![]()

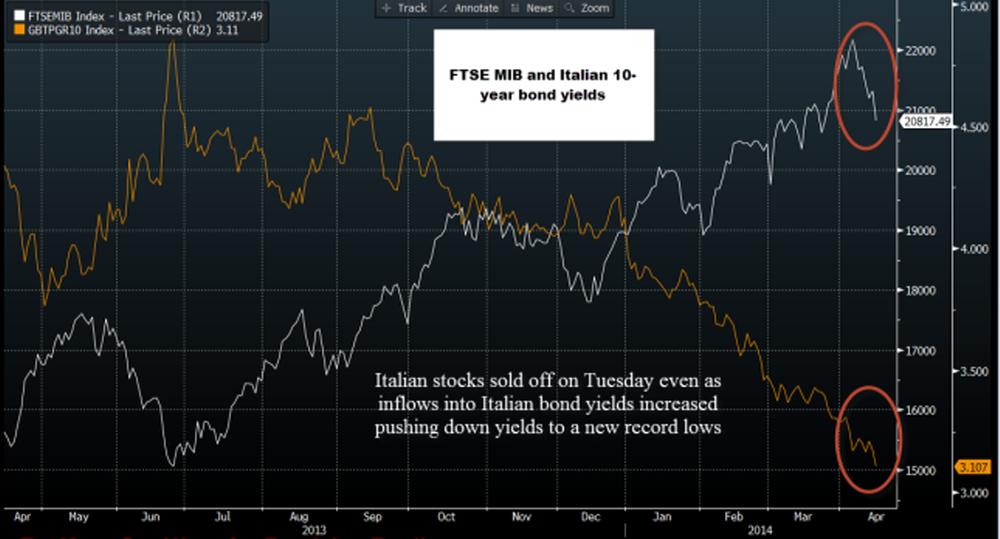

Tuesday saw some interesting price action; European stocks fell sharply on the back of a few factors and were led lower by Italy’s FTSE MIB, which fell more than 2%. However, at the same time as Italian stocks were being sold sharply, investors were buying Italian bonds and 10-year GBT yields actually fell.

As you can see in the chart below, the FTSE MIB (white line) usually moves in the opposite direction to bond yields (orange line), however today the two have moved together. This could be down to a few factors:

- Italian stocks were hit by a double whammy of pressures, firstly, overall risk aversion triggered by events in Ukraine and secondly, confirmation that the government is planning to overhaul the management structures at some state-owned companies, including changing their CEOs.

- The decline in bond yields (rise in bond prices) could also be down to Ukraine fears as we saw inflows into peripheral bonds today even though European stocks sold off. The Ukraine crisis could be triggering “safe haven” flows into European bond markets.

Who would have thought that Italian and Spanish bonds could be considered a safe haven, especially on a day that the dollar faltered? The markets work in mysterious ways and today’s moves may have been exacerbated by weak volumes in a holiday-shortened week for Europe. We will be watching this closely to see if it continues and if Russian/ Ukraine fears grab the market’s consciousness once more then we may have to get used to some strange moves in the markets.

Figure 1:

Source: FOREX.com and Bloomberg

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.