Has the Ukraine war ended?

- Risk-on sentiment and profits dominate trading.

- WTI drops 12.7%, Bloomberg Commodity Index falls 5.1%.

- US equities soar, Dow gains 2.0%, Nasdaq 3.59%, S&P 2.57%.

- Treasury yields climb for a second consecutive day.

- European currencies gain, US dollar and Japanese yen safe-havens falter.

Surging commodity prices, which had put the fear of an inflation-induced global economic slowdown into markets, collapsed on Wednesday as traders decided the outsized gains since the Russian invasion of Ukraine were ripe for profits. Equities and currencies joined in the in sharp reversal.

West Texas Intermediate (WTI), the North American pricing standard, lost 12.2% on the day, about one-third of its 33.3% jump in the eight sessions following the Russian attack. Brent, the international standard, shed 12.7% of its 35% surge from the open on February 24 to the close on March 8.

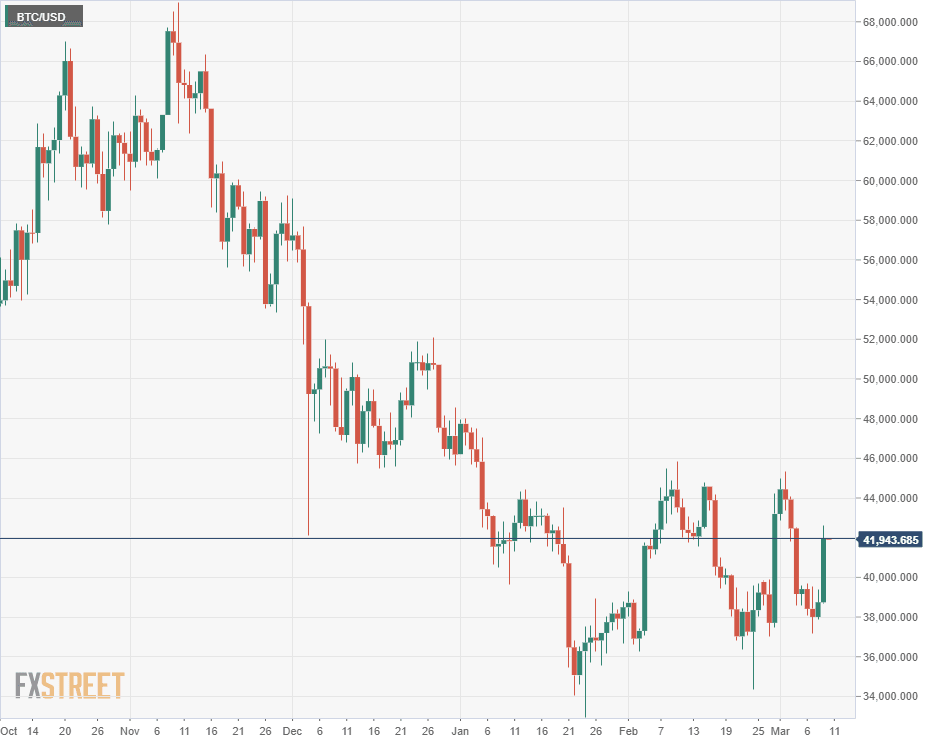

The Bloomberg Commodity Index, (BCOM) dropped 5.1%, closing at 125.84, also one-third of its 15% war increase to 132.63 at Tuesday’s close.

BCOM

CNBC

The Ukraine conflict continued with relatively little combat and no military or political developments that warranted the market reaction. The US refused to permit Poland to transfer Mig-29 jet fighters to Ukraine through the NATO air base in Ramstein, Germany. American Secretary of State Anthony Blinken has previously said the cession was approved.

Equites took their cues from commodities, completing Tuesday’s thwarted recovery, that in retrospect, was a warning that prices were drastically overextended.

The Dow Jones Industrial Average climbed 2.0%, 653.61 points to 33,286.25. At one point in Tuesday’s action the Dow was ahead over 500 points, only to close down just over 250 points. The S&P 500 rose 107.18 points, 2.57% to 4,277.88 for its best day since June 2020. The tech-centered NASDAQ, was the big winner, having its largest gain since November 2020, adding 3.59%, 460 points to 13,255.55. Wednesday’s improvements took the Dow out of its correction and the Nasdaq from bear market territory, respectively 10% and 20% from recent highs.

Silver, copper and platinum all lost ground on Wednesday as did wheat futures. Ukraine is a major global exporter of grains. Palladium, a component of the electronics in laptops and cellphones, continued higher.

Treasury prices fell for the second day as risk profiles rose and investors cut positions in safety-hedged US government assets.

The yield on the 10-year Treasury rose 7.2 basis points to 1.943%, following a 12.2 point gain on Tuesday. The 2-year added 4.9 points to 1.678 on Wednesday, after an 8.1 pont increase on Tuesday. The return on the 30-year bond rose 5.9 basis points to 2.302%, complementing the 9.1 point increase on Tuesday.

The 30-year yield is now slightly above its pre-Ukraine invasion level. The 10-year is just below and the 2-year is 5 points to the good. Treasury bond prices trade inversely to yields.

European currencies recovered a portion of the US dollar’s Ukraine safety premium.

The EUR/USD rose 1.5% to 1.1071, leaving it 2% below its open on February 24, the day of the Russian invasion.

The USD/JPY rose modestly to 115.81, up 17 points on the day.The Japanese yen’s safety status, which works to counter the general trend to the US dollar, had kept the pair in a restricted range, closing less than a figure from where it opened on the February 24 at 115.00.

The sterling rose 0.6% against the dollar finishing at 1.3186, 2.6% below its open on February 24.

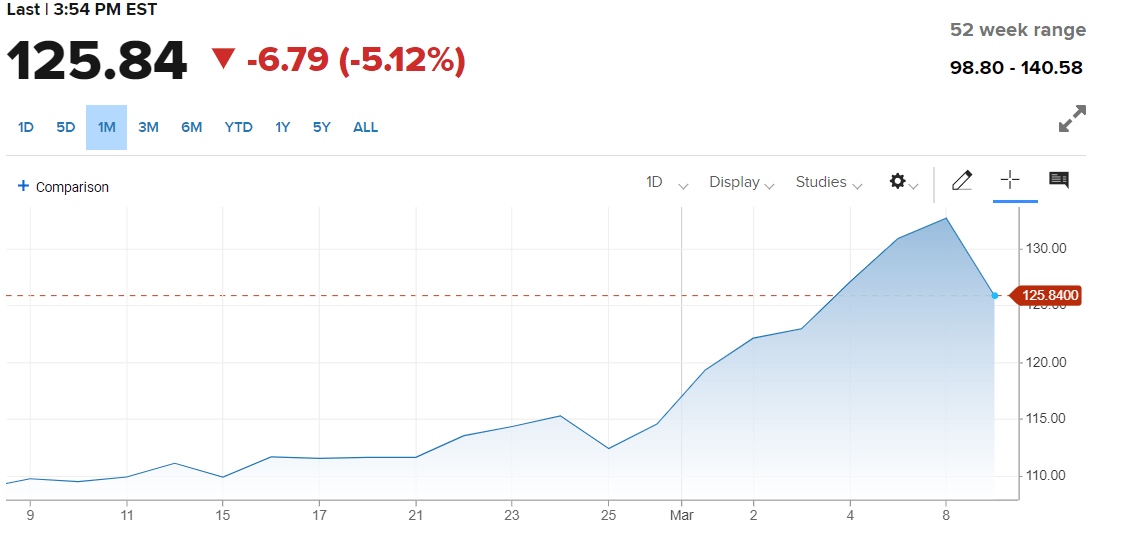

Bitcoin climbed above $42,000, with a rally in digital currencies, as the US is planning an overhaul of crypto regulation that Treasury Secretary Janet Yellen has said will be “historic.”

Conclusion: Markets remain on edge

The powerful rallies in equities and several commodities has not changed the global economic picture. The temporary lull in the Ukraine war is not a sign that negotiations are working behind the scenes to end the conflict. Russian plans for the war are unknown and her troops are moving into positions around Kyiv that could presage an assault.

Europe and the US are considering additional sanctions and military aid is flowing into Ukraine.

In the US, February consumer inflation is expected to be 7.9%, with a decided risk that it comes in hotter.

Next Wednesday’s Federal Reserve meeting will underline the dilemma facing central banks around the world. Inflation is much higher than predicted and monetary policy has barely moved from ending its pandemic support. What should be an easy segue to a tightening stance is complicated by the potential economic impact of sharply higher oil and commodity prices that are the fallout from the Ukraine war.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637824722327496439.png&w=1536&q=95)

-637824723537625234.png&w=1536&q=95)

-637824723721707909.png&w=1536&q=95)