Good news is bad news for the Fed

-

Leading indicators point towards a turnaround in macro momentum amid easing financial conditions, but the Fed is still far away from price stability.

-

The less negative growth outlook combined with a recovering China challenges the Fed’s goal of suppressing demand.

-

The ISM, JOLTs, NFP and CPI over the next week will be the final key releases ahead of the February meeting; we expect Fed to hike by 50bp.

While most global manufacturing leading indicators still remain at low recessionary levels, some are now beginning to show early rays of light. Taiwanese manufacturing PMI, which tends to lead the global PMI, had the largest uptick in December since spring of 2021 (Chart 1). Euro area new orders indices, German Ifo and ZEW as well as the Chicago PMI have all rebounded from the recent lows (see p. 2).

In Fed review: FOMC signals Fed Funds above 5% in 2023, 14 December, we warned that the pre-emptive easing in global financial conditions could risk prolonging the underlying price pressures. While the turnaround in leading indicators is positive from a growth perspective, it goes against the Fed’s goal to suppress aggregate demand.

Yesterday, we also lifted our forecast for Chinese GDP growth amid the faster reopening, which could further underpin commodity demand irrespective of western policy choices.

In the US, the drop in gasoline prices has eased headline inflation (0.1% m/m), but as wage growth remains elevated (0.6% m/m), real purchasing power recovered in November, and likely also in December. Lower headline inflation is a double-edged sword for the Fed, as recovering purchasing power boosts private consumption, labour demand and thus sustained wage inflation. Furthermore, the drop in mortgage rates illustrates that financial conditions are not tightening anymore. The most recent NAHB expectations index suggested that even the hard-hit housing market’s outlook has improved slightly.

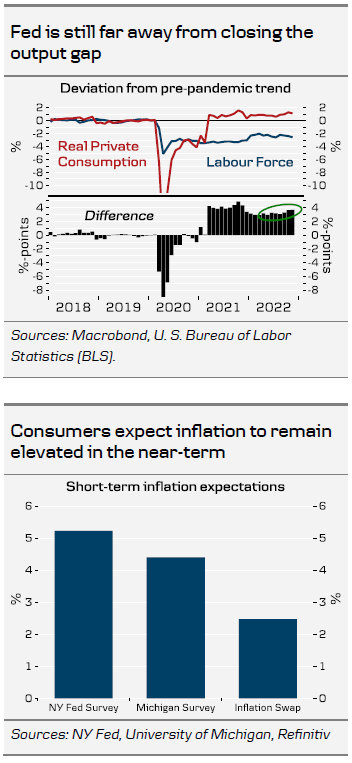

As a result, real private consumption is still above its pre-pandemic trend, even though the economy’s growth potential remains constrained by labour shortages (Chart 2). The recent decline in market’s inflation expectations has lifted US real yields to restrictive levels, but given that the Fed appears to make very gradual progress towards closing the output gap, we continue to see risks tilted towards rates remaining higher for longer. Furthermore, deflating with consumers’ inflation expectations paints a less optimistic view (Chart 3).

Bringing labour markets into balance would require several months of employment gains below 100 thousand, yet consensus is looking for twice as much this Friday. The rising employment costs feed into core services CPI, and even though normalizing energy and food prices will likely set next week’s headline CPI near 0.0% m/m, core inflation will remain closer to 0.3%. Even in Europe, where the growth backdrop is weaker, flash data from Spain and Germany pointed towards a pick-up in core prices, and similar development in the US could well tilt the market towards another 50bp hike in February.

Author

Danske Research Team

Danske Bank A/S

Research is part of Danske Bank Markets and operate as Danske Bank's research department. The department monitors financial markets and economic trends of relevance to Danske Bank Markets and its clients.