Earlier this month it looked like stocks were about to hit the skids on the backs of fears about a bubble, particularly in the technology sector. However, in the last 24 hours the view has changed markedly. Both Facebook and Apple announced monster profits. Facebook saw revenues increase by a whopping 72% and daily users of Facebook rose to 802 million, with a 40% jump in mobile users. Apple also surprised the naysayers and reported revenue to the tune of $45.6bn for the first three months of the year after a rebound in iPhone sales.

This has changed the short term picture for tech stocks and may put fears of a bubble to bed, at least for now. Tech stocks started to sell off earlier this month on fears that some companies’ valuations were too high and after a series of expensive acquisitions started to arouse investors’ fears. However, with a bedrock of strong, cash-rich, and revenue-generating companies like Facebook and Apple, the tech sector seems to be on sturdy ground.

Earnings Q1:

The fundamentals are looking good for the Nasdaq. While only a third of companies on the tech-heavy Nasdaq 100 have reported Q1 earnings so far, the results have been good. Both sales and earnings figures have surprised on the upside, largely due to Facebook and Apple. On the growth front, so far, sales growth is at its highest level for 12 months. While we need to see what the other 69 companies have to offer, this is a good start, and if it reflects the signs of things to come then the Q1 2014 earnings season could be one to remember.

Interestingly, if the Nasdaq can stage a recovery on the back of the Apple/ Facebook earnings news this could be important for S&P traders also. The S&P 500 and the Nasdaq have a correlation of 92%, although if you trade European stocks, don’t look at the Nasdaq for direction, the Dax has only moved with the Nasdaq 43% of the time since the start of this year.

Technical outlook:

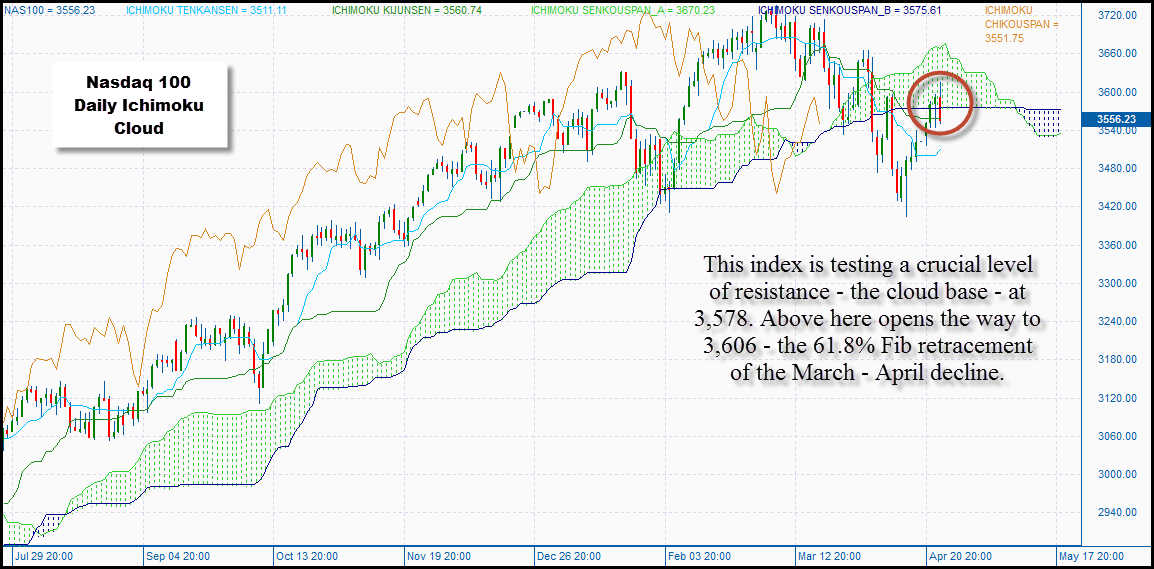

The Nasdaq is testing a crucial short term resistance zone at 3,578 – the base of the daily Ichimoku cloud. If we can stay above this level then it would be a bullish development and suggest that the recent downtrend may be over. Above here opens the way to 3,606 – the 61.8 % Fib retracement of the March – April decline.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.