Gold Price Forecast: XAU/USD looks to threaten $1800 level amid coronavirus vaccine optimism

- Gold targets $1800 following a breach of the critical $1850 level.

- Vaccine progress, Biden transition boost risk, weigh on gold.

- US CB Consumer Confidence data, vaccine updates in focus.

Gold (XAU/USD) resumed last week’s bearish momentum on Monday and fell 2% to the lowest levels in four months at $1831. Gold faced a double whammy amid a surge in the US dollar’s demand, in response to strong US business activity data, on one hand. While on the other hand, hopes of a quicker economic rebound on coronavirus vaccine progress drove investors towards riskier assets, which weighed on the yieldless gold. Reduced need for additional monetary and fiscal stimulus, as upbeat US data eased economic growth concerns, added to the downside on gold.

Looking ahead, the bright metal remains exposed to further downside risks, in the wake of the global market optimism amid vaccine progress and Biden transition process. The risk-on rally in the stocks could dash hopes of any recovery in gold, as markets will closely eye the US CB Consumer Confidence data due for release later in the NA session.

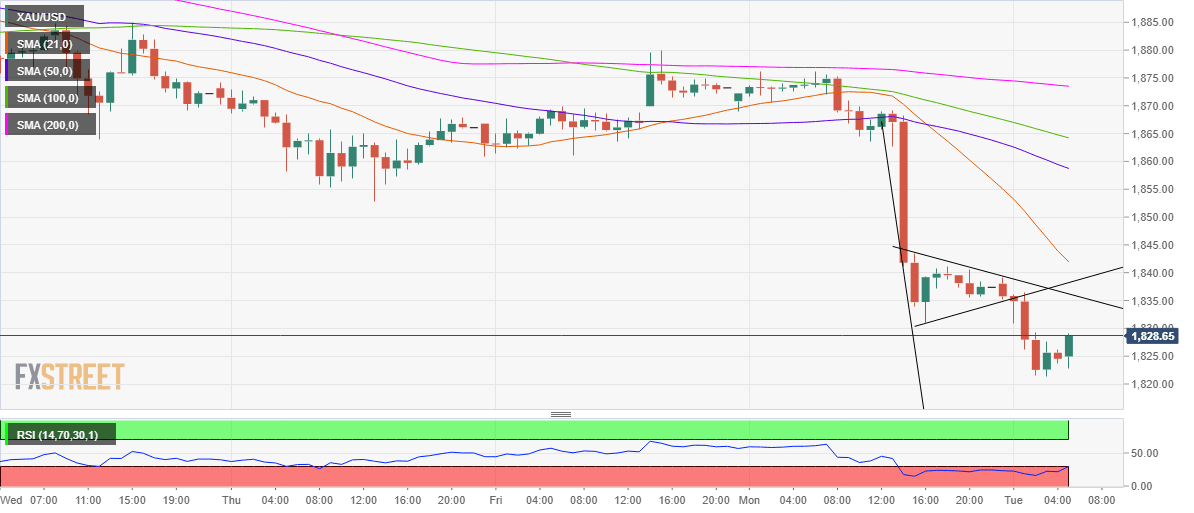

Gold: Hourly price chart

The path of least resistance for gold remains to the downside, as depicted by the hourly chart.

The price has charted a bear pennant breakout on the given timeframe, calling for a test of the measured target at $1800.

Since the hourly Relative Strength Index (RSI) trends in the oversold territory, a dead cat bounce cannot be ruled out towards the pattern support now resistance at $1836.

The next resistance is seen at the bearish 21-hourly moving average (HMA) at $1842. The long-held support at $1850 could then act as a strong resistance if the bulls extend the recovery momentum.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.