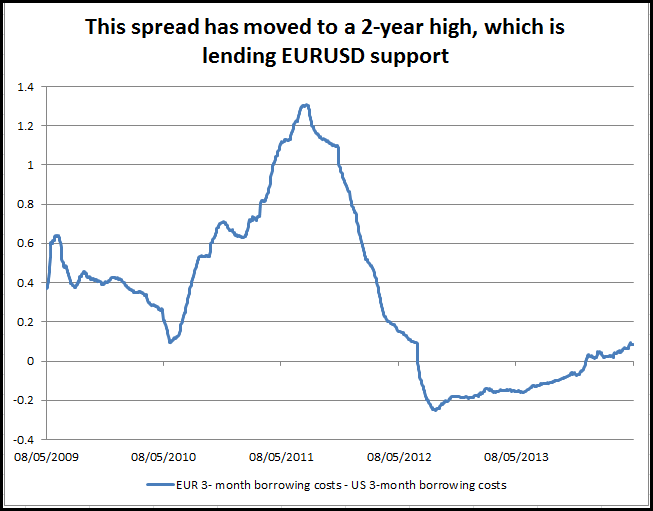

The 10-year Treasury yield has been trading in a range between 2.6 % and 2.8% since the end of January and currently it is testing the air below the bottom of the range around 2.59%. The Treasury yield has an indirect effect on dollar weakness, when yields are muted it reduces the cost of borrowing dollars, which can weigh on the value of USD. For example, the cost of borrowing USD for 3-months (according to ICE Libor rates) fell on Wednesday to its lowest level since records began at 0.2239%, which is a major drag on the buck. This has pushed the spread between EUR 3-month borrowing costs and USD 3-month borrowing costs to a 2-year high (see the chart below), the spread with GBP borrowing costs and USD borrowing costs has also widened to its highest level since July 2012.

2, low volatility

We have mentioned in previous posts that volatility has been extremely low in financial markets. The Vix index (Wall Street’s fear gauge) is close to the bottom of its recent range. Added to this, EURUSD volatility remains close to a 7-year low. How does this impact the USD? When market volatility is low it tends to favour current trends, thus the USD can stay depressed for longer than you may expect, along with Treasury yields etc.

3, The US loses the limelight

The problem for the US is that economic data has not been consistent – think last week’s weak GDP vs. strong payroll reports. At the same time, other regions are starting to shine. The OECD revised down its 2014 US GDP growth outlook, while at the same time revising higher its outlook for the UK and the Eurozone. The UK is now expected to have the fastest growth in the G7. Thus, the US has been nudged out of the limelight, which is weighing on the USD. We expect the US to play catch up in the second half of this year, but for now the market is going where the growth is, and right now the market seems sceptical of the US, preferring the Eurozone and the UK.

Conclusion:

Overall, this is a perfect storm for the buck right now: data is not consistent to instil confidence in the US recovery story; yields remain extremely low, which is allowing other currencies to make headway against the buck, and low volatility is muting the prospect of a near-term change in trend.

But don’t expect this period of low volatility to continue. If history has taught us anything, periods of low volatility often end with a bang, and things may not be any different this time. If volatility does start to rise than dollar bears should beware. The long EURUSD/ long GBPUSD trade is starting to look a touch over-crowded, so if volatility spikes there could be a rush for the exits, which may mark the turning point for the greenback.

Figure 1:

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.