![]()

The two major crude oil contracts are little-changed this Friday afternoon. Brent fell back yesterday on news China’s oil imports had dropped 8% in March and as reports suggested that the Libyan crude oil terminal Al-Hariga, which has a normal output capacity of 110,000 barrels per day, was expected to be reopened next week after it was recovered from the rebel hands. On top of this, the International Energy Agency said that Iran once again broke the 1-million-barrel-per-day oil export limit that was imposed by the West under the interim nuclear deal agreed last year. After exporting 1.65 million barrels per day in February, the IEA has estimated that a further 1.05 million b/d were shipped out in March and this figure is likely to be revised higher on receipt of more complete data. However worries over potential disruptions of Russian energy supplies to Europe via Ukraine amid the on-going standoff between Moscow and the West have prevented Brent crude to fall more sharply. In fact, the London-based oil contract has just turned higher at the time of this writing.

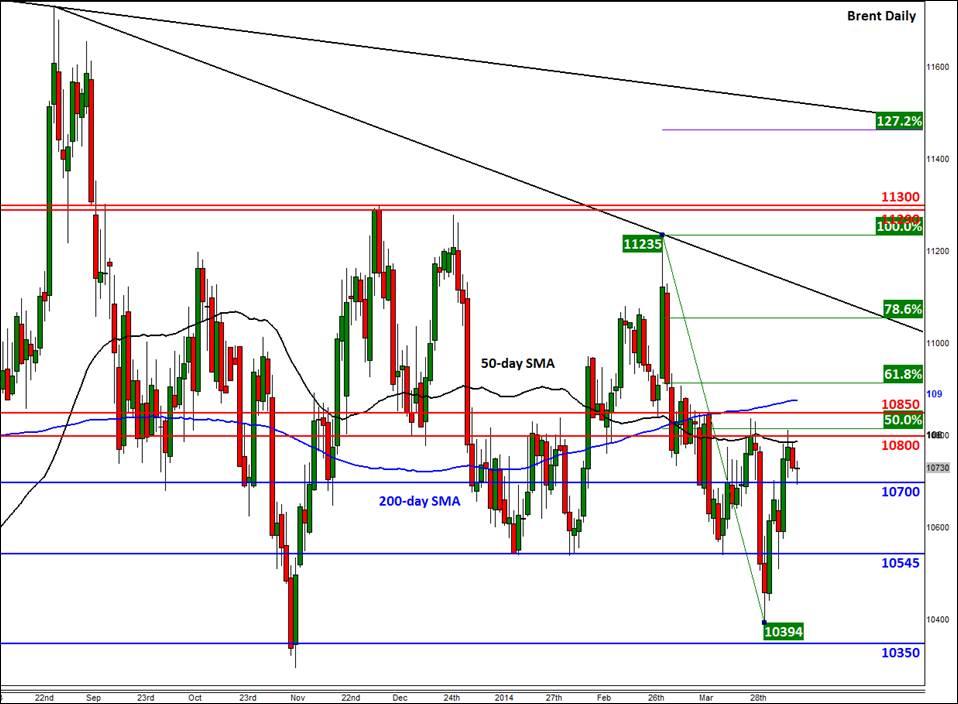

Figure 1:

In the US, WTI has remained elevated despite the recent rises in crude stockpiles and the first build at Cushing in ten weeks. It looks like investors are paying greater attention to gasoline inventories which fell once again last week by 5.2 million. At 210.4 million barrels, they remain “well below the lower limit” of the average for this time of the year, according to the US Department of Energy. This suggests that demand is very strong for gasoline, which is significant as the US driving season has not even started yet. Ethnically however WTI has struggled to rise and hold above the $103.50 level over the past couple of days. As mentioned previously, this is where a bearish trend line that goes back to the summer of last year converges with the 78.6% Fibonacci retracement level of the downswing from the March peak. So, there is a chance for a pullback towards $102.20 in the near-term. However if WTI breaks and closes above $103.50 then we could easily see it revisit the March high of $105.20 and potentially beyond.

Figure 2:

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.