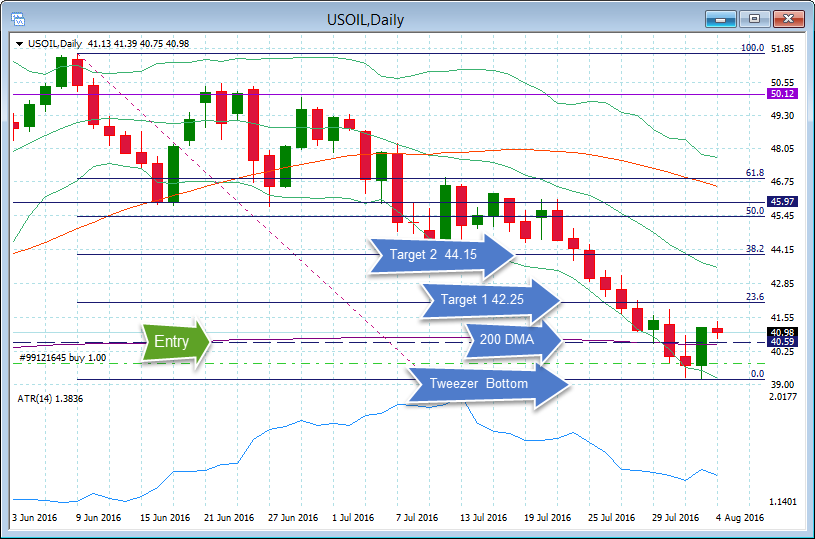

USOil, Daily

On Monday (August 1) I published a post on USDCAD (SHORT trade triggered on yesterday’s close at 1.3025) and USOil.

For USOil , I was looking for a break in the strong down trend that had persisted for the previous eight trading sessions. Mondays large down candle took the price to 40.06 a fall of over eleven percent in little over a week. Nothing continues in a straight line forever. Technically, it had also broken the key 200 DMA at 40.59 and further falls cannot be ruled out. However, in the meantime we look to BUY on the retrace in the short term for a bounce to at least the 23.6 Fib level and 14 day ATR level at 42.25 and possibly to the 38.2 fib level at 44.00. The move was confirmed with a Tweezer Bottom formation, strong buying momentum on good volume and a break back above the 200 DMA at the close on Tuesday. Should the rise to Target 1 be rejected then the next support is below 40.00 at the April low of 37.60.

We used this example in yesterday’s educational webinar to demonstrate how simple Fibonacci Retracements can be to implement. Also when they are combined with other indicators they can provide levels and targets that are often “self- fulfilling”. Join me on Tuesday August 9th at 11:00 GMT for our next Live Market Analysis webinar.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.