Gold Price Weekly Forecast: Bulls and bears in tug-of-war ahead of US inflation data

- Gold price registered weekly losses despite Friday's rebound.

- Near-term technical outlook fails to provide a directional clue.

- July inflation data from the US will be watched closely by investors next week.

Following the previous Friday’s rebound, Gold price started the new week on a bullish note and climbed above $1,970 on Monday. Surging US Treasury bond yields, however, caused XAU/USD to reverse its direction later in the week. Although the pair managed to stage a rebound on Friday, it ended up closing the week in the red. July inflation data from the US will help investors decide whether Gold price could regain traction.

What happened last week?

In the absence of high-tier data releases on Monday, investors continued to react to the softer-than-expected US Personal Consumption Expenditures (PCE) Price Index data for July. The benchmark 10-year US Treasury bond yield declined below 4% and helped XAU/USD to build on last Friday’s recovery gains.

During the Asian trading hours on Tuesday, the data from China revealed that the economic activity in the manufacturing sector contracted in July, with the Caixin Manufacturing PMI dropping to 49.2 from 50.5. Gold price lost its traction and remained under modest bearish pressure in the European session. Later in the day, the US Dollar lost its strength after the ISM Manufacturing PMI came in at 46.4 in July, slightly worse than the market expectation of 46.8. Before the end of the day, however, Global rating agency Fitch announced that it downgraded the US government's credit rating to AA+ from AAA, citing anticipated fiscal deterioration over the next three years and a high and growing general government debt burden.

This development triggered an intense flight to safety mid-week, causing global equity indexes to decline sharply and providing a boost to the USD. The pair lost more than 1% on Tuesday and extended its slide in the second half of the week to a fresh three-week low below $1,930.

Other data from the US showed that the private sector employment rose by 324,000 in July. This reading surpassed the market expectation for an increase of 189,000 by a wide margin. In turn, the benchmark 10-year US Treasury bond yield climbed to its highest level since November above 4.1% and put additional weight on XAU/USD’s shoulders.

Meanwhile, World Gold Council said that their "outlook for 2023 is broadly unchanged: we expect investment demand to remain supported and central bank demand to remain positive, albeit lower than last year,” in its Gold Demand Trends report. “Fabrication demand, on the other hand, will likely come under pressure as inflation and recent high gold prices impact affordability.” The market reaction to this report remained relatively subdued.

On Thursday, mixed data releases from the US limited the USD’s upside, allowing XAU/USD to go into a consolidation phase. The ISM Services PMI declined to 52.7 from 53.9, compared to the market forecast of 53. The Employment Index of the survey fell to 50.7 from 53.1, while the Prices Paid Index climbed to 56.8 from 54.1, highlighting increasing input price pressures in the service sector. Finally, the number of first-time applications for unemployment benefits in the US rose to 227,000 in the week ending July 29, the US Department of Labor reported.

Nonfarm Payrolls (NFP) in the US rose 187,000 in July, compared to the market expectation of 200,000, the US Bureau of Labor Statistics announced on Friday. June’s increase of 209,000 got revised lower to 185,000. Other details of the jobs report showed that the annual wage inflation held steady at 4.4%, while the Unemployment Rate ticked down to 3.5% from 3.6% in June. The USD came under selling pressure and the 10-year US yield turned south after this data, allowing Gold price to recover back above $1,940 ahead of the weekend.

Next week

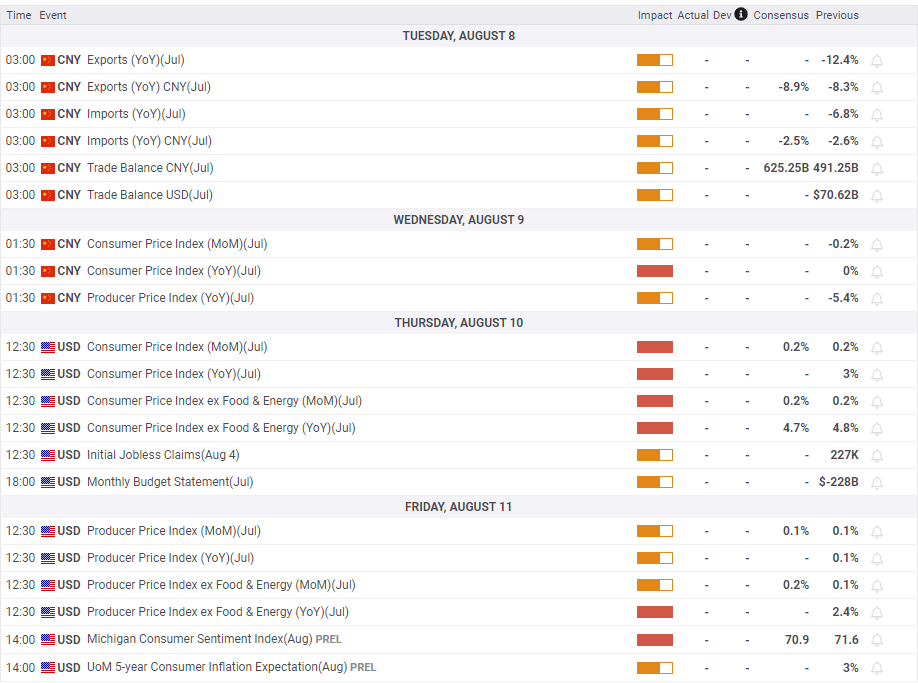

Chinese Trade Balance data will be watched closely by market participants on Tuesday. Investors are concerned about the Gold demand outlook amid growing signs of an economic slowdown in China, the world’s biggest consumer of Gold. A bigger-than-expected growth in China’s trade surplus – in USD terms – could help XAU/USD edge higher.

On Thursday, the US Bureau of Labor Statistics will release the Consumer Price Index (CPI) data for July. On a monthly basis, the Core CPI, which excludes volatile food and energy prices, and the CPI are both forecast to rise 0.2%. A big increase in the core figure, 0.4% or higher, could support the USD and weigh on XAU/USD.

Fed policymakers have been unusually quiet lately. Fedspeak after inflation data could also influence XAU/USD’s movements. Action in US Treasury bond yields could provide important clues whether markets assess Fed officials' comments as dovish or hawkish. The inverse correlation between the benchmark 10-year US yield and Gold price has been relatively strong lately. Hence, XAU/USD could turn north if the 10-year yield retreats below 4%. Conversely, the pair could find it difficult to shake off the bearish pressure in case the 10-year yield continues to stretch higher above 4%.

Gold technical outlook

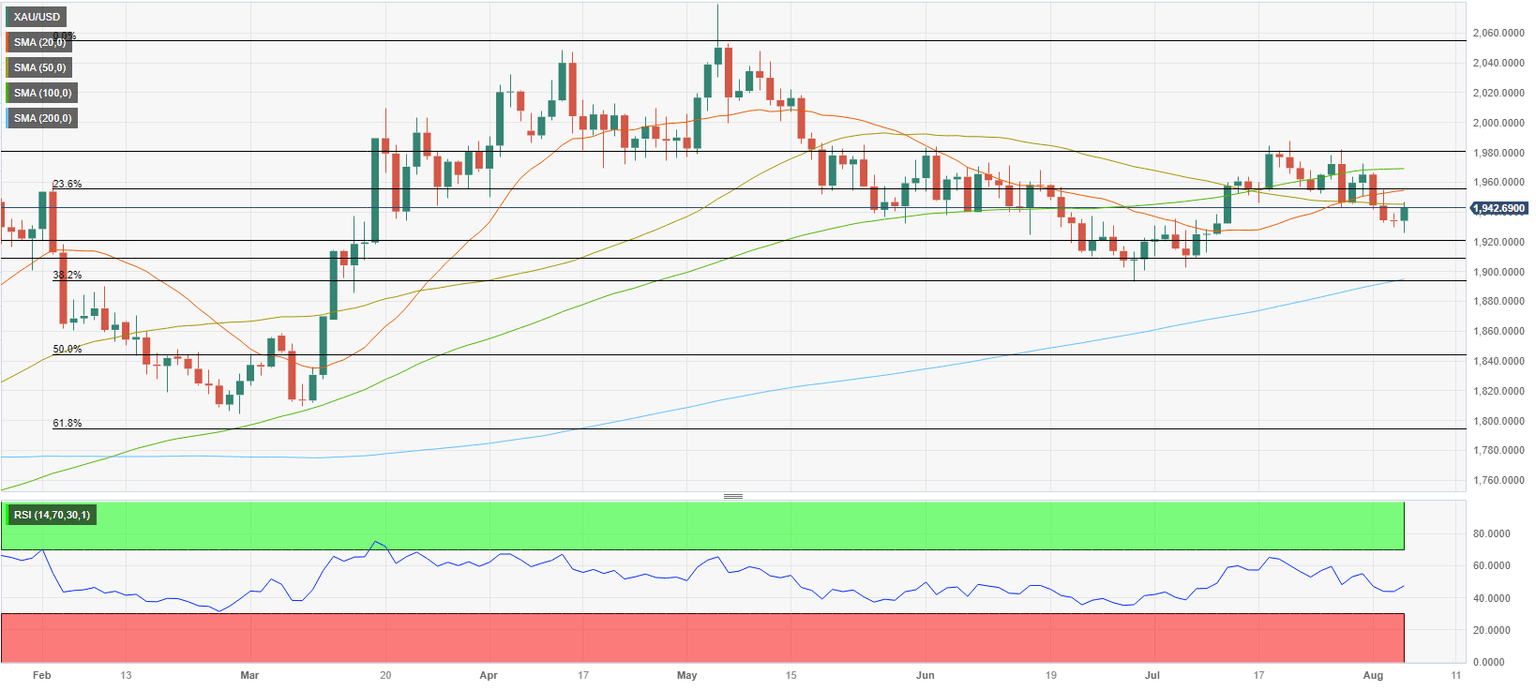

The Relative Strength Index (RSI) on the daily chart recovered toward 50 ahead of the weekend, highlighting the lack of bearish momentum in XAU/USD. On the upside, immediate resistance for the pair is located in the $1,950/$1,955 area, where the Fibonacci 23.6% retracement level of the long-term uptrend and the 20-day Simple Moving Average (SMA) align. Above that region, the pair is likely to face stiff resistance at $1,970 (100-day SMA) and $1,980 (static level) before targeting $2,000.

Looking south, $1,920 (static level) stays intact as near-term support. Once XAU/USD falls below that level, it could encounter interim support at $1,910 (static level) on its way to test $1,900 (psychological level, Fibonacci 38.2% retracement, 200-day SMA).

Gold forecast poll

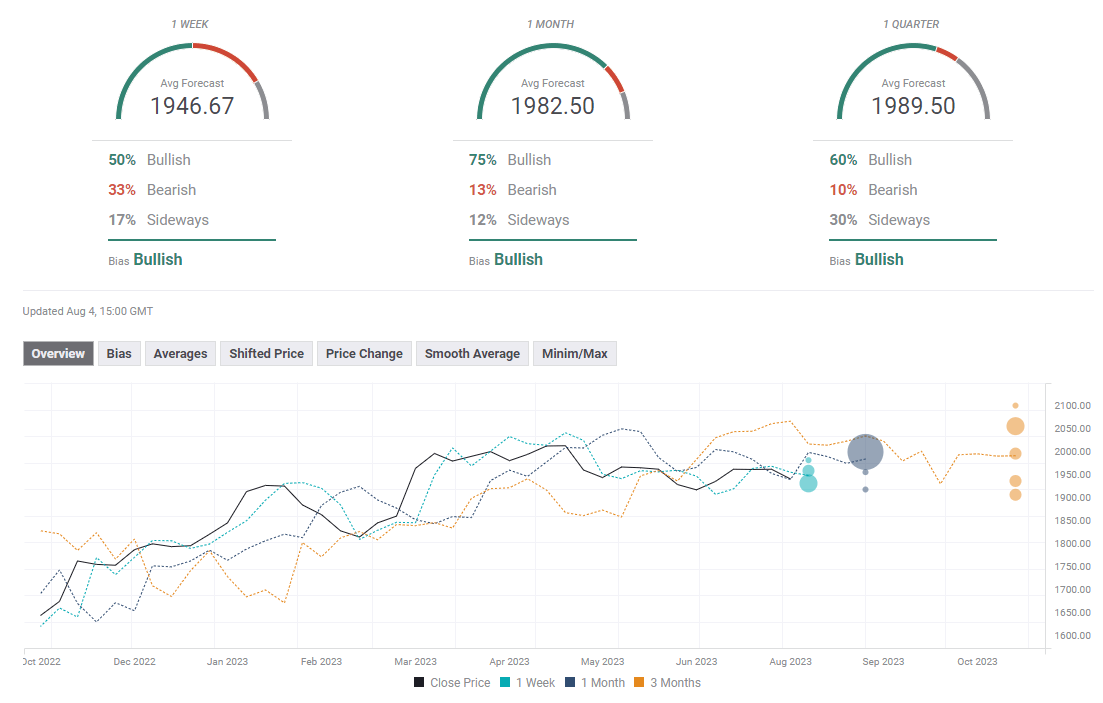

FXStreet Forecast Poll points to a mixed outlook in the near term, with the one-week average target aligning slightly below $1,950. The one-month outlook remains overwhelmingly bullish, with a majority of polled experts seeing Gold price rising to $2,000.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.