How long will high inflation persist? What happened to the great moderation?

There's been a noticeable change in inflation tendencies since Covid hit. The key question is whether this represents another regime change.

CPI and PCE inflation data from the BLS, chart by Mish.

Chart notes

-

The CPI is a measure of prices directly paid by consumers.

-

The PCE price index includes expenses paid on behalf of consumers, notably corporate-paid health insurance and Medicare.

-

Core inflation measures exclude food and energy.

-

The PCE numbers are seasonally adjusted. The CPI numbers are unadjusted.

The great moderation

The great moderation is the term economists use for the regime change starting in 1983 after Fed chairman Paul Volcker allegedly broke the back of inflation by spiking interest rates to 20 percent.

Will high inflation persist?

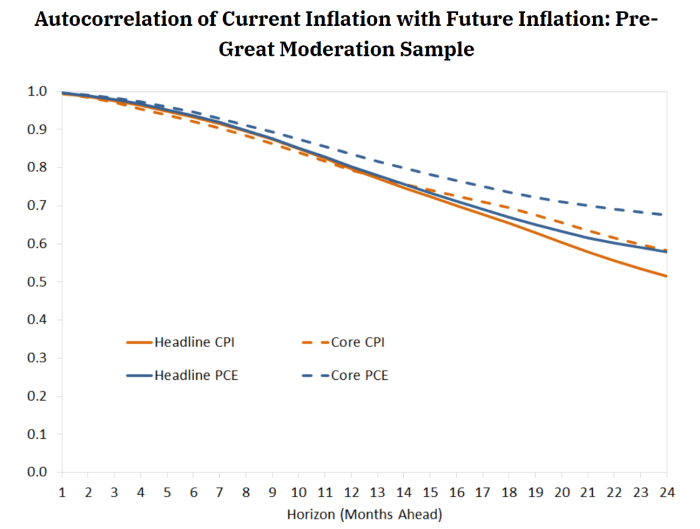

Autocorrelation Chart Pre-Great Moderation by St. Louis Fed

Credit for this post idea goes to the St. Louis Fed writers Michael McCracken and Trần Khánh Ngân for their article Will High Inflation Persist?

Even though inflation started to cool toward the end of 2022, it is still unclear how long it will take to return to its long-run average—that is, if currently high inflation will persist.

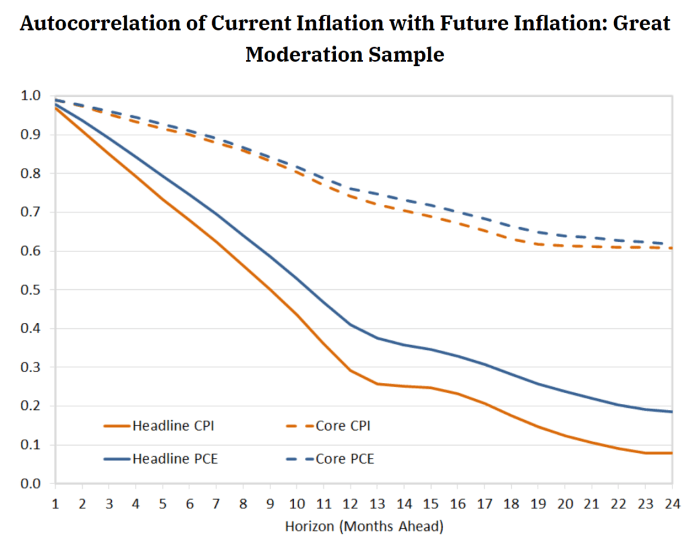

Each of the two figures plots the autocorrelation coefficients between year-over-year inflation (measured as the percent change from a year ago of a given index) and inflation at horizons of one month up to 24 months (two years) ahead. The first figure plots autocorrelations before the Great Moderation, which we define as before 1983, while the second figure plots Great Moderation autocorrelations (1983 to present).

Pre-Great Moderation, there are some modest differences in the persistence profiles of the headline and core measures of inflation, but overall, inflation is quite persistent even at longer horizons like one and two years into the future. In fact, autocorrelation for each lies above 0.5 two years out, suggesting it could take quite some time before these measures of inflation revert to the mean prior to the Great Moderation.

Although all four measures of inflation persistence move closely with one another pre-Great Moderation, there is a clear delineation between the persistence profiles of core versus headline measures during the Great Moderation. As the next figure illustrates, the correlation between future and current inflation in this period declines at a much faster pace for headline CPI and PCE than for core CPI and PCE.

Starting at nearly 1 at the one-month-ahead horizon, correlation coefficients remain above 0.7 at the one-year-ahead horizon for both core measures, while they had already dropped well below 0.5 for both headline measures.

Autocorrelation of inflation great moderation

Autocorrelation Chart During Great Moderation by St. Louis Fed

What regime are we in?

Inflation has been less volatile from 1983 to 2020.

Looking ahead, whether inflation persists may depend on which of the two regimes that we are in.

In the economic literature, a regime switch occurs when there are significant breaks in the patterns of key macroeconomic variables from one period to the next.

"What now?" is the key question. The St. Louis Fed did not offer an opinion but I will.

The regime has changed again. Inflation will be more persistent than most think.

Ten reasons for persistent inflation

-

From 1983 on, the Fed had the wind of outsourcing and globalization at its back. Global wage arbitrage kept prices in check.

-

From 2020 on, the winds of de-globalization started blowing briskly in the Fed's face.

-

President Trump started trade wars that Biden escalated. Trade wars increase prices. Contrary to Trump's claim, trade wars are neither good nor easy to win. Biden is more polite than Trump but is worse in practice.

-

The war in Ukraine further disrupted supply chains. For example, the EU got most of its natural gas from Russia. Now the EU gets Liquid Natural Gas (LNG) from the US. That gas has to be compressed (liquified) then shipped across the ocean via diesel freight liners. This makes no economic sense but is set to continue.

-

Biden's Inflation Reduction Act (IRA) is an illegal (by WTO rules) trade war in disguise. It's an "America First" plan that Trump would have been proud of. It's also in violation of WTO rules. Expect the EU to counter with an "EU First" plan.

-

The IRA's "America First" idea cannot possibly work given the minerals and materials needed have no trade-friendly source.

-

Decarbonization is highly inflationary. We have neither the natural resources nor the infrastructure to make decarbonization work.

-

The US seeks to neutralize both Russia and China. But the attempt to neutralize Russia over the war in Ukraine drove Russia into China arms and increased energy costs across the board.

-

White House policy is effectively set by Progressives. Elizabeth Warren may as well be president given she is setting energy policy and student debt cancellation policy along with other inflationary giveaways.

-

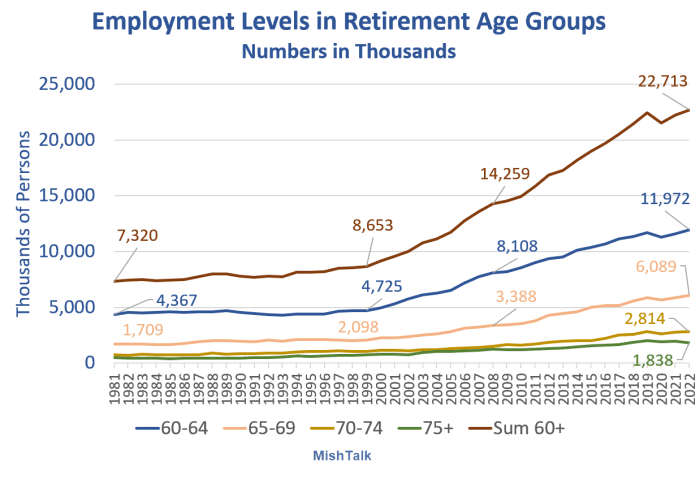

Boomer retirements are wreaking havoc on wages. There are 22 million people age 60 and over who are still working but will retire in the next decade. Demands on Medicare and Social Security are due to soar.

Point three trade wars

First a Trade War, Now a Real War, Why US Exports to China Continue to Suffer

President Biden not only continued Trump's trade war with China, he escalated it. There is no reason to believe relations between the US and China will do anything but get worse because of Taiwan.

Point five inflation reduction act

The EU is Very Worried About Biden's Inflation Reduction Act (IRA)

Under WTO rules, much of Biden's IRA is really an illegal subsidy. The EU cannot do in 5 years what the US can pass in a session if one political party is in clear control.

Point six where do we get the minerals

A Mad Rush to Build More EV Factories, But Where are the Minerals?

Incentives and free money from the Inflation Reduction Act has triggered an investment boom to build more electric vehicles.

Point seven decarbonization

Biden's Climate Change War Picks Up Steam In More Ways Than One

US allies are steaming mad at Biden for his climate change war. Let's discuss who fired the first shot and who is escalating the war.

Point nine progressives in control

- Elizabeth Warren May as Well Be President, She Makes All Biden's Calls

- Elizabeth Warren Desperately Seeks "More" Inflation

Point ten employment levels

Note that There are 158 Million People Working, 106 Million Not Working

There are 22.7 million people of retirement age who are still working. At an increasing rate over time, these people will retire. Replaced by whom? At what levels of productivity?

By the end of the decade nearly all of this group will be retired. Who will support this group and increasing Medicare needs given the percentage of full time workers keeps dropping.

Act your wage

On December 31, I noted Act Your Wage is the New Meme as Career Ambitions Plunge

There's no time to do extra unpaid work when you need a second part-time job just to pay the bills.

With millions due to retire, competition for jobs will increase.

Put this all together you have the makings of an inflationary wage spiral coupled with decreasing productivity.

Inflation conclusion

It's not all one sided. In a subsequent post I will take a look at deflationary forces.

In the short-term, the Fed via demand destruction and hiking rates will likely succeed in getting inflation lower.

However, the Fed will have a hard time keeping inflation lower due to de-globalization, decarbonization, demographics, and inept political decisions here and in the EU.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc