Backdrop:

- Often you may hear about ‘month end’ flows having a positive or negative effect on a currency during the last few day(s) of the month. Thus, we’ve decided to take a look at asset market capitalizations in the major market economies to help us try to determine which direction these ‘flows’ may move. Typically, the largest impact is seen heading into the 11am ET fix (often in the hour from 10 & 11am ET) as hedge and/or mutual fund portfolio managers scramble to rebalance their remaining currency exposure in order hedge their overall portfolio.

Market capitalizations for November were mixed across the board – The largest gain was seen in the United States which saw a rise of 549B on the month, while the biggest decline was in Australia, falling 111B (as of 11/24 close). So how do we make sense of this? Well, the more severe a change of the principal assets (primarily equities and bonds), then the more likely portfolio managers are either under or over-exposed to certain currencies. Our model suggests they may be holding significant USD exposure, consequently they may need to meaningfully diversify away from the dollar over the coming days.

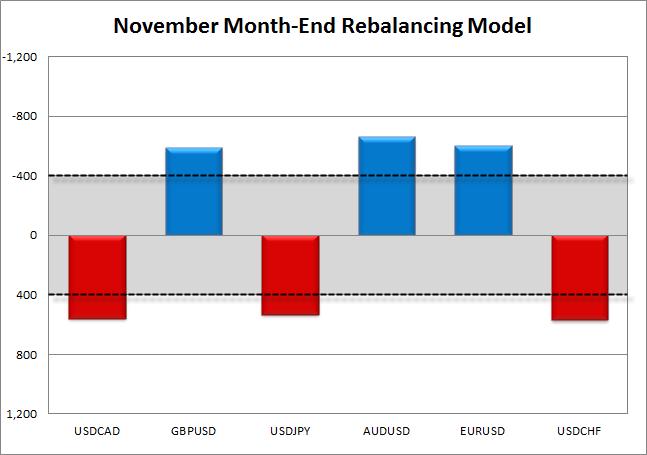

In the chart below we have outlined the expected directional movement broken down pair by pair based upon our proprietary month-end model. Customarily, a reading of +/- 400B on the month produces a stronger bullish or bearish signal. With that said, all of the major currency pairs see a reading which exceeds the +/- 400B level on the month: AUDUSD, EURUSD, GBPUSD (bullish) and USDCHF, USDCAD, USDJPY (bearish). Accordingly, we believe the buck could see a substantial impact from these flows heading into Friday’s fixing.

Please keep in mind that with the US Thanksgiving holiday on Thursday and the retail frenzy known as “Black Friday” on Friday it may cause traders to try and square up their positioning earlier than usual. As a result, the anticipated month-end flows could be stronger this upcoming Wednesday rather than on the last trading day of the month.

*Should any of the global equity markets see a rather large gain or loss over the coming days, and accordingly a change in market capitalization which would meaningfully change the signal, then we’ll post an updated chart of the Rebalancing Model on Twitter.

Source: Bloomberg, FOREX.com

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.