A few fundamental factors are weighing on the ZAR:

Growth fears in South Africa

A rapidly rising budget deficit

Another flare up in social unrest in the mining region

A general dislike for carry currencies like the rand, the AUD, etc.

The last point is of particular concern – the market is ditching risky EM and carry currencies in favour of safe havens like the yen and the CHF. After falling for most of this year, JPYZAR is up more than 10% in the last 2 weeks.

It is not only the yen that has an inverse relationship with the rand, stocks seem to as well.

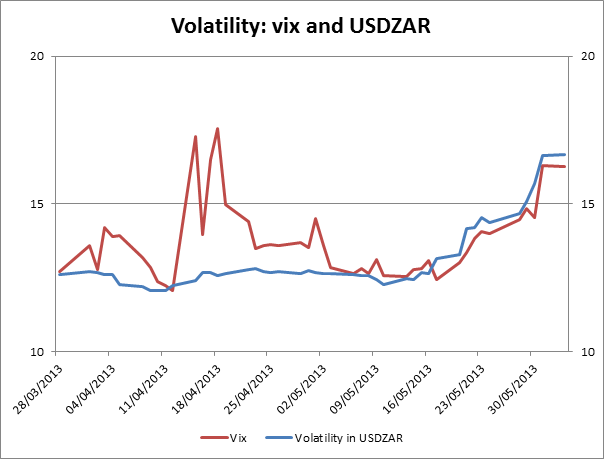

At the same time as pressure on ZAR has grown, stock markets have come off their highs. We believe there is a link between rising volatility in emerging market FX and the performance of the stock market. The chart below shows 3-month volatility for USDZAR (as measured by the option market) and the Vix volatility index, which measures volatility in the S&P 500. As you can see, volatility in USDZAR has surged and this has coincided with a rise in the Vix. When the Vix spikes stocks tend to sell off, and vice versa.

Source: FOREX.com and Bloomberg

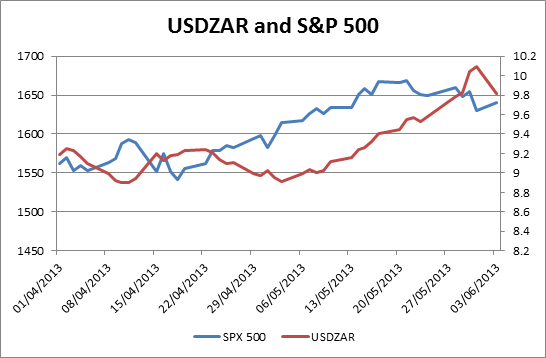

Takeaway: emerging markets are a good reflection of fears that are starting to grip the market. Thus, it is worth watching USDZAR if you trade stocks, since in recent weeks stocks and USDZAR have tended to peak around the same time.

Short term market idea: USDZAR has fallen back from highs above 10.00 in the last two trading sessions; this could help stocks to stage a short term recovery.

Key levels to watch in S&P 500:

Resistance: 1,645, 1,655, and then 1,675.

Support: 1,635 – daily pivot, then 1,615,

Source: Bloomberg and FOREX.com

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.