Gold Price Forecast: XAU/USD nears $2,750 in record rally

XAU/USD Current price: $2,744.80

- United States Presidential election spurs concerns about the future of interest rates.

- US Treasury yields extend their weekly gains amid a continued run to safety.

- XAU/USD keeps reaching higher highs, bulls in full control of the pair.

Gold Price held at record levels on Tuesday, with XAU/USD trading as high as $2,745.01 during American trading hours. The bright metal maintains the positive tone amid the dismal market mood, given tensions in the Middle East and looming US elections.

Speculative interest began pricing in a slower pace of Federal Reserve (Fed) interest rate cuts amid concerns former President Donald Trump may win the presidential race. Trump’s policies on taxes and tariffs are seen as a potential booster for inflation and even increased odds for interest rate hikes. Government bond yields extended their advance, with the 10-year Treasury note currently yielding 4.20%, its highest since late in July. The 2-year note currently offers 4.05%, also a fresh multi-week high.

Meanwhile, stock markets are in retreat mode, with most Asian and European indexes having closed in the red. Wall Street trades mixed, with the Dow Jones Industrial Average posting sharp losses and only the Nasdaq Composite trading in the green.

XAU/USD short-term technical outlook

The risk-averse environment suggests the bright metal will continue posting higher highs, with no signs of bullish exhaustion despite technical readings suggesting overbought conditions.

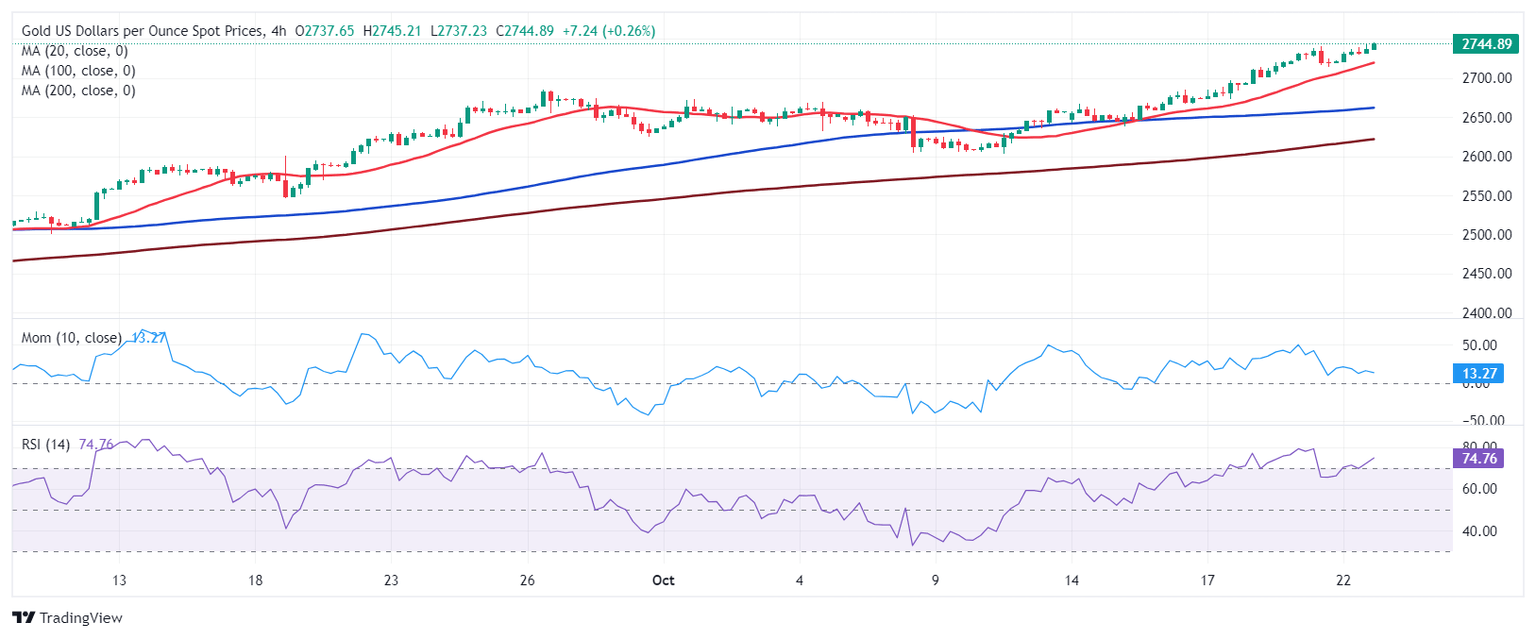

From a technical point of view, XAU/USD is poised to extend its advance. The daily chart shows that the pair trades a handful of cents below its daily high, with technical indicators reaching fresh highs while heading north. Meanwhile, the bright metal runs well above bullish moving averages, with the 20 Simple Moving Average (SMA) currently at around $2,668, far above the longer ones.

The near-term picture supports an upward extension. In the 4-hour chart, technical indicators resumed their advances, maintaining upward slopes, with the RSI indicator heading north despite being in overbought territory. At the same time, the pair develops above bullish moving averages, with the 20 Simple Moving Average (SMA) currently at around $2,718.

Support levels: 2,716.40 2,700.00 2,685.45

Resistance levels: 2,740.00 2,755.00 2,770.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.